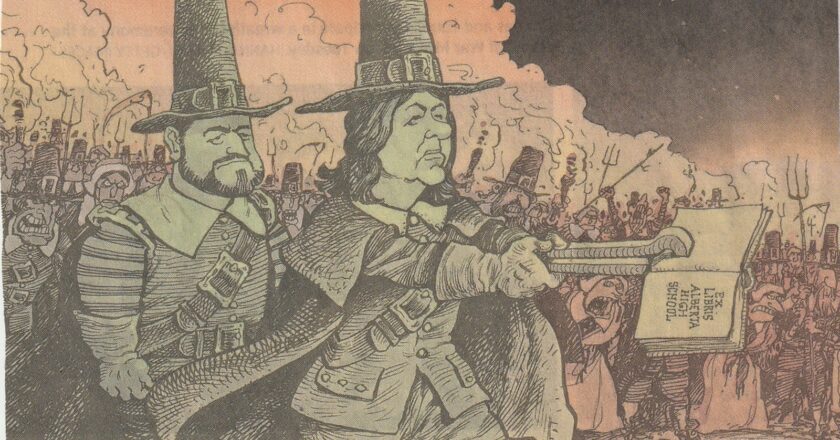

Is Danielle Smith a Separatist/Annexationist? Part 5- Alberta Next

Note to readers: The comments section below is now functioning. Please feel free to comment on any of my scribbling. I would like to hear what you think.

Key takeaways

Constitutional reforms and fiscal reform proposals likely a non-starter

Expect the UCP to move forward on an Alberta police force irrespective of what Albertans and rural Councillors think.

Expect Smith to move on restricting social services to immigrants

Tax collection and the Alberta Pension Plan actions will depend on next year's referendum results.

Quite a lot has happened in Alberta politics since my last blog which covered Smith’s post-federal election speech (25 May 2025). Intervening events have included the 23 May by-elections which drew low voter turnouts while maintaining the current seat standi...