Themes from the press conference

“No credible date for rebalance”

“Doing everything we can to encourage economic growth and development”

“Stay tuned for Budget 21-22”

“We can no longer afford to be an outlier”

“This is not a time to be talking about raising taxes.”

A focus on delivering public services more efficiently and growing the economy.

“Important for Albertans to have a discussion about revenue structure”

Albertans will continue to be “self responsible”

“We will be very reluctant to shut down the economy”

Finance Minister and Treasury Board President Travis Toews presented the UCP government’s much anticipated Fiscal Update on Thursday, 27 August. The thin 20-page document was much less substantive than I expected. At his press conference, the Minister presented both the government’s 2019-20 annual report, delayed for nearly two months due to COVID, and the Fiscal Update for the quarter ending 30 June 2020.

Toews characterized the current fiscal crisis as a “triple black swan” event consisting of COVID-19, an oil price decline, and a global economic recession. The minister attempted to spin the story of an economic recovery since the government came into power with a low tax agenda, aiding the oil industry, reducing red tape, and opening the province for business. This claim of a nascent economic recovery was quickly challenged by several economists pointing to a selective choice of metrics. The rosy picture belied a decline in 2019 GDP, continuing high unemployment and job losses continuing in the province.

Revenue

What was expected to be a $6.8 billion deficit has now ballooned to an expected $24.159 billion deficit, considerably more than the $20 billion mused about by the Premier several months ago. Unsurprisingly, the revenue to the government fell by over 20 per cent ($11.5 billion) with non-renewable revenue falling $3.9 billion, or by 75 per cent.

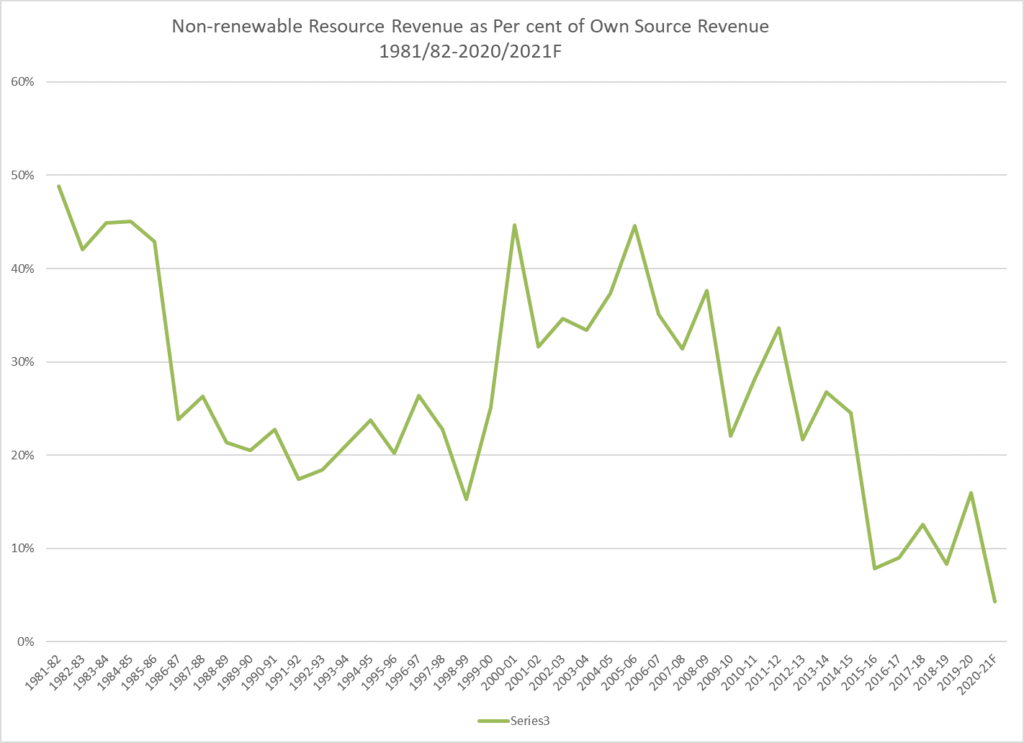

The chart below tells a large part of the story of the province’s historical reliance on resource revenue. As Chart A shows, since the mid -2000s, in spite of record high oil prices, the province’s ability to fund programs from non-renewable resource revenue (NRRR) is slowly evaporating. For this fiscal year, NRRR will make up about only three per cent of total own source revenue. Significantly, for a provincial government that loves to tell its citizens about how Alberta drives the national economy and that Ottawa is thwarting Alberta’s aspirations, over one-quarter of Alberta’s total revenue will be federal transfers.

Chart A

Source: Government of Alberta, Budgets and Consolidated Financial Statements, various years.

Other revenue numbers were equally horrific. Personal income taxes fell by $1.9 billion (15 per cent) with an even greater fall in corporate income taxes of $2.4 billion (or 53 per cent). Another variable revenue source- investment income- is expected to drop by $1.1 billion (41 per cent). Further income drops recorded were $1.6 billion from government enterprises (69 per cent). Drops included gaming and lottery revenue of $900 million and ATB Financial of $510 million due to higher loan losses. Premiums, fees, and licenses are expected to be least affected falling by $325 million, or by less than 10 per cent.

The Minister’s response to media questions surrounding revenue shortfalls was a scripted “we’ll need to have a hard conversation” about this with Albertans. According to Toews, “Our job number 1 right now is to encourage economic recovery and economic growth.” Whether this plan, some call it a hope and a prayer, will delay a credit rating downgrade, remains to be seen.

Expenditures

On the expense side, the Update helpfully divided spending between extra COVID-19 expenses of $3 billion and already budgeted spending of $47.9 billion, up by less than $100 million. The latter result is a positive feature of holding the line on regular spending. Most of the increase in budgeted spending was for health care ($301 million) as would be expected. Advanced Education spending is forecast to be $179 million higher while Education is expected to be $132 million lower than budget. Treasury Board is expected to come $152 million under budget due to “investment management fees.” It is unclear from the report how investment management fees could decrease by such an amount.

One of the more controversial expenses in the Budget is the provision for crude-by-rail contracts of between $2.3 to $2.7 billion instead of the $1.8 billion originally budgeted. This great misfortune for Alberta taxpayers is a cautionary tale about governments who feel the need to rescue the dominant sector of the economy. When governments commit publicly to do something about a temporary (or perennial?) problem, private sector negotiators have much more leeway in shifting risk to the public ‘s credit card. The question, for historians to decide is what did the officials advise and what would the politicians accept.

Of the COVID-19 expenditures of $3 billion, the bulk of the money is going to the Energy ($420 million), Environment and Parks ($367 million), Economic Development ($316 million), Labour and Employment ($273 million) departments, and last, but not least, Health ($269 million). This is an astonishing list because the Departments of Education and Advanced Education are missing from the list. Alberta’s departments which have always been flush- Energy, increasingly Environment and Parks, and Economic Development – the holy trinity of the Economic Recovery Plan, received the lion’s share. (The fiscal forecast appears to have been finalized prior to the federal government’s announcement of $262 million for schools.) A centrepiece of Alberta’s Economic Recovery Plan is spending on new infrastructure as well as funding capital maintenance. Capital Plan spending is now $8.4 billion, up $1.4 billion from budget and more than $2.8 billion higher than in fiscal 2019-20.

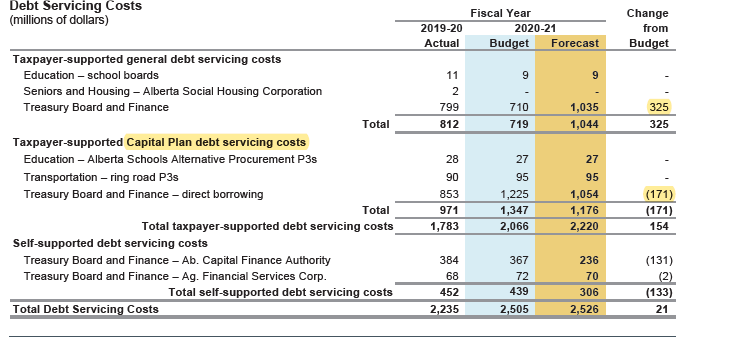

Curiously, debt servicing costs have only increased by $21 million. The minister explained this as due to refunding debt at lower borrowing costs.

Source: Government of Alberta, First Quarter Fiscal Update, 2020-21.

The above table, from page 8 of the Fiscal Update, breaks out Capital Plan and general operating debt. Why this should be reported separately is a question for accountants. All debt servicing payments come out of the General Revenue Fund as statutory appropriations regardless of the purpose incurred. How the newly dissolved Alberta Capital Finance Authority sees debt service costs go down by $131 million is presumably related to the wind down of the ACFA. The explanation is that “self supported debt servicing” has decreased by $133 million almost entirely from Alberta Capital Finance Authority.” Is the ACFA restructuring really about the definition of “tax supported debt” a metric that the current government and some rating agencies are particularly focussed on?

Debt

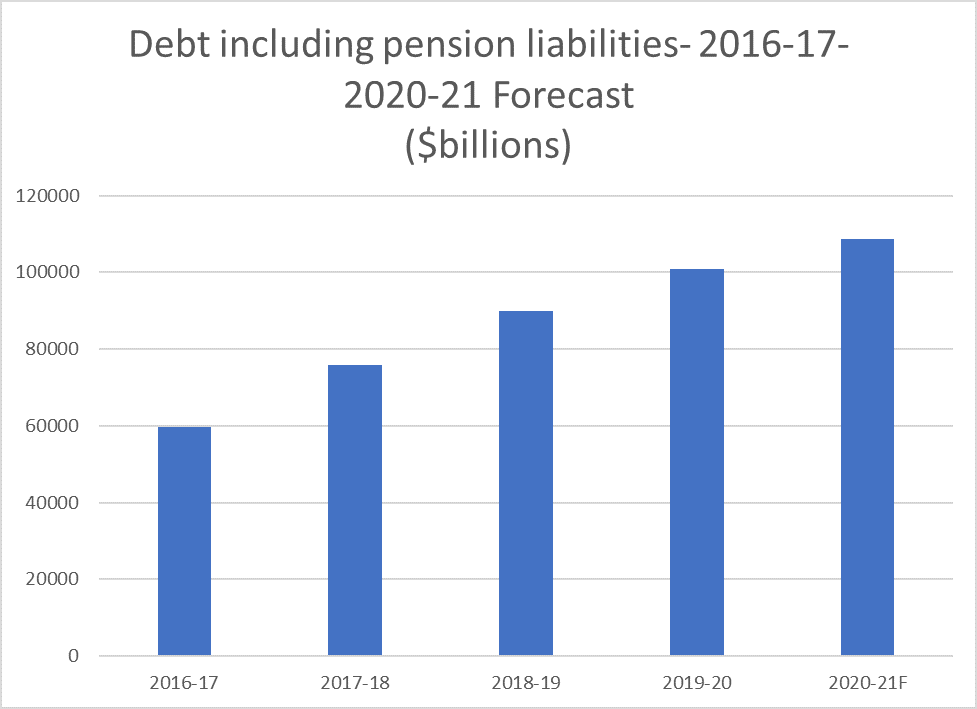

Meanwhile the tax-supported public debt will rise to nearly $100 billion by March 2021 and net debt will rise to $66.8 billion from $40.1 billion a year earlier. While Alberta’s per capita debt level and debt as a percentage of GDP are low compared with other Canadian provinces, except British Columbia, the pace of the province’s deterioration has been swifter than during the 1985-1990 period. Chart B below shows the rapid escalation of the total unmatured debt and pension liabilities since 2016-17. The chart does not net off financial assets but includes the Public Private partnership liabilities.

Chart B

Source: Government of Alberta, Consolidated Financial Statements, various years.

Questions largely unanswered

Repeatedly, journalists asked Mr. Toews about whether the fiscal reckoning comments from Premier Kenney were going to result in cuts to public services. Toews responded by reverting to the MacKinnon report’s findings that Alberta’s spending was an “outlier.” Journalists also queried him about a second wave of COVID, but he repeated the mantra about cutting red tape and taxes while reducing government spending. In short, the fiscal update was a disappointment. It contained no suggested strategies for a return to balance nor any hint of where revenue was coming except the hope that Alberta’s Economic Recovery Plan will work. For many unemployed and under-employed Albertans, this Update is too vague to be comforting.