While now is not necessarily the best time to be taking stock of one’s investment portfolio, government and provincial agency officials, who face a March 31 fiscal year end deadline, are concerned about the impact of accounting rules that require “fair market accounting” for their investments. The performance of both bond and equity markets over the next ten days will determine whether forecasts for investment income in the provincial budget ($1.96 billion for the Heritage Fund) will actually pan out.

Investment income for investment portfolios are typically composed of two types of income: (1) dividends and interest payments or cash distributions from private equity, and (2) increases or decreases of the “fair value” of the investment at year -end compared to the initial cost of buying the investment. Annual financial reports and statements under Alberta law must be released before 30 June, or three months after the fiscal year ends. As of 20 March, the TSX was down by 30 per cent since the beginning of the year. If the market does not significantly recover its losses, the budget deficit could rise by as much as $500 million to $1 billion from this change alone.

In the case of the Alberta Growth Mandate (AGM), the over-reliance on funding “growth” investment in energy companies has produced predictable results. According to the newly minted Finance Minister Joe Ceci speaking in October 2015:

While ensuring that the mandate of the fund to maximize returns for future generations of Albertans, we are announcing today that we have mandated the Alberta Investment Management Corporation to focus a prudent but significant portion of our province’s Heritage Fund to invest in Alberta’s growth.

Professionals with expertise in business development and investment, not politicians, will make decisions in the best interests of Albertans with a focus on growth, diversification and jobs.

Regrettably, and again, with hindsight, diversification and jobs and growth didn’t mix well for the Heritage Fund and future generations of Albertans. This sounds harsh but principles of portfolio diversification argue in favour of avoiding energy “bets”, especially for a province dominated by the energy sector. To reiterate what the Norwegians have learned, do not bias your investments to a “home bias”- ensure that you have inoculated yourself against commodity price crashes.

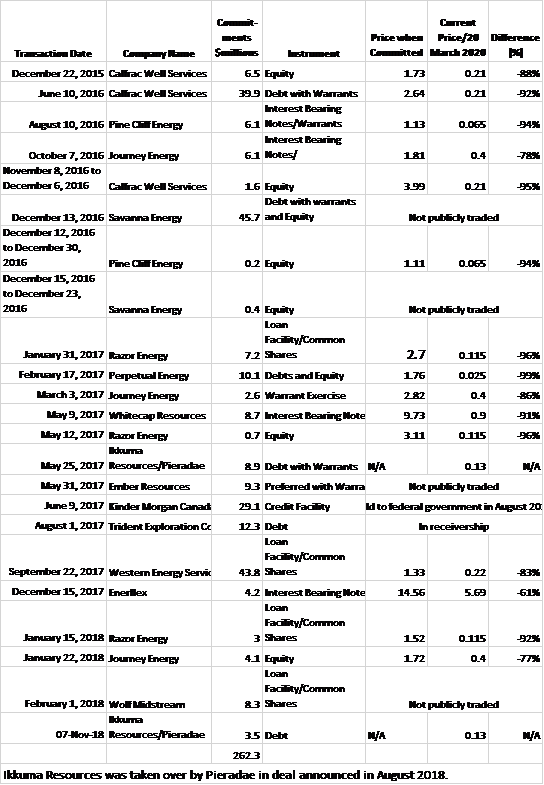

The following table shows shares prices of “AGM” companies in the energy sector up until March 20th. It is important to note that some of the investments made are not in common shares or equity but rather debt or warrants whose value is still positively correlated to the stock price. The table below contains disclosure from the latest Heritage Fund annual report (March 31, 2019).

The table shows only oil and gas investments or commitments that were made by the professional staff at AIMCo during the period from 23 November 2015 to 7 November 2018. (Quarterly reports update the current number (33) and amount ($424.8 million) of the commitments but no specific detail on specific investments.

As can be seen, there was a flurry of activity in the four fiscal years for which the Heritage Fund reports provide information (2016-19). While there is adequate transparency about the “commitments” made by the Fund, it is unclear from financial statements how such investments like Trident Exploration (declared bankrupt and owing AIMCo and ATB over $65 million) have any value. Nor is there any information on the pricing of these commitments such as the price of shares or the interest rate on debt instruments. Further, disclosure of the AGM investments in the Heritage Fund does not indicate the carrying value of these investments, so it is unclear what the actual value of these investment are at the present time. Whether disclosure will be improved (it was the NDP’s idea, after all) will be interesting to watch.

As shown in the table below, it appears that the Heritage Fund will be booking losses on these oil and gas investments.

Values since the time of initial investment or follow-on investments have plummeted. A dispassionate investor or auditor looking at these investments, would likely write the investments down to zero with the possible exceptions of Enerflex and maybe Western Energy Services.

As discussed in related posts, the AGM investments are also divvied up to other funds managed by AIMCo. These other funds include pension funds like the $44 billion Local Authorities Pension Plan (LAPP) and the $13.7 billion Public Service Pension Plan (PSPP).(Numbers at 31 December 2018.)

In the case of the now bankrupt Trident, the Heritage Fund holds only $12.3 million of the $60 million debt held by AMICo on behalf of its clients.

This use of public sector pension funds raises important public policy and governance issues: what percentage of the pension fund’s assets are held in these high risk assets? What was the nature of the information and rationale provided to the board members of the AGM investments? And, given recent changes to the relationship between the government (Minister of Finance), AIMCo, pension boards, and new funds like the Teachers’ Pension Fund and WCB funds, how are the ultimate beneficiaries supposed to view these types of investments?

The bottom line seems to be the unfortunate maxim that finance and politics don’t mix. Policy or guidelines of chinese walls don’t always work when there are desperate employers, desperate politicians, and desperate human beings. At this stage, the public has every reason to be skeptical about the meaning of words such as autonomy, professionalism, investment acumen and board governance.

To be continued…