In the following correspondence between the Provincial Treasurer and TD-Bank’s vice-president of the Alberta South Division, a longstanding complaint by the chartered banks about unfair competition from Alberta Treasury Branches (ATB) is revealed.

Backdrop

In the late 1970s, the North American economy faced surging inflation rates in the low teens and Federal Reserve Board Chairman, Paul Volcker was determined to drive the economy into recession by imposing high interest rates. The Bank of Canada, led by Gerald Bouey followed suit and Canada’s bank rate approached 20 per cent. Inevitably, heavily indebted famers, home buyers, and businesses appealed to various orders of government to shield them from the effects of high interest rates. As the correspondence reveals, Alberta’s Treasurer had oversight not only over ATB, but control of Alberta’s interest rate policy as it pertained to the Alberta Agricultural Development Corporation, the Alberta Opportunity Corporation, and the Alberta Mortgage Corporation.

The concern of the banks expressed through the T-D but felt by all the banks was the pursuit by ATB of the banks’ business customers. However, the policy pertained only to ATB’s existing customers which suggested the banks did not believe ATB was following the policy statement. Naturally the statement drafted by ATB and vetted by the Treasury department disagreed as the anodyne Treasurer’s response suggests.

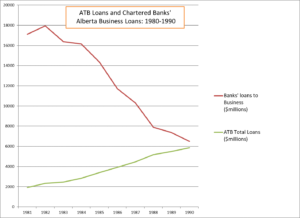

What evolved however during the 1980s, a period of acute stress for Alberta’s oil patch, homeowners, local financial institutions, business and farmers was an acute credit contraction by banks, with ATB picking up accounts being de-marketed by the banks. As the chart below shows, bank lending dried up and ATB’s loan book grew.

Sources: ATB annual reports and Bank of Canada. Table 176-0045, Chartered banks, regional distribution of assets and liabilities, at end of period, Canada, provinces and international, quarterly

And the rest, as they say, is history…. rising unemployment, falling oil prices, home foreclosures, business bankruptcies, population out-migration produced a fiscally weakened provincial government and insolvent federally and provincially supervised financial institutions.

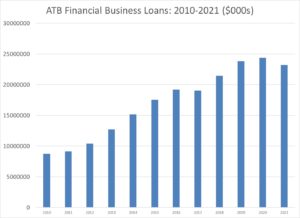

At the current point of the economic cycle, we have an ATB which has stop growing. However as the chart below illustrates, ATB corporate lending rose dramatically during the 2010-2016 period.

Source: ATB annual reports

ATB’s business loan growth doubled from $8.7 billion in 2010 to $17.5 in 2015 at the point when the Alberta economy entered a significant downturn likened at the time to a once in a generation depression. From 2015 to 2020 business lending continued growing by another 40 per cent to reach

an all-time high by 2020 even as Alberta’s GDP struggled to achieve its 2015 level. (According to Statistics Canada Alberta’s GDP in 2012 chained dollars in 2016 was $314.6 billion; in 2020 the GDP number was $307.1 billion. In Budget 2021, Alberta’s 2021 real GDP is estimated to be $336 billion but the numbers do not reflect Statistics Canada’s most current 2020 numbers.)

How the future will play out is anyone’s guess. While optimism is currently rife in the oil patch, Alberta’s economy is still in a wounded state. The bill for oilpatch environmental damage is material and may be socialized leaving taxpayers holding the bag. While blue hydrogen promises new riches and natural gas prices reach 10-year highs. the reluctance of financial institutions to be seen associating with large GHG emitters means expensive oilsands’ production expansions are effectively dead. The UCP’s newfound interest in protecting water purity is a little rich. The Alberta Energy Regulator’s newfound scrutiny of coal mines is welcome, but late in the game. Institutional investors, especially those responsive to the growing divestment movement are also under pressure to stop investment to major polluters.

Will history repeat? Will the 2015-2020 period be remembered as only the first stage in a decade long depression in which ATB will function as the lender to businesses where banks have decided to let their customers go? Will we see difficulties in the Financial prospects of Alberta-based financial institutions? Will Alberta businesses and the Alberta state be able to shift from their fossil fuel reliance to “reinvent” their business model? How will housing and constructions markets, which play such a major role in Alberta’s economy, fare if interest rates rise and Alberta’s economy continues to stagnate?

Sympathies to Finance Minister Toews who has inherited both a disturbing fiscal legacy but also a ideological playbook which reduces his scope to creatively shape a very different way of life for Alberta and Albertans.

Source: WIkipedia

Correspondence

R. Carl Smith

Vice-President and General Manager

The Toronto-Dominion Bank

Alberta South Division

1700 Home Tower

Toronto Dominion Square

Calgary, Alberta

T2P 2Z2

March 28, 1980

The Honourable Lou Hyndman,

Provincial Treasurer,

Province of Alberta,

323 Legislative Building,

Edmonton, Alberta

Dear Mr. Hyndman:

It was my understanding Treasury Branches of Alberta would be providing a preferred interest rate of 14 1/2 % for existing borrowers. I understood this program is as outlined in your statement of November 7th, 1979, copy attached. It has now come to my attention Treasury Branches are aggressively pursuing accounts of both our Bank and other banks, offering interest rates well below Prime. This would seem to be contrary to your statement. It would, therefore, appear an aggressive new business development program by Treasury Branches is being subsidized by the taxpayers of the province. It does not seem fair to see this subsidy arrangement being handled only by one lender.

I would appreciate hearing your thoughts on this matter,

Yours very truly

Carl Smith

Enclosure

MINISTERIAL STATEMENT BY PROVINCIAL TREASURER, HONOURABLE LOU HYNDMAN

WEDNESDAY NOVEMBER 7, 1978

On October 25th I advised the Assembly that the Treasury Branch had agreed to consider special short-term arrangements with respect to its existing lending policies as they affect small businesses in Alberta.

I also advised that, during the period of assessment of the impact of the Bank of Canada’s 14 % bank rate, all interest rates of the Alberta Opportunity Company and the Alberta Agricultural Development Corporation would be frozen and that the Alberta Mortgage Corporation would review its direct lending program.

The Treasury Branch and the government has completed their initial assessments and I therefore advise the House as follows:

The Treasury Branch advises that effective immediately the interest rate under its Small Business Loan Program, for existing borrowers, will be held at 14.5%. This preferred rate will apply only to existing Treasury Branch Small Business Loans. This Program makes available to Alberta small businesses loans up to $500,000 for worthwhile purposes. This preferred rate will also apply to Treasury Branch customers who have obtained loans under the Federal Small Business Loans Program.

Loans by farmers from the Treasury Branch, guaranteed by the Alberta Agricultural Development Corporation, will also be held at 14.5%. This will be accomplished through a policy change by the Treasury Branch and also by the Agricultural Development Corporation absorbing temporarily the 1% service charge made to Borrowers. This 14.5% preferred rate will also apply to the Treasury Branch AGRI-plan Loans Program and the Federal Farm Improvement Loans Program.

The temporary cancellation of A. D. C.’s 1% service charge will also apply to Long’s by chartered banks and credit unions, guaranteed by the Agricultural Development Corporation, thereby reducing loan costs to their customers as well.

Loans of the Alberta Opportunity Company, which is and will remain a lender of last resort, we’ll stay at the base rate of 12 % and will be reviewed monthly.

The Alberta Home Mortgage Corporation is monitoring the impact of high interest rates on its programs and on prospective home buyers. Existing subsidies to low-income earners may be modified in the weeks ahead.

The Superintendent of the Treasury Branches advises that as hundreds of thousands of Albertans rely on Treasury Branches has a safe place to invest their funds, the Treasury Branch has already increased the interest rates being paid on deposits and they will continue to maintain competitive deposit rates with those being paid in the marketplace.

These special program modifications, designed to assist small businessmen and farmers will be in effect during this period of very high interest rates. The program will be open for reassessment and possibly further modification should the Bank of Canada bank rate increase or decrease in the weeks and months ahead.

Office of the Provincial Treasurer of Alberta

May 6, 1980

Mr., R. Carl Smith

Vice-President and General Manager

Toronto-Dominion Bank

Alberta South Division

1700 Home Tower

Toronto Dominion Square

Calgary, Alberta

T2P 2Z2

Dear Mr. Smith:

Many thanks for your letter of March 28th regarding your concerns relating to Alberta Treasury Branches.

The program modifications addressed in my November 7, 1979 statement were intended to assist small businesses and farmers in Alberta. Insofar as Treasury Branches is concerned, it marked the commencement of their policy of maintaining, during this period of unusually high interest rates, an interest rate differential of half a percent below Prime on their AGRI-Plan and Small Business Loan Programs.

The present effect of that policy is such that, with the Treasury Branches’ prime lending rate being 16 ½%, farmers and small business operators can obtain loans under these programs at an effective rate of 16%.

Treasury Branches has a sound record as responsible members of the financial community. A review of their performance over the years shows an organization which is working side-by-side with Albertans without subsidy by the provincial government. Treasury Branches’ efforts in providing services through the Branch and Agency system have been directed largely at rural parts of the Province. As well, the profits generated by Treasury Branches compare favorably with the industry.

These comments are general in nature but I know that Treasury Branches’ Superintendent Fred Sparrow would be pleased to meet and discuss with you any specific current concerns you have.

It is important that all members of the Alberta financial community operate in an atmosphere of mutual trust and cooperation and as such, your candid expression of concern is appreciated.

Yours truly,

Lou Hyndman

Provincial Treasurer

LDH/kaz

Source: Provincial Archives of Alberta, PR1986.0245 (Hyndman papers), Box & 30, File 558.

Related Posts