[Updated 23 August 2020. Note: This report was in development before the DBRS Morningstar report of Thursday 19 March. The report is only available to purchasers of the service. Normally, the Province of Alberta posts on its Investor Relations page the reports. To date, this has not taken place. Nor has there been an official reaction to the downgrade to AA- from AA and the outlook to negative.]

One of the key audiences of any government budget, but especially a budget under increasing duress and scrutiny, are credit rating agencies such as Moody’s, Standard & Poor’s and DBRS Morningstar.

Credit evaluation is as much an art as a science, requiring an understanding of financial principles, economics and political science. Agencies provide opinions on probabilities of default of borrowers. This same art and science is critical to well-functioning operations of financial institutions like banks, ATB and pension funds.

First Take

In the initial review of the UCP’s first budget of 24 October 2019, here were the major strengths and weaknesses identified by the agencies:

Strengths

- Low taxes provide “competitive advantage and flexibility to address fiscal imbalances”

- Young population

- High income levels from resource industry

- High level of liquid financial assets providing financial flexibility, including good access to financial markets

- Stable institutional framework

- Ultimate support from federal government

Weaknesses

- Concentration of economy on fossil fuel resources

- Implementation risks of addressing structural deficit, including labour relations and public pushback

- Rapidly rising debt burden

- Significant contingent liabilities including deposit liabilities of ATB and credit union and unfunded pension liabilities.

“Investors Relations”

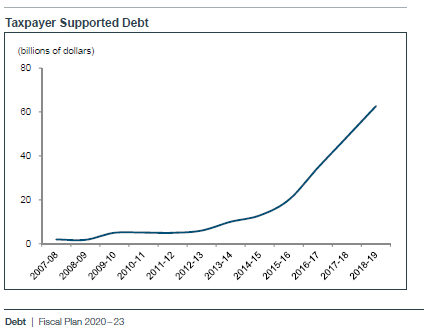

The UCP government seems a little more focused on what is called “investor relations.” While the term had been used during the NDP inter-regnum, the October and the February budgets had a discrete section in the Fiscal Plan addressing debt (pp. 189-204). The Investor Relations function is becoming increasingly important as Alberta’s debt rises.

In this section of the province’s website and the Budget documents, the province’s borrowing programs and strategy are outlined. Of particular note is the hockey stick diagram on page 191 of Budget 2020 showing the growth in provincial taxpayer supported debt since 2007-08 as well as a similarly shaped stick on debt servicing costs three pages on.

A key part of any government debt strategy is the ability to access multiple markets, in different currencies, and throughout the maturity spectrum (from one day to 30 years or more). Alberta has debt outstanding in seven currencies, not including the Canadian dollar. Alberta does not take currency risk as it enters into arrangements (derivative contracts) with other high credit borrowers, to lock in the exchange rate exposure. (This process is conceptually simple although there are many factors such as changes in credit ratings or financial market conditions, which may influence the outcome of specific contracts.)

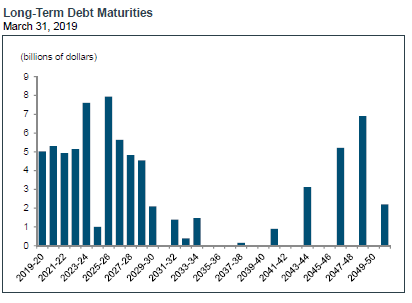

Maturities over the next 3 years are in the range of $5 billion, in 2023-24, maturities rise to over $7 billion reflecting significant previous borrowing in the 5 to 10 year range as deficits became the norm commencing in the late 2000s. Looking at the chart suggests that the province has considerable room to borrow in the 7, 10 and 30 year range at favourable rates. Certainly one benefit of the recent financial market meltdown has been the plunging of yields on Government of Canada bonds from levels of 2 per cent to less than one per cent for 10 and thirty-year bonds. The budget conservatively estimated borrowing rates at twice the current level.

At the end of March 2019, short term debt cost the province about 2 per cent with long-term debt costing on average about 2.7 per cent.

While the current situation will favour longer-term issues, the challenge for Investor Relations staff will be managing shorter-term borrowing which might be subject to periodic liquidity crises at this exceptional time. This is a problem for the whole financial system which is being carefully watched by central banks the world over.

Longer term borrowing will also require a deft hand in ensuring the spread above other major provincial credits such as Quebec, B.C., and Ontario remain tight. This group responsible for liaising with rating agencies (which I did in the 1986-96 period) will need to ensure that the messages it delivers are factual and non-partisan.

Rating agencies are not naive

Rating agency personnel increasingly are financial specialists who examine credits scientifically. However, good raters must understand how political entities like governments (or Crown corporations) operate. Agency personnel understand that a government like Alberta operates in a liberal democratic system and that some measures taken by governments will be resisted strongly. Thus, for agency personnel it is important that they pose questions directly to politicians about their (cabinet) perspectives of how feasible are the structural reforms being contemplated by a new government. Raters also know that promises made during elections are often rolled back due to extenuating circumstances. And finally, ratings of provincial debt, base some of their opinions on the fact that in a federation, with significant intergovernmental transfers, a federal government may step in to preserve the credit-worthiness of the sub-national government’s credit rating by guaranteeing or providing funds to a province near default.

Key uncertainties- rising deficits

The budget was written before the COVID 19 pandemic was recognized by the World Health Organization, the Saudi-Russia spat, and financial market meltdown unfolded. The first and obvious question for the agencies is “will the budget be revised?” (This presumably is an agenda item high on the agenda of the Mintz Economic Recovery panel advising the government)

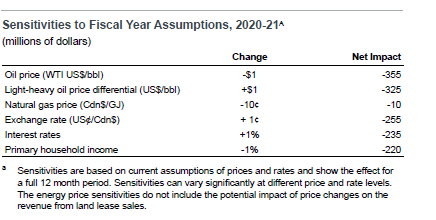

With a sensitivity of $355 million per $1 WTI and an assumed average price of $58 U.S., if prices of $30 per barrel hold for the year, Alberta would probably receive no resource revenue and forego perhaps $1 to $5 billion in income taxes. Indeed should personal income go down by 5 per cent, which is not unreasonable under the circumstances, that adds another $1 billion in borrowing. Not only is resource revenue threatened. Alberta’s budget also depends on investment income for about 5 per cent of its revenue. With equity markets falling by more than 30 per cent since the budget, absent a strong market recovery before the end of March, the deficit forecast for 2019-20 of $7.5 billion will likely be higher by $5- $10 billion.

On the spending side, the government has announced $500 million for the health care system, as well as a $50 million commitment including: deferrals of mortgages, loans and lines of credit at ATB for up to six homes for individuals, payment holidays for utility companies and student loan repayment. Thus the budget deficit and fiscal plan for a balanced budget by 2022-23 look increasingly improbable.

The question from the rating agencies then becomes “what is plan B?” Will Alberta use some of its vaunted tax advantage? The quick answer from Premier Kenney is that a sales tax is a “dumb idea,” especially at this time of economic distress. Yes, that makes sense but what are the alternatives? Flow through shares, a massive underwriting of losses to the energy sector, continuing high deficits, or more austerity?

The more delicate question for the rating agencies and the general public is the health of the energy sector and the residential and commercial real estate sectors. It is a delicate question as ATB Financial has a loan book which features $16 billion in residential loans, over $5.9 billion in commercial real estate loans, and $4.1 billion in energy sector loans. These features could be forgiven if energy was not a dominant force in Alberta’s economy today. However, with the perfect storm of low oil prices, a highly indebted population, and a worldwide recession, the response of rating agencies will be critical. Another blow to Alberta’s budget this fiscal year (2019-20) will be the financial impact of the financial market correction as noted. Global stock indexes are down at least 30 percent since the budget was released. However, there are no sensitivities given about changes to equity prices- a number that would be useful to rating agencies and to public finance analysts.

Aid from Ottawa in the form of a significant fiscal stabilization payment ($1.5-$2.5 billion) will help and is warranted. However, the main issue remains: how will Alberta transform its economy over the coming decades? Will the Alberta government use the crisis to double down on the energy sector, possibly with the use of the Heritage Fund and other funds managed by AIMCo? Or will the federal government use its spending power and credit card nudge Alberta towards a greener future?

Over the coming months, agencies will feel out provincial officials on whether the budget will be revised. Given COVID 19’s impact on Alberta, the oil price shock (trading below $23) and demands on rating agency personnel (they are also reviewing other provincial budgets), it will be the summer before ratings are published.

| For those of our subscribers that did not attend the Budget post-mortem on 9 March 2020 at the University of Alberta go to Post-mortem to view |

Related Posts