Updated 20 December 2023

If low taxes was the supreme good of libertarian governments and eliminated the need for additional company specific grants, why is the UCP government doling out up to $5-billion in additional handouts mainly to foreign=owned corporations for capturing carbon.

The announcement by Premier Smith and the heretofore missing in action Brian Jean- Alberta’s energy minister paved the way for another major announcement, this time Premier Smith alongside Deputy Minister Chrystia Freeland (see below).

Danielle Smith and Deputy Prime Minister Chrystia Freeland Source: Twitter X Danielle Smith

Alberta Carbon Capture Program

Another successfully orchestrated communications announcement by Smith came this past Tuesday 28 November. With the wind in her sails, Smith has come off two federal high court victories (impact assessment and toxic plastics), and getting a gift by Justin Trudeau with his ill-advised carbon tax holiday for heating oil.

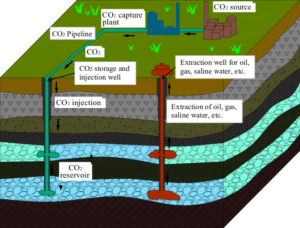

The statement issued by Premier Smith and Energy Minister Brian Jean heretofore missing in action, was accompanied by a slick promotional video announcing Alberta’s grand plans to decarbonize the oilsands and other segments of Alberta heavy industry. Readers are advised to review the short two-minute video as this infomercial will be central to the Alberta government’s ambitious plans to attract vast pools of (foreign) capital to extend the life of the oilsands. Pictures of in situ plants embedded in the forest, woodlands and rivers are juxtaposed against pipes and industrial facilities. A simple schema showing how CO2 capture and storage is included at the beginning of the video.

What the program does

The program branded the Alberta Carbon Capture Inventive Program (ACCIP) “will provide major industries with up to 12 per cent of new eligible capital project costs. The ACCIP will help businesses in multiple industries, such as oil and gas, power generation, hydrogen, petrochemicals and cement, reduce their emissions by incorporating CCUS technology into their operations.” The release goes on to claim “CCUS is currently the only viable option available for these industries to significantly reduce their emissions” (emphasis added).

But is this true? CCUS is well accepted by government officials, most politicians and financial analysts as not economically viable. Since CCUS is not economically viable, industry has been lobbying federal and provincial governments for many years for taxpayers money- whether grants or tax holidays, to build these facilities. Building carbon capture facilities is a sine qua non for the oilsands because without CCUS the last figleaf of environmental respectability for emissions intensive bitumen production will be gone. (A recent column by Graham Thomson in the Tyee provides more background.)

The promise of carbon capture and the actual carbon captured remains wide apart. A year ago, the U.K.’s Institute for Energy Economics and Financial Analysis found that of 13 projects examined and accounting for about 55% of the world’s current operational capacity – seven underperformed, two failed and one was mothballed, the report found. Not a particularly good track record for taxpayers to be supporting.

The Alberta program is conditional on the federal government legislating its CCUS tax credit (announced in 2021) and related operating supports, such as contracts for difference.

Business cheer leading formed part of the narrative with leaders from the Industrial Heartland, the Pathways Alliance, Strathcona Resources, Heidelberg Materials (cement), and the International CCS Knowledge Centre making the following claims-

- “CCUS is a safe, proven technology used around the world;”

- “Alberta’s long history of emissions reduction policy and investment in carbon capture and storage technology is globally significant.”

The cost to Alberta taxpayers will be considerable and is expected to range between $3.2 to $5.2 billion over the next decade. The program purports it will generate $35-billion in investment and add up to 21,000, presumably permanent, jobs.

Where is the Canadian Taxpayers’ Federation (CTF) on these corporate handouts?

Strangely the CTF has been silent about the Alberta’s government’s liberal use of grants to fund multinational corporations’ investments. A glance at its website reveals a litany of complaints at the federal government, most notably the carbon tax, “Trudeau’s tax on farms and food,” and “government waste.” The CTF appears to be mostly mute on the billions in corporate dole handed out to multinational vehicle manufacturer for battery infrastructure.

Dow Chemicals’ “investment”

The Alberta joint statement by Premier Smith and ministers Brian Jean and Matt Jones reads in part:

At nearly $9 billion, this project is one of the largest private sector investments in Alberta’s history. At peak, this world-class petrochemical facility will create about 6,000 jobs during construction and 400 to 500 full-time jobs when operational. Path2Zero will produce and supply approximately three million metric tonnes of certified low- to zero-carbon emissions polyethylene and ethylene derivatives for customers around the globe while further establishing Alberta as a world leader in emissions-reducing technology like carbon capture, utilization and storage.

On a cold 29 November day in Forst Saskatchewan, at the joint announcement/press conference, hosted by Dow Chemicals at their Fort Saskatchewan facility, federal minister Chrystia Freland said it was “a great day” for Fort Saskatchewan, Dow and “the whole world.” She brought with her federal ministers Boissonsault and Champagne.

This “historic:net zero petrochemicals project will utilize up to $400 million in federal tax credits for carbon capture and hydrogen. This program will provide a total amount of $400-million “front-loaded.” Freeland boasted about Canada’s ability to attract foreign investment saying Canada had attracted the third most foreign investment in the world conveniently omitting the multi-billion handouts to multinationial automotive manufacturers.

This “proud daughter of Alberta” defended the federal government’s investment attraction programs to compete with Biden’s Inflation Recovery Act. Freeland also signalled that this announcement and the federal government’s commitment to these tax credits will support the Pathways Alliance’s goal of unlocking large amounts of CCUS investment.

| “Scheduled for construction commencement in 2024, the project’s capacity additions will unfold in phases. The initial phase is slated to commence operations in 2027, contributing around 1,285 KTA of ethylene and polyethylene capacity. The subsequent phase is set to begin operations in 2029, adding 600 KTA of capacity.”

Zacks Investment Research |

Dow Chemicals fit-looking chair and CEO Jim Fitterling praised the assistance of both the federal and provincial government. Acknowledging his board committed to the $6.5-billion U.S.this previous day, he noted ccess to cost effective petrochemicals and “top-class work force” were key factors in the decision. The project will showcase “industrial decarbonization,” decarbonized 20 per cent of Dow’s global ethylene production. “This is where business strategy and smart government policy come together.”

Dow’s CEO didn’t talk about low taxes nor the specific dollar amount of public funds going into corporate pockets south of the border.

Following Fitterling, federal industry champion Jean-Francois Champagne gave a Ra-ra speech sycophantly thanking Dow Chemicals while recalling all the text messages that went into the build-up to this massive transfer of Canadian public moneys. Champagne reminded his audience that the original Dow was Canadian born.

Premier Smith also upbeat praised her ministers and MLAs present including Brian Jean, Nate Glubish and Jackie Armstrong-Homeniuk the Fort Saskatchewan area MLA and Parliamentary Secretary for Ukrainian Refugee Settlement.. Armstrong-Homeniuk’s re-election is doubtless reassured with this generous dose of taxpayers’ money. .Smith also referenced the work done by former premier Kenney, and former ministers Sonja Savage and Dale Nally.

The Recipient – Dow Chemicals

Dow has a remarkably low market capitalization of $36.7-billion U.S or about $50-billion Canadian and would not be able on its own to support this project. The project has two other unnamed partners who will be contributing up to $2.7-billion in capital costs for the hydrogen production aspects.

Dow’s ownership structure is shown below with the ten largest owners being institutional investors.According to Refinitiv data there are 1.927 institutional investors with positions in Dow. As shown below the biggest investors are U.S. headquartered institutions.

| Institutional Investor | Per cent Shares owned |

| Vanguard Group | 8.74 |

| State Street Global Advisors

Blackrock Institutional Trust Company Pzena Investment Management Geode Capital Management JP Morgan Asset Management Morgan Stanley Smith Barney Capital World Investors Dimensional Fund Advisors Capital Research Global Investors |

4.97

4.65 2.6 1.91 1.7 1.34 1.31 1.2 0.92 |

| Source: Refinitiv | |

According to Zacks Investment Research

The $6.5-billion project, excluding government incentives and subsidies, encompasses the construction of a new ethylene cracker, a 2-million MTA polyethylene capacity expansion and retrofitting the existing cracker to achieve net-zero Scope 1 and 2 emissions. Anticipated to generate $1 billion in EBITDA growth annually throughout the economic cycle, the project is set to decarbonize 20% of Dow’s global ethylene capacity.

This means that up to $2.2-billion in Canadian tax dollars ($1.6-billion U.S.) will mean that Dow will earn $1-billion a year for decades on $4.9 billion in company funds for a return on equity of 20 per cent before interest taxes and amortization. Without public money the project would have gone elsewhere.

A key feature of the investment will be in the advertising its net-zero bona fides. According to Zacks

To attain net-zero Scope 1 and 2 emissions, the Fort Saskatchewan Path2Zero project will deploy Linde’s air separation and autothermal reformer technology. This will convert the site’s cracker off-gas into hydrogen, serving as a clean fuel for the site’s furnaces. Additionally, carbon dioxide emissions will be captured and stored. The technology will reduce nearly 1 million MTA of CO2e while offsetting all emissions from the new capacity.

Implications

Alberta and Canadian taxpayers and the CTF should be asking are these programs worth it?

According to the CCUS news release up to 21,000 jobs and up to $35-billion in investment will be created. On a per job basis, with a maximum of $5.8-billion in grants, taxpayers are paying $276,000 per job to attract profitable multinational corporations to Alberta.

For the Dow Chemicals project, as noted above Alberta and Canadian taxpayers.will be giving institutional investors- mainly American- a return on equity of about 20 per cent for up to 50 years.There will be 400 to 500 permanent jobs in the Fort Saskatchewan area with 5,000 to 8,000 non-permanent construction workers at peak construction.

A quick, ‘back of the envelope’ analysis of tax dollars per person-years worked, .assuming 15,000 person years of permanent employment and 19,000 person-years for construction workers means 34,000 person years of employment. This equates to a person-year cost of nearly $53,000. Assuming the average salary of $125,000 per year, this deal will generate about $4.25-billion in wages, mainly for the Fort Saskatchewan area.Over 30 years the government would get back about $400 million in income tax payments.

As noted, this deal will definitely enhance The Honourable Jackie Armstrong-Homeniuk, chances of re-election.

The federal and provincial appearance by high level officials was meant to show Albertans that Alberta can capture goodies from Ottawa. Smith appears to be able to work with the Deputy-Prime Minister and ministers who are cheerleaders for constituents and industrial concerns. However, there is considerably more opposition in Ottawa to corporate handouts, particularly to the fossil fuel industry, than in Alberta. .

In a related story I examine the ad-hominum attack by Premier Smith and her Environment minister, Rebecca Schulz at the sidelines of the COP28 on the federal Environment minister Stephen Guilbeault.

Postscript

Not only had the Government of Alberta pledged to give up to $1.8 billion to Dow, it also well before the announcement had signalled it was prepared to give Dow a special exemption with regard to paying contractors. On 14December, the Calgary Construction Association issued a press release denouncing thus special exemption granted under the little known Prompt Payment for Construction Work Act (PPCLA) passed by the Legislative Assembly in 2022 “to foster fairness and transparency in payment practices within the construction industry – notably, requiring owners to pay contractors within 28 days of receiving proper invoices.”

Under Order in Council 180/2023 dated 28 September the set out in the attached Appendix.Prompt Payment and Construction Lien (Prescribed Persons, Entities and Project Agreements) Regulation was established. What the new regulation does is to exempt “Any project agreement between Dow Chemical Canada ULC and a contractor for the provision of materials or work done for the construction and installation of Dow Chemical Canada ULC’s Path2Zero Expansion Project.” from the the 31‑day limitation required under the Act.

As the Calgary Construction Association complained:

The erosion of trust and relationships within the construction industry is a significant concern for the CCA. Granting exemptions based on investment dollars to the Province sends a damaging message that fairness can be compromised, eroding trust between contractors, subcontractors, and suppliers. This erosion of trust jeopardizes the collaborative nature of the industry, which relies on strong relationships for success.

Once again here was a nominally free enterprise government distorting the playing field by giving a multinational corporation based in the United States an advantage over local construction firms- as well as billions of taxpayer dollars. Truly another head scratcher.

Related Posts

Alberta 5, Ottawa 2- still many thorny questions remain -Part 1(Revised)

Alberta’s continuing devotion to resource revenue and the legacy of ignored policy advice