Genesis, analysis, investment imperative, rating agencies

Treasury Board President and Finance Minister Trevor Toews was provided considerable advice as he prepared his October 2019 budget. The precursors included the NDP’s “path to balance”- a Recovery built to Last, the UCP platform, Alberta Strong & Free, the report of the Blue Ribbon Panel (MacKinnon Report) and the Shadow Budget produced by the C.D. Howe Institute. In this report, we look at how the Alberta budget compares with these other “suggestions” or “guideposts.” Then we examine the “big gamble” that underlines the UCP budget- if they create the environment for investment, will it come? Finally, we ask how the rating agencies will evaluate the UCP’s initial stewardship of Alberta’s public finances.

Genesis

Unlike the October 2015 budget, former Finance Minister Joe Ceci was tasked to create, Minister Toews had a wealth of experienced advice to rely upon in setting fiscal course. In particular, he had a well articulated policy framework- both fiscal and non-fiscal- to work with in the form of his party’s platform. This obviously was not the case for Joe Ceci, a former social worker and City of Calgary Councillor.

Minister Toews inherited a fairly robust fiscal platform which was principally aimed at restoring fiscal balance quickly and incenting the energy sector to invest massively to create jobs essential in creating a favourable environment to trim the public sector down to size.

One of the key pledges in the Alberta Strong & Free platform was a $1 million review of the province’s finances (a job that should have informed the NDP’s first budget (but did not). The UCP, with its unpaid advisers knew that any incoming government, particularly with fraught fiscal circumstances, must avail themselves of the opportunity to blame previous governments for the fiscal situation they inherited. Alas, when the NDP came into office as innocents, euphoric, with a new swagger that enabled insiders to claim victory was really the blessings of personality and not aversion to the entitlement of the PC past, they forgot to use the first year to blame the previous government for its fiscal mismanagement. But we digress.

In the event, Kenney and Toews could rely on “expert,” “blue ribbon” resources that were credible in the eyes of the business community, the media, and the broad (indifferent) public. Armed with the “credentials” of academics, public servants, “bankers”, and former politicians, and communications specialists the aura of the “expert” panel was formulated. The “wise persons” would “guide” the government to the promised land of Balanced Budgets and Debt Repayment. These experts, like this writer, were schooled in the MacKinnon-Dinning recipe of spending cuts.

As we explore below, the fundamental issue is whether a resource based, staples economy has another phase of hyper-development left in it to create badly needed jobs to assure the social contract and, of course, re-election.

Analysis

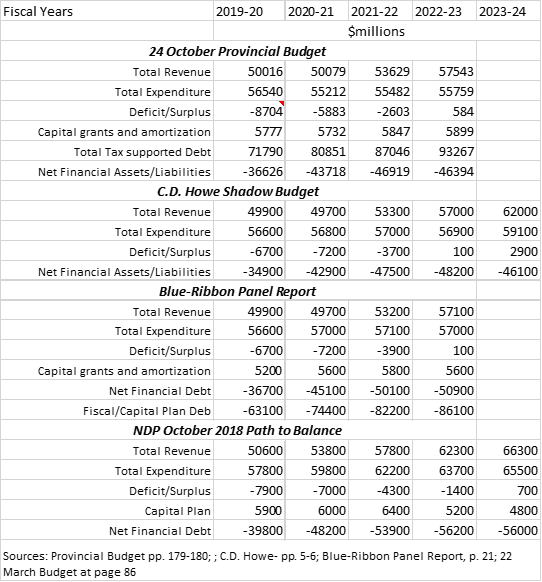

The table below compares the basic metrics in any fiscal plan which rating agencies examine to determine how credible the plan is. Credibility is a subjective concept and relies upon the agency’s personnel’s judgements (maybe 5-8 people) on whether the plan can be achieved.

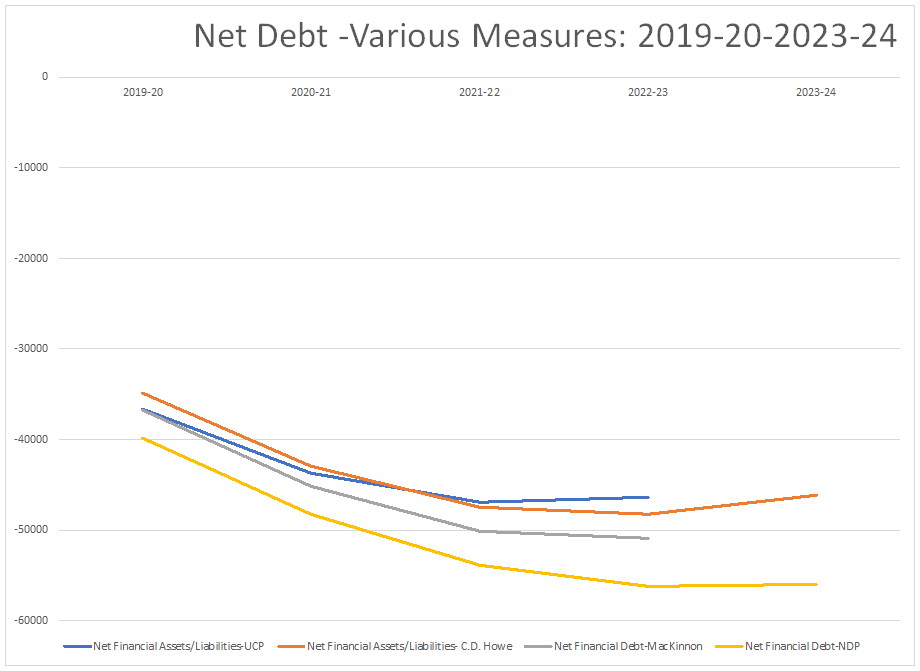

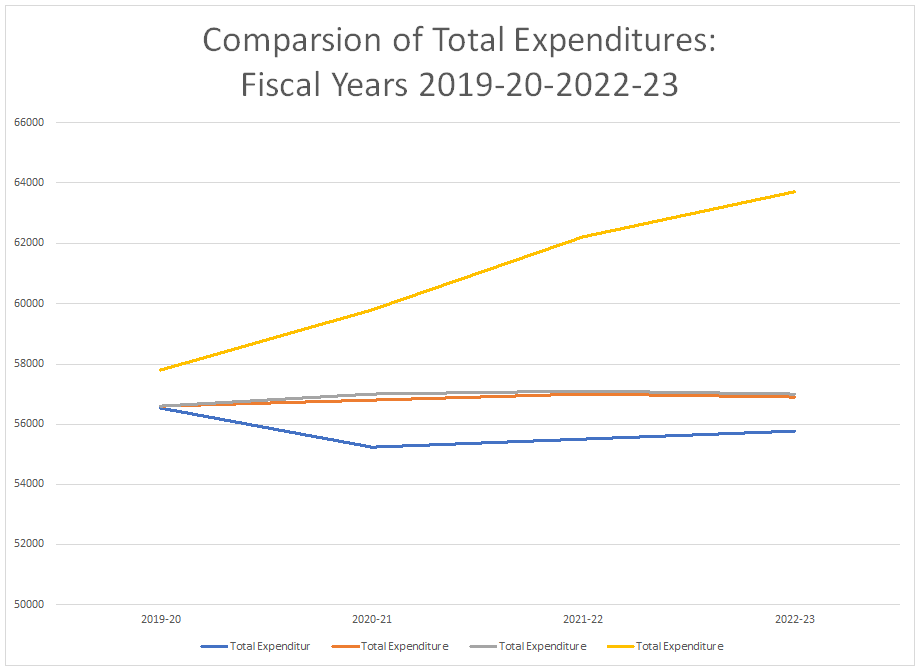

In the table above, from the rating agencies’ perspective, the key metric is debt outstanding. As shown, various reports describe debt outstanding differently. What appears to be a somewhat consistent number is termed “Net Financial Assets/Liabilities” in the Toews’s budget and C.D. Howe, and “Net Financial Debt” by MacKinnon and the NDP’s “Path to Balance.” The ending point in all this is about $56 billion in net financial debt by 2022-23 under an NDP government and $46.4 billion in the October 2019 budget- a difference of roughly $10 billion. The chart below shows the evolution of these different measures over four years. As the period unfolds, the distance between the NDP path to balance and Toew’s budget gets wider.

So if you are a credit analyst at Moody’s, S&P or DBRS, how do you provide advice to your clients, institutional investors with hundreds of millions of dollars to invest in Canadian provincial bonds. Do you buy Quebec or B.C., Ontario or Alberta bonds? Four years is a long-way out in the time frame of financial markets- a lot can happen. Certainly, judging from the yellow (NDP) line, as an investor looking for safety, the UCP plan appears superior.

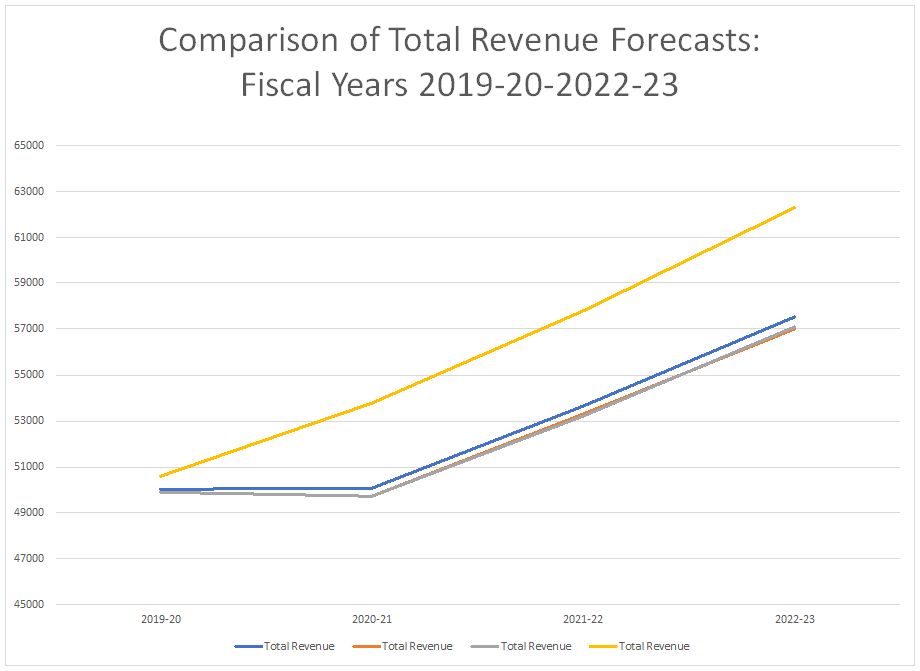

Judging by the graph above- total revenue, the NDP forecast looks optimistic. What is interesting is that the UCP government is not banking on any revenue recovery until 2021-22 perhaps in the expectation that the spending freeze will slow growth and the policy measures taken to spur investment and jobs won’t kick in until two years from now. Note also the near conformity in the revenue lines used by Toews, MacKinnon and the C.D. Howe estimates.

Although the UCP derives its electoral support from Calgary and rural Alberta, its path to balance is not taking any chances with the oil and gas “fairy” quickly returning. It was the NDP who relied more heavily on the oil patch to restore the province’s fiscal fortunes.

This chart is the key differentiator. It shows that the Kenney government has decided to push its public service to restrain costs and manage the inevitable stress and conflict for at least two years, leaving time just before the next election to open up spending. Before the budget, there was speculation that the Kenney government was talking tough but that the budget would be less draconian. The chart above shows this not to be the case.

It is a calculated gamble that the tough medicine aimed at the Edmonton based public service will be viewed favourably outside the capital region where all but one of the seats are held by New Democrats. The budget measures should play well to its base constituency but the question becomes how will affected school boards and universities outside Edmonton cope with spending restraint. Is it likely that school administrators in Calgary or at Bow Valley College will be able to maintain adequate services for two years while Edmonton-based administrators are less able to maintain adequate services? Who knows.

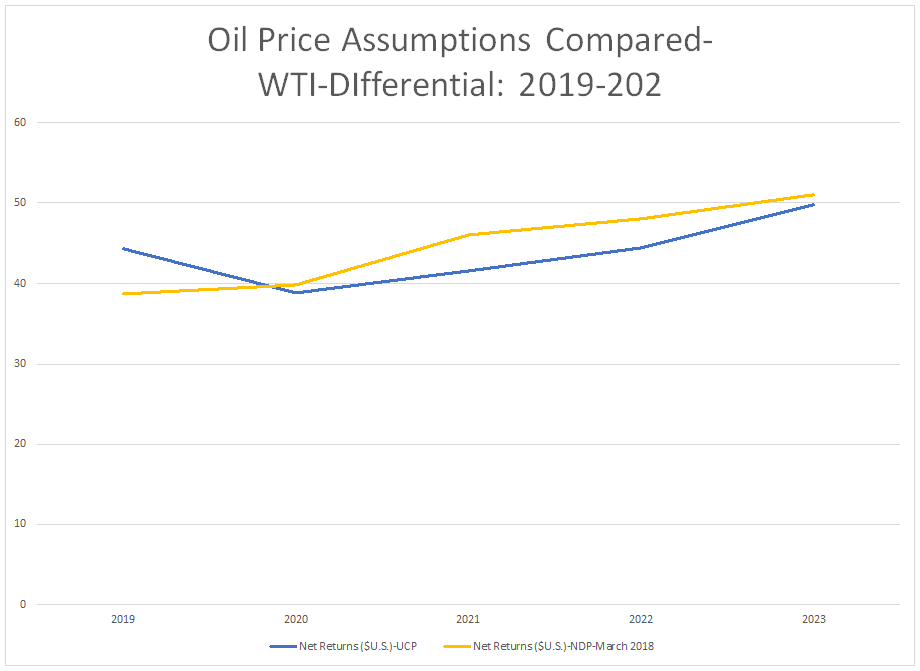

The chart above shows the UCP with more conservative net- backs with the differences all but eliminated in the final year of the projections.

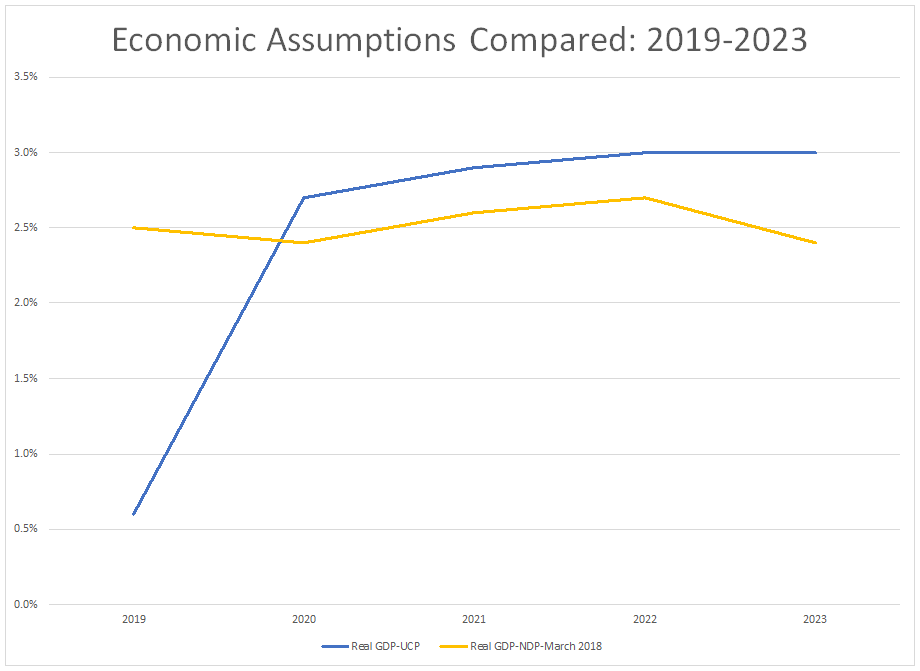

The chart above compares the NDP’s real GDP projections against the UCP’s. Other than the initial year- 2019, which has turned out to be a rather dismal year for the province, the UCP is betting on stronger GDP growth than anticipated in March 2018. The UCP do caution that if growth does not come back further measures on the expenditure side will be required.

Not surprisingly, the expenditure side is the key difference between the UCP and NDP’s fiscal forecasts. As MacKinnon correctly pointed out, expenditures are within the control of the government (debt servicing less so) and this is where the focus of the present government lies.

Investment Imperative

The whole UCP budget is premised on the assumption that an Alberta “open for business,” soon with the lowest corporate tax rates in the country, will be a haven for investors, entrepreneurs and capital investment will flow into Alberta.

But is this gambit justified given the changing circumstances of Alberta’s principal industry- the exploration, development, mining, production and refining of fossil fuel products? The government has eschewed the role of renewables and the emergence of new digital technologies, machine learning and continues to place bets on petrochemical plants, pipelines, new mines and SAGD facilities.

As part of this coordinated effort, deregulation is expected to aid in the attraction of more capital into the province. Reducing red tape and speeding up regulatory approvals are looked upon as key strategies in luring investment back into the province.

Also key is maintaining an upbeat environment for investment attraction. In this regard. the Canadian Energy Centre (“War Room”) will focus the government’s communications efforts to discredit opposition to the expansion of the fossil fuels industry (the object of investment attraction). Essential to the Centre’s message will be energy is the only business through which Alberta’s economy can thrive. The government, communications experts, and budget are also emphasizing opportunities in the trades and apprenticeships in returning prosperity after the dark years of the NDP’s reign. Meanwhile the post-secondary sector and renewables will face sharp reductions in funding.

Critical to this is ensuring that no alternative voices are heard and opposing views are discredited. UCP policy carries on the NDP policies of curtailment (admittedly with criticisms and blame for the railcar purchases) and its energy diversification program. This narrative builds on the belief systems that the only way to build an economy is by attracting elephant investments like petrochemicals or refining. In their dying days, the Notley administration turned increasingly to creating short-term, ad hoc programs designed to produce jobs.

Is this the future that will be sustainable and sustain Alberta’s finances? Obviously fossil fuels will be necessary over a transition period to a low carbon future. While demand still is growing, the Kenney government and its supporters in the oil industry insist that Canada (Alberta) must meet that growing demand. But is this the wisest course? It would seem the simplest as unemployed truck drivers, engineers, and other energy professionals are underemployed or unemployed. Office towers lie vacant waiting for an economic rebirth.

Unfortunately the first six months has not seen a rebirth in employment or investment. It is far too early to make any judgments about the success of the new government’s agenda. However, recent events- job losses at Husky’s head office and Encana’s move to Denver do not seem promising. Moreover, a common interpretation of the federal election results is that consciousness is growing for a greener future. Also troubling is the alternative message that a greener economy can also produce jobs. The idea that energy may not be the only engine of growth in the Canadian economy must be worrying to people in Calgary’s War Room.

Source: Calgary Herald

Rating Agency view

As stated above, the Toews’ budget will be greeted favourably by the rating agencies. They will be pleased with the government’s collective commitment to addressing the fiscal situation. Toews’ predecessor, Joe Ceci, was known to be dismissive of the rating agencies’ concerns, responding with status quo arguments missing the fundamental concerns of the agencies- viz, namely the trend and the lack of attention to fiscal issues.

Currently, the ratings for Alberta are as follows

Credit ratings

| Province of Alberta Credit Reports | Province of Alberta Long-term Rating | Province of Alberta Short-term Rating |

|---|---|---|

| Moody’s Credit Opinion (PDF, 1.2 MB) March 5, 2019 | Aa1 (Outlook negative) | P-1 |

| S&P Global Research Update (PDF, 300 KB) February 15, 2019 | A+ (Outlook stable) | A-1+ |

| Fitch Press Release (PDF, 26 KB) April 4, 2019 | AA (Outlook stable) | F1+ (Outlook stable) |

| DBRS Press Release (PDF, 189 KB) March 1, 2019 | AA (Negative trend) | R-1 (high) (Negative trend) |

Source: https://www.alberta.ca/investor-relations.aspx#toc-4

It has been over seven months since any comments have been issued by any of the four agencies. We expect the raters to visit the province over the next couple months and might anticipate comments and updates in December. Given the emphasis on spending control, expect the ratings to remain the same in their first updates. The conversation will very much be dominated by how tough the politicians will be on holding the line.

Given the UCP’s platform, the MacKinnon report’s recommendations and this budget, the government has not produced any major surprises for the agencies. Consistency and follow-through are rewarded by the agencies in time. There will be questions about the government’s resolve on the labour front and response to inevitable decays in public services, especially health care.

Given the province’s significant liquid resources and concrete measures to control spending, agencies will be watching for a continuation of the progress in next March’s budget and evidence of the economy reviving. Adding to their confidence in the new administration are scenarios included in the budget showing weaker economic growth along with the government’s strategy to deal with possible fiscal deterioration. Once again this anticipation demonstrates a concern about fiscal matters, mostly absent in the previous administration.

In summary, the real question is whether corporate tax cuts, pro-energy rhetoric and open for business exhortation will improve Alberta’s fiscal situation. Time will tell!