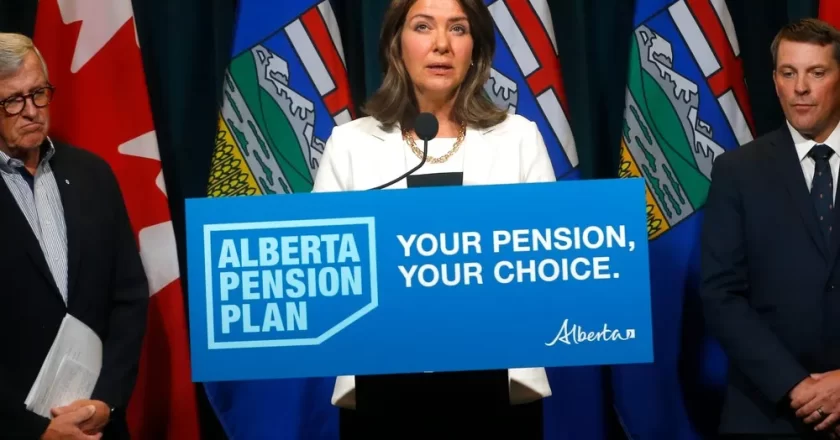

C-387 and the Alberta Pension Plan- Response from Finance Canada

Background

Last summer, I wrote the following letter to the then Finance Minister and Deputy Prime Minister, Chrystia Freeland.

Edmonton, Alberta T6C 4R1

12 August 2024

The Honorable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

Member for Parliament, Toronto University-Rosedale

Ottawa, Ontario

Canada K1A 0A6

Dear Ms. Freeland

Re. Bill C-387

In the last sitting of the House of Commons, M.P. Heather McPherson, M.P. for Edmonton Strathcona tabled an important private member’s Bill C-387 which would limit the exclusive authority of the Minister responsible for administering the Canada Pension Plan (CPP) and the Governor in Council from allowing a province to withdraw from the pension plan.

This exclusive executive authority under sect...