Politics of the Alberta Growth Mandate

In past articles, the Alberta Growth Mandate was explained as a significant policy initiative in the first NDP budget of October 2015. It should be noted that, in the fall of 2015, Alberta was reeling from significant declines in investment and job losses, and a rookie NDP government was looking for quick wins to support jobs in the Alberta economy. The policy objective was to support Alberta companies (as defined by the Alberta Investment Management Corporation (AIMCo)) and based on meeting one of the following criteria.

a. Creates jobs in Alberta

b. Builds new infrastructure in Alberta

c. Diversifies Alberta’s economy

d. Supports Alberta’s growth

e. Connects Alberta’s companies to export markets

f. Develops subject matter expertise within Alberta.

At a later date, the mandate of the AGM was enlarged without an accompanying political announcement. The Growth mandate, released under AIMCo letterhead, added another initiative- to apply resources of AIMCo to identify investments consistent with the AGM and that would “benefit all of AIMCo’s existing clients through existing investment strategies,” in other words, Alberta public sector pension funds.

Abpolecon.ca also drew attention to the heavy allocation of investments to oil patch firms. In the most recent look at this largely unknown investment pool inside the Province’s Heritage Fund, we delved into specific investments negotiated by AIMCo, and speculated about current market values of the energy investments and associated risks assumed by public sector pension funds.

Now we look at the the “political payoff” received (or not) by the NDP (via AIMCo) in exchange for much needed investment from Alberta taxpayers and public sector pension plans.

Companies

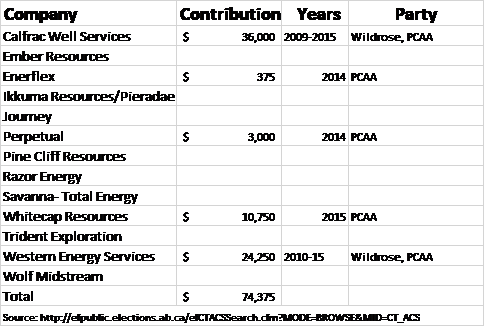

In the Table below we show donations to political parties from the corporations which benefited from the Crown/Taxpayer/Pensioner investments. The information contained in the analysis below is taken from the Elections Alberta website: financial contributions to candidates and parties.

A total of $74,375 in political donations were made by 5 companies on the Energy investment list. The most active contributor was Calfrac Well Services which donated $36,000 to the Progressive Conservatives and Wildrose between 2009 and 2015. The second biggest contributor was another oil services company, Western Energy Services, which donated over $24 thousand to the Tories and Wildrose between 2010 and 2015. Not surprisingly, the NDP is absent because of its policy of not accepting money from corporations.

In 2015, the first Bill introduced by the NDP eliminated political donations for corporations and unions.

Directors

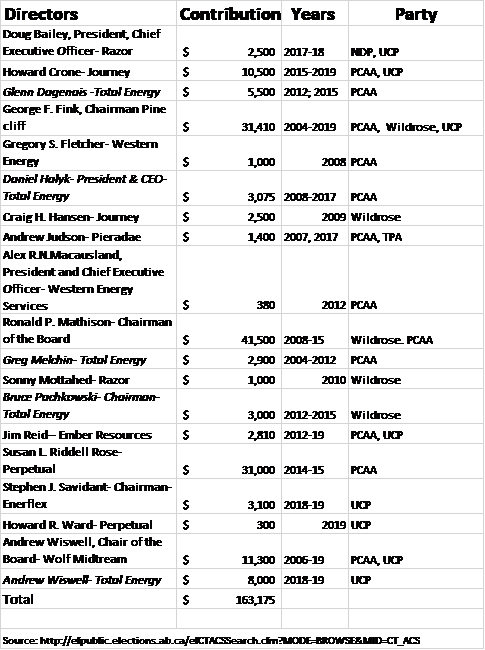

In the table below, we look at donations from individual directors of these corporations to political candidates and parties.

As a general rule, the Chair of the Board or President play a more active role in making donations to parties and candidates

Ron Mathison, a leading energy entrepreneur heads two companies that were recipients of an AGM investment. In addition to being Chairman of Calfrac, he is also the Chairman of Western Energy Services. (In November 2018, Mathison’s holding company MATCO Investments purchased “ 1,314,800 common shares in the capital of Western Energy Services Corp. adding to an already large holding of nearly 14 million shares.) Mathison worked at Peters & Co. , a boutique investment house known for bringing small to medium size energy companies to market. Mathison’s two companies are the largest investee companies in the Alberta Growth Mandate with $91.8 million, or over 20 per cent of the AGM investments in equity, debt with warrants, and loans to these two service companies.

George Fink, the Chairman of Pine Cliff, was also a significant donor to the three conservative parties from 2008 to 2019 (Wildrose, PCs, and UCP).

In all, directors of AGM companies contributed over $163 thousand to the main political parties contesting elections over the past 15 years. Only $1500 was received by the NDP from the President of Razor Energy in 2017 and 2018. Razor received its first $7.2 million investment in the form of a loan and common shares in January 2017, with two follow-on investment totalling $1.7 million in equity in May 2017 and January 2018.

Whose to blame?

Amidst concerns about AIMCo’s independence from government in the wake of Bill 22, measures to consolidate investment management under AIMCo, CEO penned an opinion piece in the Edmonton Journal. Entitled “Investment independence is essential to AIMCo’s mandate, ” Kevin Uebelein categorically stated:

the Alberta government has no say whatsoever regarding where or how we invest. AIMCo’s operational and investment independence from government is such an important consideration of our business that it was explicitly written into our founding legislation, The Alberta Investment Management Corporation Act.

Such a statement seems to absolve the former and current Finance Ministers of responsibility for specific investments made. Or does it? Certainly the former Finance Minister signed off on the incredibly general criteria contained in the Mandate. However, the original budget speech was explicit that “professionals with expertise in business development and investments, not politicians, will make decisions in the best interest of Albertans with a focus on growth, diversification and jobs.” Still, where was the follow-up by the Minister and his senior officials? Did AIMCo’s board, all appointees by the government, not at least ask AIMCo management about the performance of these investments on “behalf of future generations of Albertans?”

In a future post, we will look at whether the goals of growth, diversification, and jobs was achieved.