Financial institutions- banks, insurers (property and casualty, life and Health), investment banks, credit unions, investment managers, and provincial institutions like ATB Financial- are critical to the economic well-being of any economy. Given that the Alberta economy is capital intensive- that is its primary industry, oil and gas exploration and development- requires huge amounts of money to extract the resource, the competitiveness and well-functioning of these institutions is essential.

Our financial sector is MIA on climate change23-1-18 GM

Payday lenders closing stores amid new restrictions15-1-18 EJ

Payday loan progress16-1-18 EJ

Bank (sic) offers financial services to inner city’s poor, homeless26-9-17 EJ

Given the decline in the price of oil, the basis on which loans re advanced to the energy sector- the lending value- has declined significantly as the “price deck”used to value current and future production, has declined precipitously. As some of the articles referenced below show, many national and provincial financial institutions are facing rising loan loss provisions. Rising losses impair the capital base of these institutions (all things being equal) and, especially for local institutions, can cause regulatory concerns and a restriction on the ability to lend.

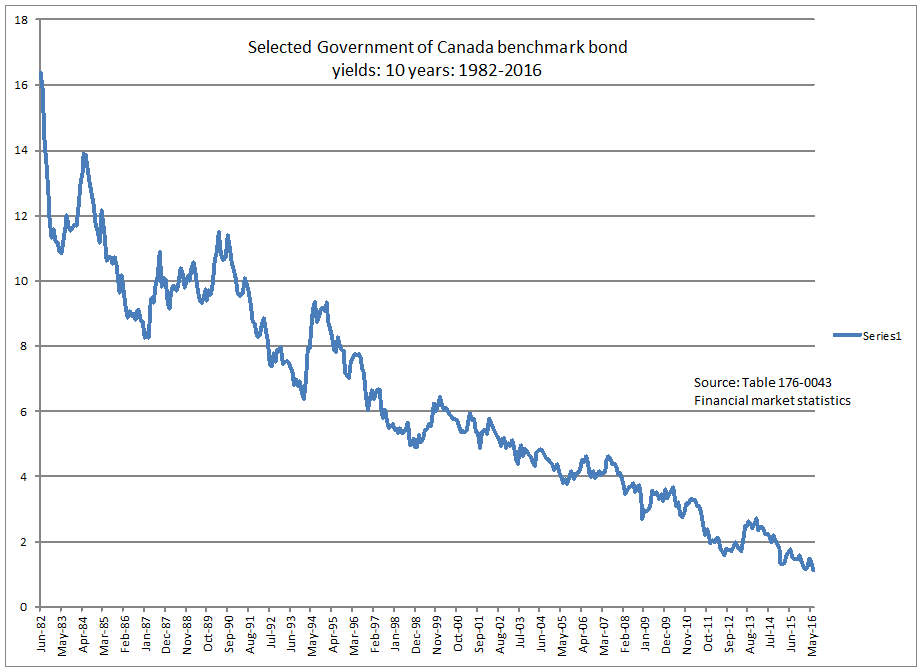

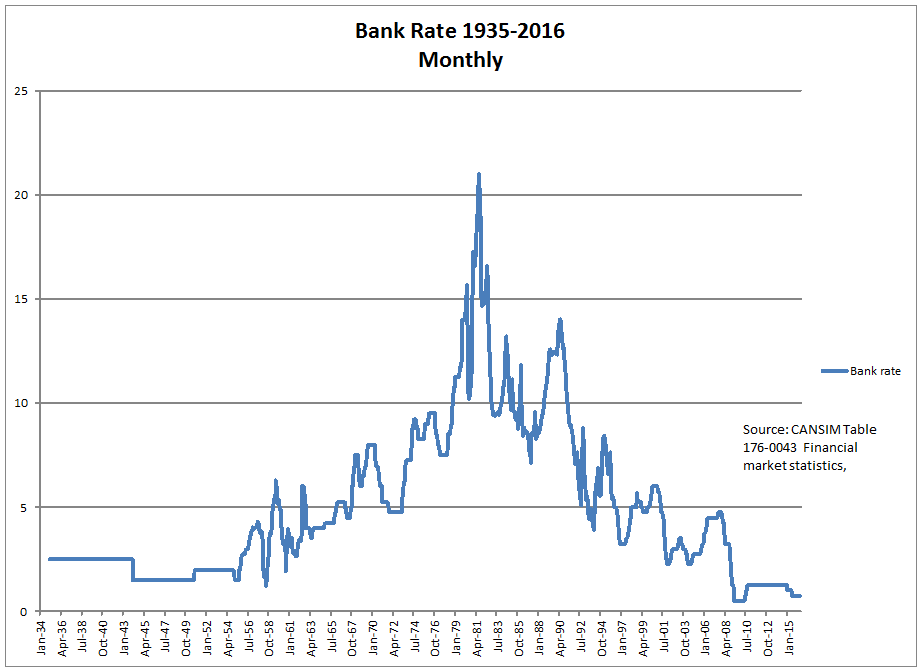

One of the main differences between the 1980s and the current period is the interest rate environment. In the early 1980s, interest rates both long-term and short-term were very high. These high rates of interest put great pressure on borrowers since interest payments themselves (let alone any principal repayments) comprised a heavy burden. Today, interest rates across the board are at lows not seen in some cases for 500 years! While individuals as consumers of autos and houses seem to be anxious to borrow, industry in general is loath to invest given a variety of uncertainties. This reluctance is prevalent in Alberta due to the decline in oil prices.