In October 2015, the newly minted NDP government released their first budget. It was a difficult time for this rookie government as Alberta’s economy was in free-fall and Calgary’s economy was reeling. Finance Minister Joe Ceci sought something positive and the two major provincial financial agencies, reporting to the minister, were enlisted into a program to support deserving Alberta companies.

According to Minister Ceci, there were three cornerstones in his maiden budget: 1) to stabilize public services, 2) a plan to balance the budget, and 3) to act on jobs and diversification. Included under jobs and diversification was a measure to mandate AIMCo “to focus a prudent but significant portion of our province’s Heritage Fund to directly invest in Alberta’s growth. Three percent of the Heritage Fund – $540 million – will be targeted to growth-oriented companies in Alberta. ”

And thus the Alberta Growth Mandate (AGM) was born. But has this budget measure delivered? By 2020 had this measure added jobs and diversified the economy?

The NDP government and its successor, has done a reasonable job at creating a transparent system of reporting on the AGM transactions undertaken by AIMCo on behalf of the taxpayers of Alberta. Successive Heritage Fund reports show the dates of AIMCo investments and the amount and nature of the investments. The reporting however is deficient in showing the market value of these investments as well as the income earned from the investments.

The Criteria

In order for AIMCo to invest Heritage Fund moneys (and other fund moneys), the investment has to satisfy only one of the following criteria:

a. Creates jobs in Alberta

b. Builds new infrastructure in Alberta

c. Diversifies Alberta’s economy

d. Supports Alberta’s growth

e. Connects Alberta’s companies to export markets

f. Develops subject matter expertise within Alberta

Other Funds can also invest

The December 2015 Memorandum of Understanding document between the Finance Minister and AIMCo stated:

“AIMCo will execute upon this allocation in two initiatives:

- Additional resources will be allocated to identifying and reviewing investment opportunities that would satisfy the mandate and not fit within any of AIMCo’s current investment strategies; and

- An increased focus will be undertaken on identifying and reviewing investment opportunities that would both (a) satisfy the mandate; and (b) benefit all of AIMCo’s existing clients through existing investment strategies. Investments that are made through either of these two initiatives will be reported against the Alberta Growth Mandate.”

By allowing other funds to “get in on the action,” the AGM could leverage on the funds managed by AIMCo for its other clients, such as the $45 billion Local Authorities Pension Plan. Thus, not only was up to $540 million in Heritage Fund assets available to be tapped but other Alberta public sector pension funds which meet the investment criteria of the AGM.

In the first Heritage Fund Annual report after the mandate was proclaimed, “AIMCo,” it was noted, “has a significant due diligence process to ensure that capital is deployed prudently.” The TransAlta Renewables and Calfrac investments were noted. The Calfrac investment was glowingly described as: “an innovative pressure pumping services provider focused on North America’s premier unconventional natural gas and light oil plays plus strategic international markets.” This is not to say that AIMCo could invest all these pension funds in AGM-like investments. Rather, given that some portion of public sector funds could be allocated to higher risk investments, then Alberta-based companies subject to AIMCo due diligence could be added to the higher risk investments of these pension plans.

By 2017-18, the the Heritage fund recorded nearly $200 million in investments, virtually all of which was in the oil and gas and real estate sectors.

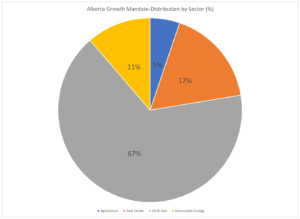

By March 2019, AIMCo had invested $406 million of Heritage Fund assets in 30 companies comprising the AGM. The following pie charts show the diversification of these investments first by company and then by sector.Alberta Growth Mandate- industry

Assessment- diversification

As can be seen from the pie chart showing the distribution of investments by sector, the mandate appears to be biased towards traditional sectors of Alberta’s economy- oil and gas and real estate. Of the $406 million of investments, 67 per cent or $269 million were placed in oil and gas companies or servicing companies; 17 per cent or $70 million in real estate; 11 per cent in renewable energy ($45.9 million) and five per cent in agriculture ($21.2 million). So if diversification was a criteria, this one of six criteria obviously was not met.

List of Investments, 31 March 2019

| Transaction Date | Company Name | Commitments ($millions) | Instrument | Sector |

| November 23, 2015 | TransAlta Renewables | 45.9 | Equity | Renewable Energy |

| December 22, 2015 | Calfrac Well Services | 6.5 | Equity | Oil & Gas |

| June 10, 2016 | Calfrac Well Services | 39.9 | Debt with Warrants | Oil & Gas |

| August 10, 2016 | Pine Cliff Energy | 6.1 | Interest Bearing Notes/Warrants | Oil & Gas |

| October 7, 2016 | Journey Energy | 6.1 | Interest Bearing Notes/ | Oil & Gas |

| Nov. 1, 2015 to December 31, 2017 (approval on Oct. 1, 2014) | VERSUS (10th Avenue Residential | 24.2 | Direct Investment | Real Estate |

| Nov. 1, 2015 to December 31, 2017 (approval on Mar. 23, 2011) | Manning Town Centre | 6.4 | Direct Investment | Real Estate |

| Nov. 1, 2015 to December 31, 2017 (approval on Jul. 23, 2014) | Stonegate Industrial Buildings | 22 | Direct Investment | Real Estate |

| Nov. 1, 2015 to December 31, 2017 approval on May 25, 2015) | West Village Towers | 0.3 | Direct Investment | Real Estate |

| Nov. 1, 2015 to December 31, 2017 (approval on Sept. 14, 2016) | Stonegate Common Phase I Retail | 6.2 | Direct Investment | Real Estate |

| November 8, 2016 to December 6, 2016 | Calfrac Well Services | 1.6 | Equity | Oil & Gas |

| December 13, 2016 | Savanna Energy | 45.7 | Debt with warrants and Equity | Oil & Gas |

| December 12, 2016 to December 30, 2016 | Pine Cliff Energy | 0.2 | Equity | Oil & Gas |

| December 15, 2016 to December 23, 2016 | Savanna Energy | 0.4 | Equity | Oil & Gas |

| January 31, 2017 | Razor Energy | 7.2 | Loan Facility/Common Shares | Oil & Gas |

| February 17, 2017 | Perpetual Energy | 10.1 | Debts and Equity | Oil & Gas |

| March 3, 2017 | Journey Energy | 2.6 | Warrant Exercise | Oil & Gas |

| May 9, 2017 | Whitecap Resources | 8.7 | Interest Bearing Notes | Oil & Gas |

| May 12, 2017 | Razor Energy | 0.7 | Equity | Oil & Gas |

| May 25, 2017 | Ikkuma Resources | 8.9 | Debt with Warrants | Oil & Gas |

| May 31, 2017 | Ember Resources | 9.3 | Preferred with Warrants | Oil & Gas |

| June 9, 2017 | Kinder Morgan Canada | 29.1 | Credit Facility | Oil & Gas |

| August 1, 2017 | Trident Exploration Corp | 12.3 | Debt | Oil & Gas |

| August 8, 2017 | Bonnefield | 21.2 | Private Equity Direct Investment | Agriculture |

| September 22, 2017 | Western Energy Services | 43.8 | Loan Facility/Common Shares | Oil & Gas |

| November 27, 2017 | First Nations ETF | 7 | Interest Bearing Notes | Oil & Gas |

| December 15, 2017 | Enerflex | 4.2 | Interest Bearing Notes | Oil & Gas |

| December 31, 2017 | Five Corners Residential | 10.6 | Direct Investment | Real Estate |

| January 15, 2018 | Razor Energy | 3 | Loan Facility/Common Shares | Oil & Gas |

| January 22, 2018 | Journey Energy | 4.1 | Equity | Oil & Gas |

| February 1, 2018 | Wolf Midstream | 8.3 | Loan Facility/Common Shares | Oil & Gas |

| 07-Nov-18 | Ikkuma Resources | 3.5 | Debt | Oil & Gas |

| 406.1 | ||||

| Source: Alberta Heritage Savings Trust Fund, 2019 Annual Report, at page 9. |

In future posts, we will dive more closely into the investee companies and how exposed these companies are both to declines in oil prices and environmental liabilities.

Thank you for your blog. Some of those ‘energy’ companies were alternative (solar / wind), correct? I’m alsonwondering about the support provided for expansion of local brewing and distilling companies? And the various tech companies? And cannabis? Were they not helped under AIMco?

Elizabeth- from what I can tell from the Heritage Fund reports, there is one renewables energy company which is TransAlta. As far as brewing, distilling or cannabis companies are concerned unless these have been recent investments- since 31 March 2019, it doesn’t look like it. Definitely nothing on the tech side.

My take is that AIMCo, for whatever good reasons it had back in the 2016-19 period believed that investing mainly in oil and gas was a prudent thing to do. Given what has happened over the past few years and especially since March 9th, this has proven to be a poor investment decision.

WHether the the NDP government monitored these investments against the criteria set out in the mandate is another question.