Budget 1981-82: Communications objectives

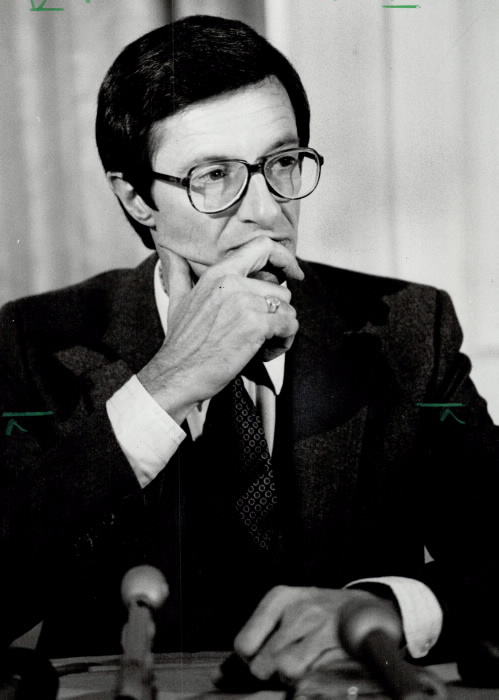

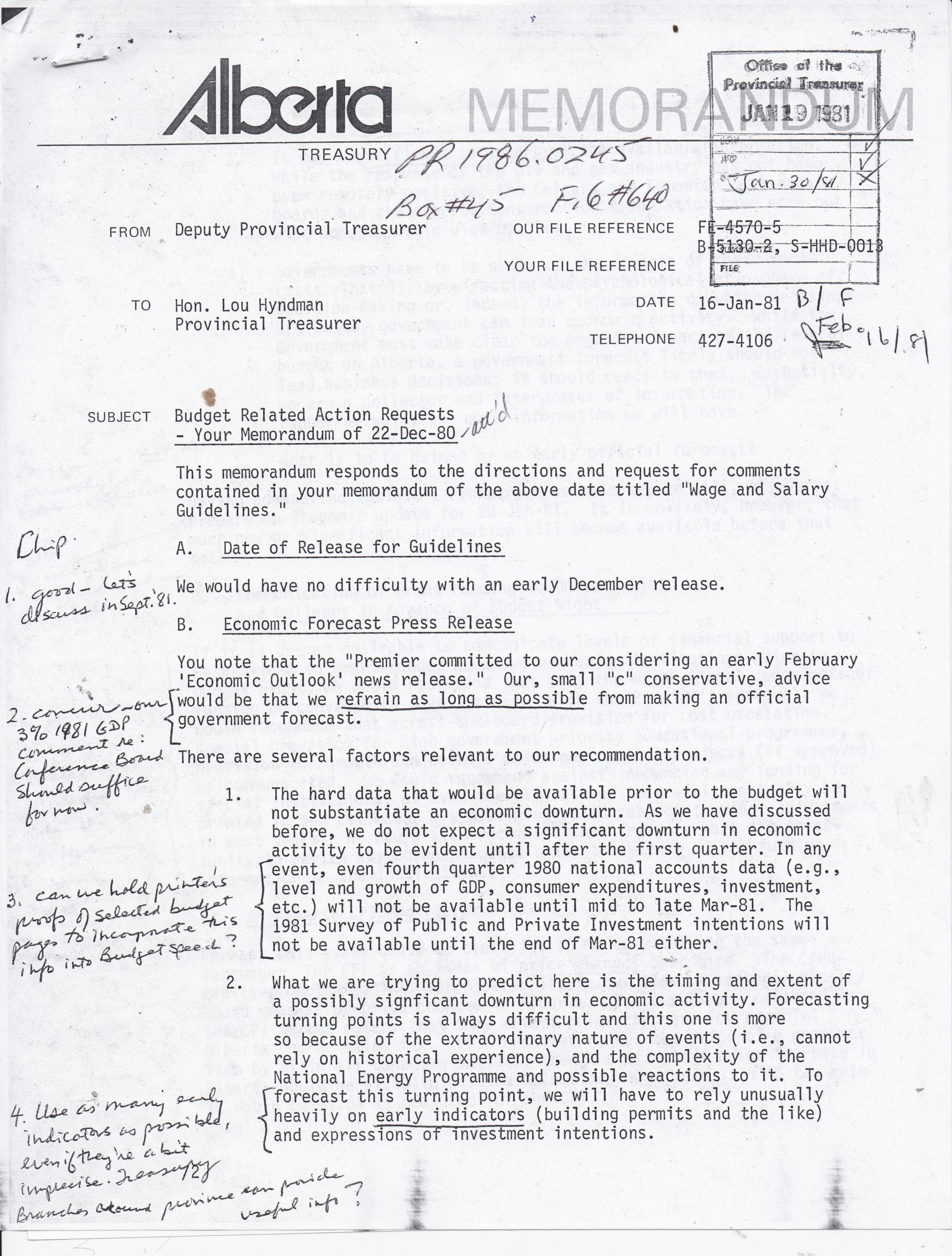

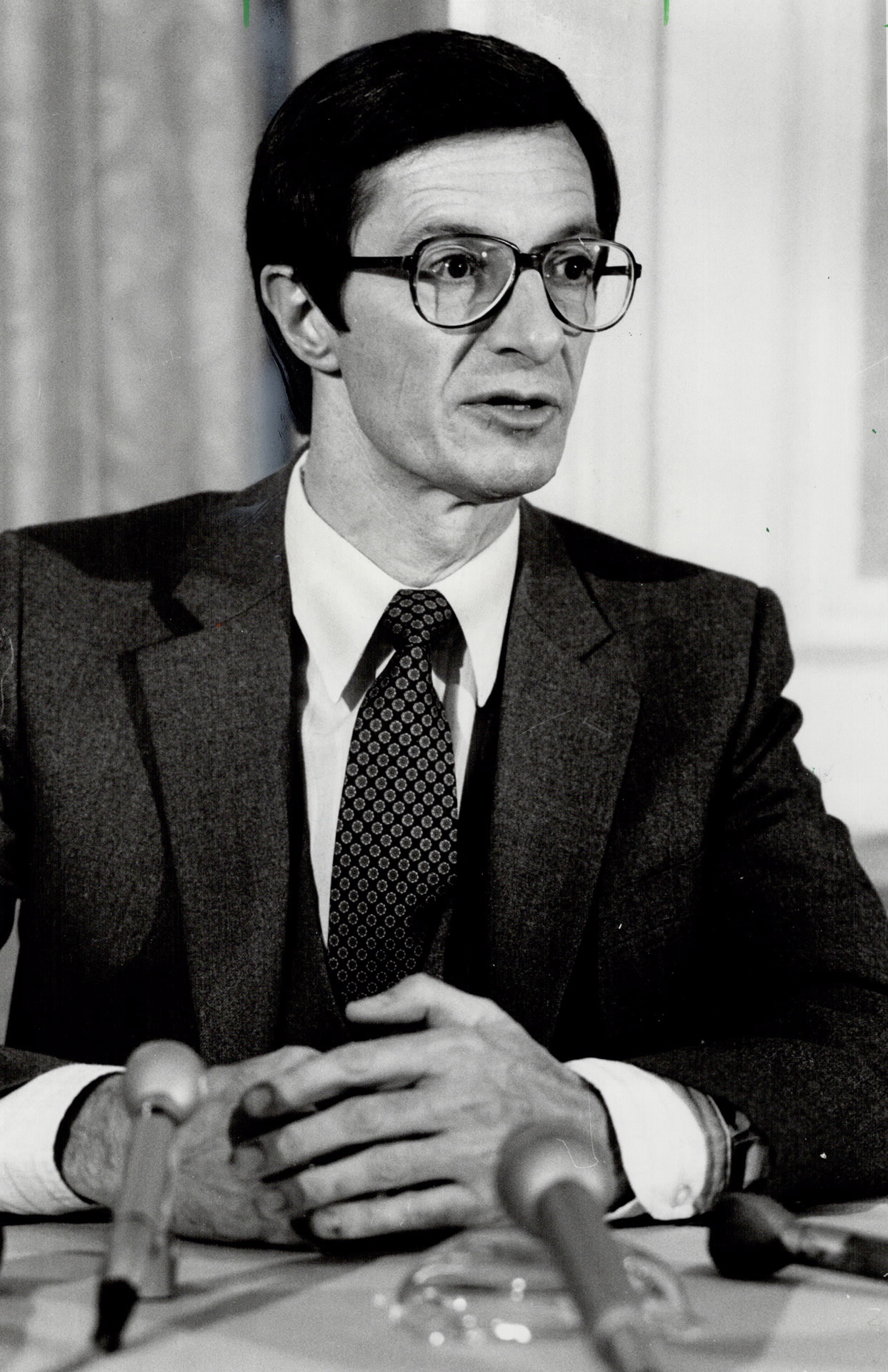

The April 1981 was a pivotal budget for the Province of Alberta. Every budget has key communications objectives, as Lou Hyndman's one-page memorandum to his Treasury Board and cabinet colleagues, reveals.

This budget was Alberta's first after the National Energy Program was announced. As last week's Abopecon.ca reported, the previous month, the Treasury department was wary about providing any economic forecasts and the prevailing mood in the provincial government and the whole economy was grim. The situation back in 1981 is analogous to the circumstances facing the current government.

For the Conservative government, re-elected for the third time in 1979 with 74 of 79 seats, it was clear that the government would use its considerable fiscal resources to maintain public services an...