Highlights

- Economic assumptions on balance appear realistic with some upside

- Spending kept flat mainly through cuts to ministries except Health, K-12 Education, and Social Services

- Capital spending to remain elevated although next two years see a significant reduction.

- No new taxes or tax increases- nothing on revenue structure review

- Debt levels will rise to close to government’s fiscal anchor

Economic Assumptions

The Government seems to be following the playbook from Ralph Klein’s early years in leading the province out of what had been chronic deficits. Conservative resource revenue forecasts based on past history rather than hoped-for future prices helped return the provincial government to balance quickly. These conservative revenue forecasts restrained the public and various interest groups (and spending ministers) from advocating for new money because according to the budget it was not there. This lowballing became a political football later on as opposition parties criticized Klein and Treasurer Dinning for being too strict on the spending front. However, the balanced budget came earlier than legislated and Klein’s Tories swept to power again in 1997.

Below are the oil and gas assumptions and how they compare with private sector forecasts. As shown, the oil price forecast is about $6 below the average of bank economists and industry analysts for the 2021-22 fiscal year.

| Oil and Natural Gas Assumptions | |||||

| 2019-20 | 2020-21 Forecast | 2021-22 Estimate | 2022-23 Target | 2023-24 Target | |

| West Texas Int. (U.S. $/bbl) | 54.85 | 39.3 | 46 | 55 | 56.5 |

| WCS @ Hardisty ($Cdn/bbl) | 53.14 | 37.2 | 40.7 | 51.6 | 52.7 |

| Light-heavy oil price differential ($US/bbl) | -14.82 | -11 | -14.6 | -14.7 | -15.3 |

| Alberta Reference Price ($Cdn/GJ) | 1.39 | 2.1 | 2.6 | 2.5 | 2.4 |

| Source: Government of Alberta, Fiscal Plan 2021-24, p. 81. | |||||

| Oil Price Benchmark West Texas Intermediate (U.S.$/bbl) | |||||

| 2021 | 2022 | 2023 | 2024 | ||

| High | 58.5 | 62 | 68.2 | 74.2 | |

| Low | 46 | 48 | 53 | 54.06 | |

| Average of all Private Forecasts | 51 | 54.5 | 57.5 | 61 | |

| Government of Alberta (calendar year) | 45.5 | 53 | 56 | 60 | |

| Source: Government of Alberta, Fiscal Plan 2021-24, p. 66. | |||||

There may be considerable upside to the provincial government if there forecasts prove too pessimistic. The table below shows the sensitivities to various factors outside the government’s control.

|

Sensitivities to Fiscal Year Assumptions, 2021-22 (millions of dollars) |

||

| Change | Net Impact | |

| Oil price (WTI US$/bbl) | -$1 | -230 |

| Light-heavy oil price differential ($US/bbl) | $1 | -185 |

| Natural gas price (Cdn$/GJ) | -$0.10 | -20 |

| Exchange rate (U.S. /Cdn$) | 0.01 | -165 |

| Interest Rates (% change) | 0.01 | -205 |

| Primary household income | -1% | -160 |

| Source: Government of Alberta, Fiscal Plan 2021-24, p. 90 | ||

| Sensitivities are based on current assumptions of prices and rates, displaying impacts over a 12-month period. They can vary significantly at different price and rate levels. Energy price sensitivities do not include potential impacts of price changes on land lease sales revenue. | ||

With respect to other forecasted economic variables, the Government seems a tad bit optimistic on GDP growth, unemployment and housing starts. GDP growth for 2021 is slightly more optimistic than other forecasters in 2021, slightly more conservative in 2022 and more optimistic for 2023 and 2024.

| Alberta Real Gross Domestic Product Benchmark (% change) | |||||

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| High | -6.4 | 6.1 | 6 | 3.6 | 3 |

| Low | -6.3 | 4.1 | 2.7 | 2.7 | 2.1 |

| Average of all Private Forecasts | -7.2 | 4.6 | 4.4 | 3.2 | 2.6 |

| Government of Alberta (calendar year) | -7.8 | 4.8 | 3.7 | 3.3 | 3.1 |

| Source: Government of Alberta, Fiscal Plan 2021-24, p. 70. | |||||

Unemployment in Alberta is a key driver influencing personal disposable income which affects personal income tax receipts in particular.

| Alberta Unemployment Rate Benchmark (%) | ||||

| 2021 | 2022 | 2023 | 2024 | |

| High | 10.9 | 10.4 | 8 | 6.6 |

| Low | 9.5 | 7.2 | 8 | 6.6 |

| Average of all Private Forecasts | 10 | 8.4 | 8 | 6.6 |

| Government of Alberta (calendar year) | 9.9 | 8.4 | 7.3 | 6.3 |

| Source: Government of Alberta, Fiscal Plan 2021-24, p. 71. | ||||

In the current years, the Finance ministry is close to other forecasters but the outer years, the disparity grows somewhat. Unemployment rates will become an increasing salient issue politically as the calendar inexorably moves towards the next election window. The issue of jobs in modern industrial states is seen largely as a job for the state but the acceptance that “market-based solutions are best” means that conservative government are loathe to take true ownership stakes unless they believe the stakes will pay off politically. Public Works projects are an easy sell as they guarantee specific numbers of construction jobs in the short term. However, other types of investments like Trans Mountain and Keystone XL hold significant amounts of political risk with future prospects “controlled” by one order or government or another national government.

In the case of Keystone XL, the Government of Alberta chose to describe its exposure of about $1.3 billion ($304 million equity investment and $892 in loan guarantees) but did not set aside a write-down. Predictably it chose to take significant write downs on the NDP’s gambit with oil-by-rail mandated by some desperate oil and gas producers but not for Keystone XL.

Housing starts also are critical in keeping construction unions and workers busy. As the table below shows, the Finance department has a slightly more sanguine view of the housing market than other forecasters. The optimism may be based on low interest rates underwriting a stronger demand for housing in Alberta. However, over the past month, long-term yields on government bonds have risen dramatically, so this is a sector which much be watched very closely in assessing the province’s finances- particularly on the revenue side.

| Alberta Housing Starts Benchmark (in thousands) | ||||

| 2021 | 2022 | 2023 | 2024 | |

| High | 26.1 | 29.9 | 30.3 | 32.9 |

| Low | 22 | 22.5 | 26.8 | 28.8 |

| Average of all Private Forecasts¢ | 23 | 25.5 | 28.5 | 30.8 |

| Government of Alberta (calendar year) | 26.2 | 28.3 | 31.5 | 34 |

| Source: Government of Alberta, Fiscal Plan 2021, p. 72. | ||||

Spending

The government has continued to flatten its spending, excluding extraordinary COVID and the Economic Recovery Plan expenses. The table below reveals that total spending will barely increase over the next three fiscal years, in line with the Government’s desire to move per capital spending levels down to those of the average of the big three other provinces.

| Budget 2021- Expense Summary (millions of dollars) | ||||||

| 2019-20- Actual | 2020-21 Forecast | 2021-22 Estimate | 2022-23 Target | 2023-24 Target | Percentage Change 2019-20 to 2023-24 Target | |

| Operating Expense by Ministries | ||||||

| Health | 20,870 | 20,541 | 21,418 | 21,418 | 21,418 | 2.6% |

| Kindergarten to Post-Secondary | 8,134 | 8,181 | 8,248 | 8,248 | 8,248 | 1.4% |

| Post-secondary | 5,477 | 5,119 | 5,044 | 5,085 | 5,118 | -6.6% |

| Social Service Ministries | 6,147 | 5,930 | 6,276 | 6,373 | 6,391 | 4.0% |

| Other ministries | 8,008 | 7,491 | 7,295 | 7,267 | 7,245 | -9.5% |

| Total Operating expenses (before COVID-19/Recovery Plan) | 48,636 | 47,262 | 48,281 | 48,391 | 48,420 | -0.4% |

| Capital grants (before COVID-19/Recovery Plan | 1,678 | 2,195 | 2,644 | 1,754 | 2,297 | 36.9% |

| Amortization etc. | 3,720 | 3,892 | 4,009 | 4,145 | 4,216 | 13.3% |

| Debt Servicing | 2,235 | 2,369 | 2,764 | 3,085 | 3,335 | 49.2% |

| Total Expense including COVID1-9/Recovery Plan | 58,376 | 62,488 | 61,918 | 58,404 | 58,852 | 0.8% |

| Source: Government of Alberta, Fiscal Plan, 2021-24, p. 98 | ||||||

As shown above the big hits will be taken in the post-secondary education system and other ministries including Energy, Environment & Parks, Agriculture and Transportation.

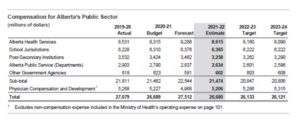

Much political and bureaucratic energy has been devoted to brining down the compensation levels of government departments and provincial agencies.The approach assumes, inpart, that the cost of living in Alberta

The Government hopes to achieve a 3.5 per cent reduction by 2023-24 from the actual compensation spending in 2019-20 shaving $958 million of the wages and salaries of public sector workers. Some of the savings will be from attrition and possibly lay-offs. Budget 2019 set out to prune the size of the public service by 7.7 per cent by the end of March 2023. Negotiations with the Alberta Union of Provincial Employees, the United Nurses Association, and the Alberta Teachers’ Association will likely be contentious as the UCP government pursues its downsizing agenda.

The day after the budget came down, Health Minister Shandro announced an agreement had been reached with the Alberta Medical Association over fees. Details were scarce. According to the news release “Our tentative agreement allows for fiscal sustainability into the future, while maintaining a strong focus on patient care and fairness and equity for physicians.” In the table above, the Fiscal Plan shows that compensation rise from the 2019-20 level by less than one per cent by 2023-24. On the AMA’s part, the process is now in the hands of members “for their assessment,” according to AMA President, Dr. Paul Boucher.

Economic Recovery Plan- many strategies

The budget, echoing the release of the June Economic Recovery Plan, sets the context for broad economic strategy by reminding Albertans that oil and gas is responsible for the

“Some suggest diversifying the economy requires a transition from our traditional sectors such as energy. Let me be clear, Mr. Speaker. That is not this government’s position……..the continuous improvement of the standard of living of all Canadians. And it has provided a foundation for economic diversification in Alberta – spurring technological innovation and providing the wealth for further investment, consumer spending, and benevolence. Mr. Speaker, I want to be clear: economic diversification is a key component in economic recovery, and a key priority for this government, and it includes a strong and innovative energy sector.”

Along with the energy strategy is the following grab-bag list of sectoral strategies: Agriculture; Culture; (whose budget was cut 20 per cent); Finance and Fintech; Labour and Talent; Pharmaceuticals and Life Sciences, Tourism; Aviation, Aerospace and Logistics; Investment and Growth; and Manufacturing. It remains clear that the energy strategy will be front and centre.

Capital Spending

The Capital Plan is mainly focussed on four main areas: capital maintenance and renewal, Municipal Infrastructure, Health, and roads and bridges. This year will see a total of $8.2 billion dispensed. Spending will trend down in the two years following by almost one-quarter as the currently weak economy presents opportunities to put Alberta workers to work.

Revenue

The Finance Minister was categorical in his statement that the Budget introduces no new taxes or raises existing taxes. Except for the impact on personal income tax exemption levels which have been frozen, the message is consistent with Toews’ and the Premier’s position that raising taxes at this time of COVID and low oil prices would be a mistake. The Table below illustrates the main revenue sources. The Minister talked about a possible review

|

Budget 2021- Total Revenue (millions of dollars) |

||||||

| Revenue Source |

2019-20- Actual |

2020-21 Forecast |

2021-22 Estimate |

2022-23 Target |

2023-24 Target |

Percentage Change 2019-20 to 2023-24 Target |

|

Personal Income Tax |

11,244 |

10,936 |

11,647 |

12,439 |

13,258 |

17.9% |

|

Corporate Income Tax |

4,107 |

2,242 |

1,891 |

2,482 |

3,139 |

-23.6% |

|

Other Tax Revenue |

5,747 |

5,304 |

5,527 |

5,748 |

5,939 |

3.3% |

|

Resource-Revenue |

5,937 |

1,978 |

2,856 |

4,718 |

5,869 |

-1.1% |

|

Federal Transfers |

9,072 |

11,381 |

10,181 |

9,872 |

9,785 |

7.9% |

|

Investment Income |

2,828 |

2,390 |

2,205 |

2,325 |

2,478 |

-12.4% |

|

Net Income from Business Enterprises |

-225 |

1,227 |

1,877 |

2,065 |

2,472 |

N/A |

|

Premiums, fees and licenses |

3,929 |

3,960 |

4,133 |

4,227 |

4,339 |

10.4% |

|

Other Revenue |

3,585 |

2,878 |

3,380 |

3,546 |

3,586 |

0.0% |

|

Total Revenue |

46,224 |

42,296 |

43,697 |

47,422 |

50,865 |

10.0% |

|

Source: Government of Alberta, Fiscal Plan 2021-24, p. 75. |

||||||

Several things stand out: first corporate income tax is not expected to even rise to levels seen in 2019-20 before the oil price and COVID 19 crisis. The Job Creation Tax Cut has yet to hit Alberta’s bottom line. Personal income tax is expected to resume its ascent from the current year’s nadir. Resource revenue, like corporate income tax, notoriously volatile, will almost make it back to the levels seen in 2019-20 and as noted above, there may be considerable upside. Federal transfers are expected to fall from a COVID peak but will still represent nearly 20 per cent of revenue to the provincial government. Notably by fiscal 2023-24, personal income tax revenue and corporate income tax will only represent barely one-third of overall revenue, with federal transfers close to 20 per cent. The shortfall is expected to be made up by resource revenue- always a tricky proposition.

Debt

The provincial debt of $98.1 billion consists of $73.1 billion of tax-supported debt, 6.0 billion in loans to government business enterprises (mainly ATB), and $18.1billion in loans to provincial corporations mainly Alberta Capital Financing Authority. Most of the debt is long-term (80 per cent) and a small portion ($3 billion) in Public-Private Partnerships. The bulk of the borrowing is done in the Canadian and U.S. markets.

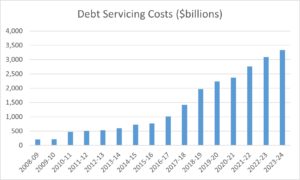

Debt servicing costs have increased rapidly as the debt has mounted over the past decade. THese costs are highly sensitive to interests rates controlled by global central banks. The movement in long-term rates in the past two months in Canada and the U.S. could be higher costs during this fiscal year.

Growth in per capita taxpayer-supported debt has gone from $511 in 2008-09 to an estimated $29,081 in 2023-24. These are scary numbers for Albertans who feel that their taxes are still too high for the services they receive.

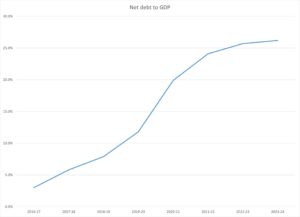

Critical to the Government’s relationship management with rating agencies is how the fiscal anchor of taxpayer-supported debt to Gross Domestic Product (GDP) will hold.

The current projections show a leveling off in 2022-23 as the economy almost grows as fast as the debt. However, the key will be whether revenues hold and interest rates stay low.

Related Posts

I’m a fan of fiscal anchors. Not all that keen on debt as % of GDP.

> Often too far in the future and hard for folks to understand. I like

> anchors with more immediacy which can affect current budget planning.

> One that’s in the news is dsc as % revenue. Easy to understand:

> interest payments relative to income. David Dodge I believe is

> talking about this. From what I understand, he says the anchor should

> be 10%. For 2021 I think Alberta’s dcbt to revenue is about 7.5%.

> Haven’t given this indicator much thought other than I like its

> understand ability and impact on budget planning if a government is

> close to the target. In the Klein years we used the anchor that

> resource revenue forecast couldn’t be higher than previous 5 year

> average. It was easy to communicate and affected current budget

> planning. There is no one perfect anchor. Probably need a suite.

> Most of all need government commitment!