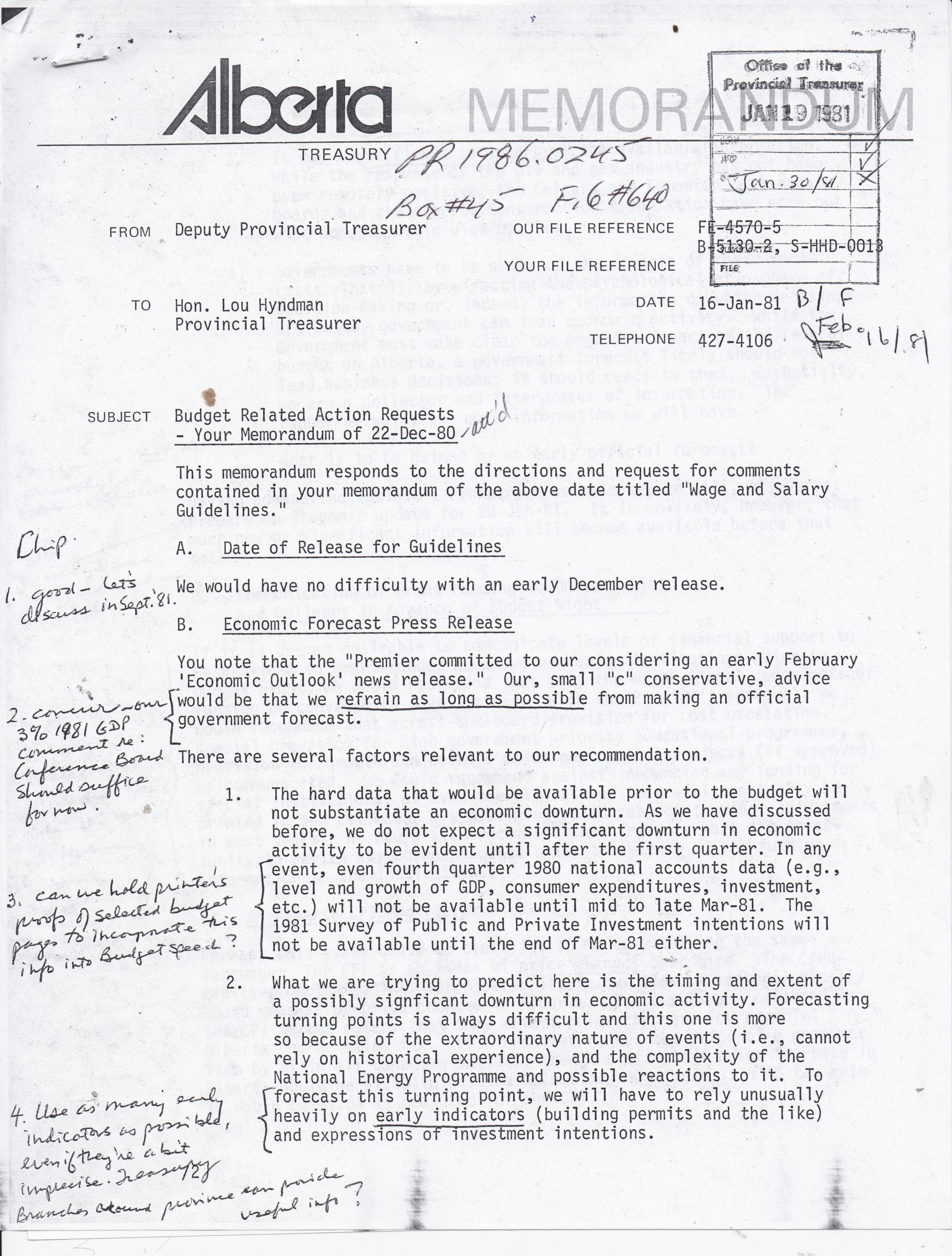

“Triple Black Swan Event”

Themes from the press conference

"No credible date for rebalance"

"Doing everything we can to encourage economic growth and development"

"Stay tuned for Budget 21-22"

"We can no longer afford to be an outlier"

"This is not a time to be talking about raising taxes."

A focus on delivering public services more efficiently and growing the economy.

"Important for Albertans to have a discussion about revenue structure"

Albertans will continue to be "self responsible"

"We will be very reluctant to shut down the economy"

Finance Minister and Treasury Board President Travis Toews presented the UCP government's much anticipated Fiscal Update on Thursday, 27 August. The thin 20-page document was much less substantive than I expected. At his press conference, the Minister presented both the gover...