On Wednesday, the Parkland Institute at the University of Alberta released my study Can AIMCo be Fixed?

my study Can AIMCo be Fixed?

Key findings and recommendations of the study were:

- AIMCo is one of the most significant provincial agencies in Alberta- its importance is central to the financial security of nearly 500,000 people

- Since a pension is intended to provide financial security in retirement- any behavior by government, the asset manager or pension boards which undermines security or creates uncertainty erodes trust which is foundational to the pension bargain.

- AIMCo’s investment performance has, since its inception, been mediocre and recent poor returns contributes to the erosion of the trust.

- The ownership structure of AIMCo must be changed- AIMCo’s sole owner today is the Government of Alberta even though about two-thirds of its funds are pension fund assets.

- AIMCo’s current board is all- white- this lack of diversity is a problem-

- Independence from government influence over investment decisions is critical to trust.

- AIMCo is now the sole statutory provider to nearly all public sector pension plans – this monopoly status is not conducive for trust or responsiveness when one party has no choice in changing investment managers.

Trust is central to the Pension Bargain

Pensions especially defined benefit (DB) pension plans are agreements between employers and employees who contribute to an investment fund out of which are paid pension benefits. The point of a pension is to provide financial security in retirement. In some respects pensions are deferred wages which are provided by employers (and ultimately taxpayers for public sector plans) and the employees through pre-determined contribution rates. DB pensions are typically calculated as a percentage of an the employees’ average last few years’ salary. Uncertainty about the durability of pensions or government interference in the operations of pension funds erodes that trust.

Pages 9-20 of the report summarize recent actions of AIMCo and the government resulting in an erosion of trust.

In its first budget, the UCP government announced its was sweeping teachers’, WCB, and AHS investments- over $30-billion- under the management of AIMCo. There was no consultation with the ATRF and ATA

Secondly, Bill 22 following out of the budget removed public sector pensions plans’ ability to move their investments to another manager- measures just put in place by the NDP in 2018.

Thirdly, in March 2020 with extreme volatility on global equity markets-due to COVID a complex volatility trading strategy called VOLTS led to large losses ultimately closed out at about $2.1-billion. This development created more distrust of AIMCo and the government.

Fourth, the manner in which new investment management agreements (IMAs) were imposed through ministerial order sent the wrong signals to boards and members. The ministerial order was signed just before Christmas 2020 but not communicated to affected boards until January 4th. This agreement limited severely the pension plan boards’ ability to make investment policy and strategy changes.

The IMA issue caused the ATA to sue the provincial government and AIMCo. This case was resolved out of court this fall but the IMA has not been made public. I understand the offending sections of the IMA were taken out as part of the deal withdrawing the lawsuit

Another source of mistrust between government and pension plans is Finance Minister Toews’ reference to “public money” of AIMCo. Public sector pension plans’ investments are not public money- they are investments held in trust to pay pensions. – they are not public money once employer contributions are made.

Investment Performance Compared

Comparison of investment performance results is fraught with complications and the qualifications on the findings are found in Appendix B of the Report.

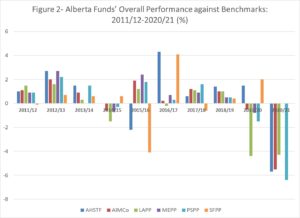

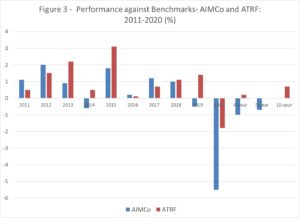

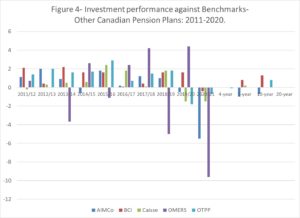

The data points in the following charts highlight the difference between the overall benchmark set by the plan’s boards or AIMCo and the actual results. Benchmarks are performance expectations set by the various pension fund boards what they define as satisfactory performance. If actual returns are greater than expectations this is what is referred to as the “value added” by the pension manager or in industry parlance “adding alpha”. Scores above zero mean that the investment manager has exceeded the benchmark.

Figure 2 in the Report looks at value added by AIMCo managers for four public sector plans- Local Authorities, Public Service, Management Employees and Special Forces as well as the Heritage Fund.

Performance generally has been met- that is benchmarks have been exceeded . But the last few years performance has been poor – mainly due to the VOLTS strategy (Volatile Trading Strategy).

Figure 3 from the Report shows that for longer-term returns, the ATRF recent 10-year period returned a respectable 70 basis points above the benchmark. ATRF’s 4-year performance is over one percentage point higher than AIMCo’s.

Slide 7 AIMCo versus its peers

Figure 4- This compares AIMCo’s performance against its peers- B.C. Investment Management Corporation, Caisse de depot, Ontario Teachers and Ontario Municipal Employees Retirement System (OMERS).As the figure shows- AIMCo performance has been ok- not the worst (OMERS is) but not the best and its performance has been poor over the last several years.

Poor investment performance is something I believe the new AIMCo CEO is focused on improving.

Recommendations

The ownership of AIMCo needs to be changed. Two-thirds of AIMCo-managed funds are public sector pension funds. The largest fund is the Local Authorities Pension Plan with about $54-billion in assets at the end of 2020. The next major AIMCo clients are Alberta Teachers and the government’s Heritage Fund. Government investments should give government input into the direction of AIMCo but not control.

Ownership of AIMCo

To address this concern my first policy recommendation is to eliminate the Crown’s sole ownership of AIMCo. Ownership positions would be subject to negotiations between the major clients of AIMCo and the Government of Alberta, The proportion of board seats would be based on the amount of funds managed by AIMCo. Revised legislation could address board representation eliminating the need for the provincial Cabinet to appoint all directors. The appointment of board members would be the sole responsibility of the pension plans’ corporate boards and the government. This makes sense because the provincial government is no longer trustee or administrator of the plans.

Board Representation and Skills

The current constitution of AIMCo’s board- all white members- does not reflect the demographics of the population they are ultimately serving. At the present time there is a very high bar to qualify to serve on AIMCo’s board- Individuals must “have proven and demonstrable experience and expertise in investment management, finance, accounting or law or experience as an executive or a director in a senior publicly traded issuer.” In other words, you need to be part of the corporate club.

This is not to say each current director of AIMCo is not qualified- however a lack of diversity on boards means that issues tend to be discussed only in financial or technical terms. But there is more at stake in pensions than numbers. Legislation should broaden the skills qualifications which should be defined more broadly to include a range of professional backgrounds, such as HR management, Indigenous relations, environmental sciences, IT, and medical science. As well, the non-Canadian directors should broadly reflect AIMCo’s investments in other geographic markets notably Asia

Independence from government

The 2018 reforms under the NDP -creating a new joint governance model- was partly based on “taking politics out of pensions.” The UCP government did not tamper with joint governance- except for a change in representation on one board. However, Bill 22 meant AIMCo was suddenly thrust into the political spotlight although AIMCo was entirely absent in the UCP’s election platform. This raises the question- “what did the government see in making AIMCo a political issue?”

Although AIMCo’s Mandate and Roles document speaks to independence of the board, the fact remains that the government is the sole owner and appoints all the directors. That is why a new ownership structure 1s recommended to give the government a minority participant and keep politics out of pension governance.

AIMCo’s Monopoly status

Lastly AIMCo’s monopoly status should be revoked. My recommendation is to give plan participants the option to give two-years notice of departing after AIMCo has managed its funds for eight years. If, after eight years, a pension board and co-owner of AIMCo concludes AIMCo’s performance is inadequate and, as co-owner has given up the fight to improve performance through the board, the pension plan would give notice and transfer all or some of its funds to a new manager.

New CEO

A new CEO Evan Siddall has arrived at AIMCo with the task of improving client relations and investment returns. The agreement on the IMA with Alberta teachers suggests more responsiveness and there are signs that investment performance may be improving. However, the proof is not in words but in concrete actions. It’s hoped this report will stimulate discussion on this important public policy issue.

Tomorrow we will report on Premier Kenney’s initial comments from today’s Omicron press conference.

Related Posts