Demographics, Economic Data, Government Finances, Intergovernmental, Investment, Opinion/Research, Politics

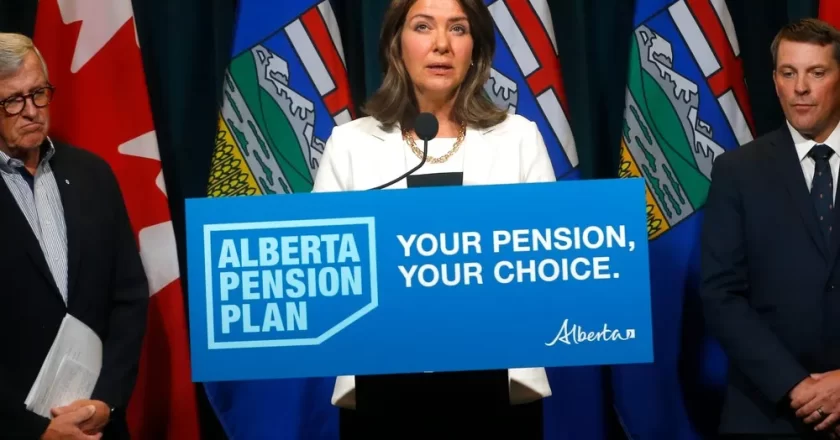

The Frustrations of a FOIPP applicant- the case of the APP (Part 2)

Updated 8 April 2023

Key Takeaways

By January 2023 all the technical work had been completed for a launch of the APP plan four months before the UCP campaign made no mention of reviving this policy recommendation of the "Fair Deal" Panel.

The public service relied on the expertise of outside parties due to lack of in house actuarial expertise. This FOIPP disclosure did not reveal how much the government ultimately paid even though Smith provided the $1.8-million figure to her 630 CHED Saturday call-in radio show.

Existing administrative structures aren't conducive for sharing information as the onus is on the deputy head to decide what to disclose making it very difficult for senior officials to offer advice contrary to the preference of their political masters.

The "Fa...