Twilight of the Money Gods, the title perhaps a nod to Frederick Nietzsche’s Twilight of the idols, is an explosive critique of the discipline of economics as a religion. John Rapley, according to his Globe and Mail biography is political economist specializing in global development, the world economy and economic history. Rapley born in Canada, completed doctoral studies in Canada and pursued post-doctoral work at Oxford University. This book is the best book I have read on the history of economic thought. Particularly interesting is his description of the evolution of political economy of Smith and Ricardo into the neoclassical canon of Alfred Marshall.

He situates the great debate on free trade within the context of a rising and dominant and the Britannica English corn laws. He relates the economic and financial forces behind the set up of the London School of Economics and Political Science as a sponsor for the views of Austrian Frederick Hayek as a counterweight to the emergent popularity of Maynard Keynes soon to dominate the economics priesthood.

Rapley begins his critique with an examination of money. His scholarship is exacting and always grounded grounds ending ideas grounds evolving ideas about the economy with relevant context. Relevant context include social, political, religious and technological conditions.

His central thesis, that prominent economists, including central bankers, now constitute a powerful priesthood and, like Catholic and other churches, create moral codes wrapped around with positivist science grounded in mathematics. But like all powerful churches which dominate discourse in the academy, politics and now media channels, their narratives, dressed up in science are false idols relying on faith.

This religious faith is exposed and found wanting by Rapley for a number of reasons. First, Rapley sites 1973 Nobel laureate Wassily Leontif. reflections on the power obtained by the profession through its use of “scientific” models. Leontif was deeply worried the econometric modelers did not understand nor appreciate the nature of data, including deficiencies, fed the model. Data sets for instance are regularly updated.

According to Leontif, economics was “riding the crest of intellectual respectability….an uneasy feeling about the present state of our discipline has been growing in some of us who have watched its unprecedented development over the last three decades.” Further in his American Economics Association Presidential Address he warned “it is precisely the empirical validity of these assumptions on which the usefulness of the entire exercise depends” (emphasis added).

All data gathered by human hands, and especially in semi developed countries data can be subject to enormous error. He cites the Ghanaian GDP which was revised by 60%. (Ghana is an African country which is regarded as having one of the best statistical agencies on the continent.) So much for being scientific. Garbage in -garbage out. The problem goes deeper because what is measured is an aggregate of human behaviours which, unlike temperatures, include value judgments about what is employment, consumer prices, and measures about improvements in consumer products.

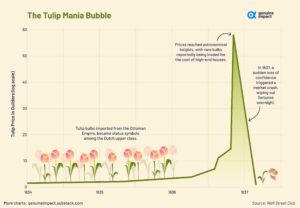

Rapley, like many critics, illustrates the dangers of assumptions used to develop series of equations and inferences ultimately about human nature. The new theology known as neo-liberalism, prizes markets and “utility maximization.” However, humanity makes choices that can be altruistic and not always selfish. Eugene Fama’s ‘efficient market hypothesis” is one example of a religious belief that prices are rationally grounded. Repeated financial crises and manias over history demonstrate that prices can be driven to stratospheric levels by hysteria.

Rapley is no fan of colonialism imperialism and capitalism. He cites the heterodoxy of Hyman Minsky who pause its financial crises as being endemic to modern finance capitalism. Rapley deftly contrasts Minsky’s underappreciated scholarship with claims by Bill Clinton and Lawrence Summers and others about the end of the business cycle. He uses a scalpel to dissect the LCTM bailout which

featured the famed Maestro, Alan Greenspan, then Federal Reserve Board chair, rescuing very rich investors who now had the message, if you are connected your risks will be underwritten by the US treasury- the notorious Greenspan put.

Rapley’s coverage of the housing crisis and the subsequent rescue of Wall Street banks; this time by Fed Chairman Ben- of Bernanke, is equally galling- of how the contradictory messages of free markets and too big to fail was rationalized by the high priests of finance. Of how mathematicians and physicists created these “riskless” assets were foisted upon the world, including supposedly sophisticated institutional investors. Of how this American structured product was sold around the world. How money hungry rating agencies willing to stamp “AAA” on financial models did not really consider “tail risk.” Bank CEOs who should have known better, did not understand the models but had faith in the science supporting them. Alas financial crises have not been abolished. Even in recent memory, LCTM, the Asian crisis, and the dot.com craze weren’t enough for experienced CEOs to worry about what could go wrong. Short memories for the silver-haired bankers viewed as titans by an adoring, and uncritical media. Perhaps Rapley’s greatest contribution lies in the simple maxim that “what goes up comes down.” Manias and mass hysteria are still with us and economic profits, high priests and seers are mainly charlatans talking up their own book.

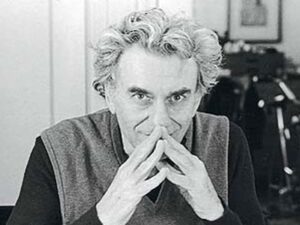

Hyman Minsky, Professor of Economics, MIT

Source: Wikipedia

He ends his book with a quote from “largely and dangerously ignored” Hyman Minsky-

If economics is too important to be left to the economists, then it is too important to be left to the economist-courtier. Economic issues must become a serious public matter and the subject of debate if new directions are to be undertaken. Meaningful reforms cannot be put over by an advisory or administrative elite that is itself the architect of the existing situation.