Analysis and Opinion

Correction made 8 July 2020 re. $1.906 trillion, not billion

Premier Jason Kenney has doubled down on his bet to rescue Alberta’s beleaguered economy with more corporate tax cuts and higher infrastructure spending.

Alberta’ Economic Recovery Plan or ERP is a curious blend of spin, self-praise, capitalism at public expense, and a few interesting policy ideas. But overall the plan reads as an unimaginative, traditional blend of slogans, new organizations, and promises about jobs. According to the Premier, “jobs and the economy come first.”

Most importantly though, the Report confirms Alberta leaders are essentially hostage to international and domestic finance capital. The Premier even observed in his Press Conference that he had met that morning with United Arab Emirates (UAE) investors while searching for investments for a petrochemicals plant. (This overture to UAE investors is a tad ironic in light of the ethical oil argument advanced by Kenney supporters.)

External sources of capital have become the largest source of investment into Alberta and a critical contributor to Alberta’s economic growth. Much of the economic adversity experienced by Alberta since 2014 is tied to the flight of tens of billions of dollars of capital investment. To reverse this trend, and bring back job – creating investment, Alberta’s government will create Invest Alberta, a dedicated investment promotion agency that will lead our investment attraction strategy in a new direction with better capital markets communications, proactive investment promotion targeting key companies and sectors, and concierge service for prospective investors seeking to navigate through regulatory and other hurdles. (Page 11)

In effect the Premier, his cabinet and his ERP council are admitting that Alberta does not have the homegrown capital to nurture economic growth.

The Alberta Illusion

And how is it that Alberta has now arrived at that sad state? The easiest answer is: we’ve become too complacent and complicit about the soundness of Alberta’s economic foundation since the time oil prices quadrupled in the 1970s. Disposable income grew automatically whether you were a small business, truck driver, government worker, or corporate executive. Everyone could get a job whether fully qualified or not. (Admittedly, exceptions to this favourable situation occurred between 1986-1994 and since 2016.)

The conflict in Alberta’s central dilemma exists between a saver mentality, wishing to squirrel away resources for an unpredictable future, and the more frenetic mentality which likes to demonstrate they have “arrived.” The saver -steward never won the debate and Albertans are now paying that price.

Alberta’s government has been dominated by a “serial entrepreneur” mentality who never quite makes it into the big leagues. Adam Sadler, in a gritty performance as a diamond dealer in Uncut Gems, plays that serial entrepreneur. Howard Ratner (Sadler) unfortunately had too many outside commitments (girlfriends, ex-wives) to juggle with “big scores” blowing up and creditors on his doorstep. He really had no plan, moving from creditor to creditor, pawn broker to pawn broker, investor to investor. And each time, they would take a piece of the bounty. He could not save, he was restless, and emotionally unstable.

Source: https://upload.wikimedia.org/wikipedia/commons/a/a5/Adam_Sandler_2011_%28Cropped%29.jpg

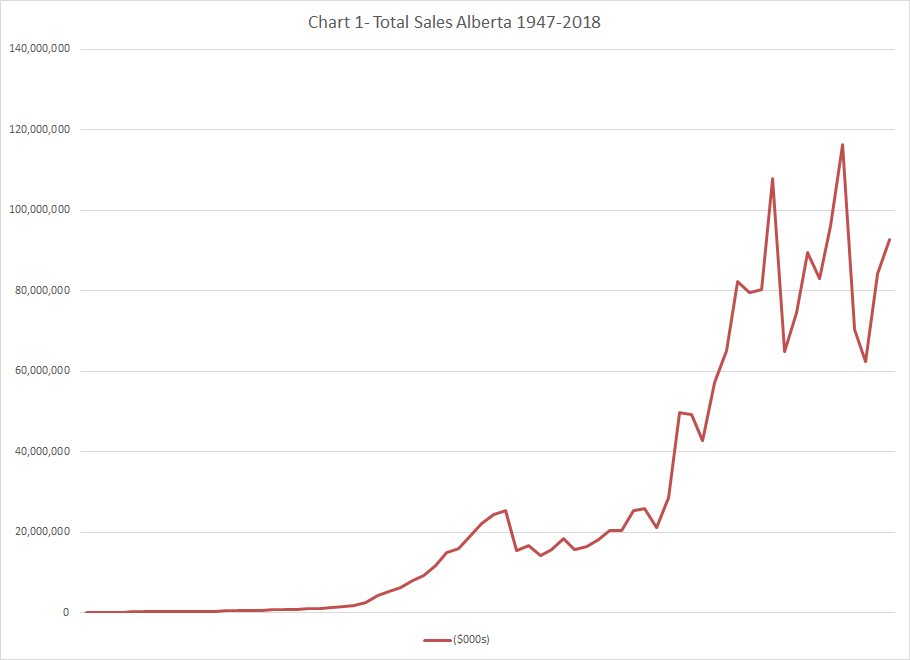

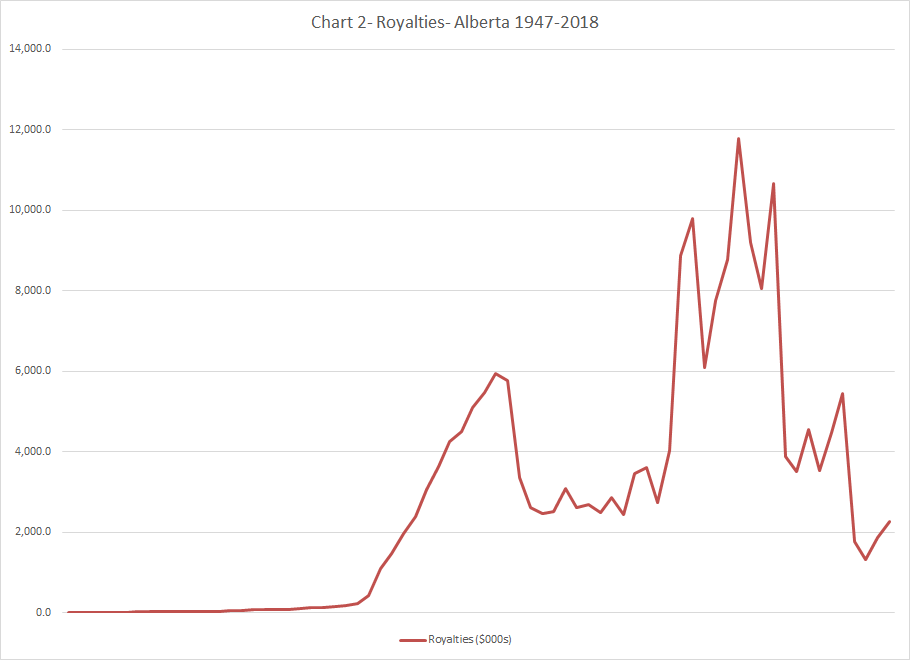

Alberta’s creditors have only pounded at Alberta’s door once, in 1936, when Alberta refused to pay its creditors. Then Alberta got lucky in 1947, again in 1973, in 1999, and in 2006. Between 1947 and 2018, according to CAPP data, Alberta’s oil and gas sector producers had cumulative revenue (sales) of $1.906 trillion. Contrast this number with $201 billion in royalties to the owner, or 10.5 per cent return. These cumulative figures suggest Alberta had access to a bigger piece of the revenue but demurred taking a bigger share.

ERP as prospectus

So if the problem is a shortage of capital, then this ERP becomes the prospectus for Alberta’s vigorous entry into the world of attracting global institutional investors. Prospectuses are legal documents used to woo mainly institutional investors and multinational corporations to obtain financing via the purchase of debt or equity securities.

What then will politicians and senior bureaucrats from the newly minted Invest Alberta do in these finance capitals? They will, in the words of Premier Kenney “aggressively” promote and defend Alberta’s record.

In the face of direct foreign competition and deeply misleading attacks on our energy industry, we will work closely with the world’s leading banks and investors to define and defend Alberta’s leadership on environmental, social and governance (ESG ) standards across all sectors, and to outline major capital investment opportunities

on a regular basis. We will target the largest and fastest growing firms for strategic discussions about moving teams, divisions and even headquarters to Alberta based on the structural competitive advantage our economic plan provides to them in lower tax, faster/clearer regulation, the youngest and best educated talent pool, low cost of living, affordable property, and world – leading quality of life.

Is the strategy to target the “largest and fastest growing firms” realistic for a small player like Alberta? This strategy is one that virtually all economic development strategists around the world push. This elephant hunting (petrochemicals) has historically proved to be a very poor way of diversifying Alberta’s economy. The recent North West Upgrader (an over budget “partnership”), and examples from the 1980s like Gainers and MagCan, have proven to be expensive relative to the jobs created. This big bet strategy of picking winners over losers is especially fraught when the energy and petrochemical industry has been pre-selected, It should horrify UCP’s Wildrose funders.

Abpolecon.ca will be anxiously waiting to see the leadership appointments to Investment Alberta. The appointments will reveal how bold this new agency will, or will not, be.

So the strategy appears to be the “same old, same old”: what politicians and senior officials been recommending for the last two decades. Alberta’s complaint then? If only investors understood us and took our word for our “world-class” environmental record and world-class regulators.

How is the full court press to be operationalized? Actually there are some specifics, but they are disturbing.

Standards and frameworks : Alberta is actively engaging with industry partners to enhance reporting practices and standardization so Alberta’s leadership in ESG performance metrics is accurately represented.

Data and analytics : Alberta will continue using transparent, objective and third – party data to correct

mischaracterizations of Alberta’s environmental performance and support its position as a part of the

solution to move toward a lower – carbon economy.

Advocacy and messaging : Representing our energy industry accurately within the investment community by focusing on positive, forward – looking and scientifically supported information

Strategic engagement : Actively engaging with industry stakeholders and market participants to ensure that further integration of ESG metrics into investment decision – making does not continue to target Alberta’s energy sector disproportionate.

Response of global investors

However setting international investors straight about the truth of Alberta’s energy industry may prove to be rather difficult. Institutional investors have access to a wide range of data- scientific, opinion, and spin. Global institutional investors have a wide range of choices where to place their funds. Such global investors are advised by a range of specialists in the global fossil fuel energy and renewable energy fields, to which Alberta is competing. In these discussions, decisions boil down to costs of production, including guaranteeing low royalty rates, but also the liabilities investors will be incurring.

The international investor will also know there is virtually no references to renewable (1 mention), green (0) or sustainable (3, two of which refer to energy resources) energy. Nor are the phrases “environmental liabilities,” or “tailings ponds,” those inconvenient words, anywhere in this prospectus.

The operational plan is to redefine standards and frameworks so “that ESG performance metrics are accurately presented.” This Orwellian gambit will pit experts in the proper measurement of gases, accounting for asset retirement obligations, and a correct definition of remediation. This Orwellian perspective has already apparently won because Alberta only uses “transparent, objective and third – party data” in order to defeat “mischaracterizations of Alberta environmental performance.” “Trust us” in other words.

The action plans suggest that the Canadian Association of Petroleum Producers had an major role in the drafting of the ERP. For example: (1) Alberta is actively engaging with industry partners; (2) Alberta will continue using transparent, objective and third – party data; (3) representing our energy industry accurately; and (4) actively engaging with industry stakeholders and market participants.

This does not seem to leave much room for other civic or non-business advocacy groups to participate in the dialogue. By redefining terms, the industry, through its government allies, will attempt to convince investors the industry alone is the source of truth.

How well will investment professionals, particularly young millennials, view this rather thin prospectus, short on detail, desperately begging for money? How would knowledgeable investors view the long history of boom and bust of Alberta’s finances? What does this history reveal of stewardship and notions of steady vs. sporadic progress?

Younger analysts will, or should be, should be appalled at the indifference to climate change. While Alberta seeks dollops of investment for both its operating and capital budget, it will be competing with trillion dollar investments in renewable energy and infrastructure investments (public transit) built on electricity rather than fossil fuel. Will Alberta be successful?

Alberta Job Creation Tax Plan

The centrepiece of the strategy to lure investment is the “Job Creation Tax Cut,” a corporate income tax cut which has been accelerated by 18 months. Labelled by business as “bold,” this strategy is founded on economic theories positing that lower corporate income taxes will create more investment and therefore more jobs.

This theory is a highly problematic approach to economic development for a variety of reasons. First, investment returns are determined by a host of factors including: transportation costs, labour costs, personal and municipal tax rates, private and public infrastructure, public services including schools and health care, and proximity to markets.

Other than the lowest combined corporate income tax rate, there is not a compelling case for investment in Alberta for goods-producing, value-added companies, with global aspirations. Alberta is far from world markets, has no tidewater, and its labour costs at present are high. Second, it is virtually impossible to isolate the role of provincial corporate income tax in analyzing investment location decisions. Finally, there is limited empirical evidence that this policy idea has worked or will work.

Indeed, all the years of corporate income tax cuts which came federally and provincially in the 2000s, under Paul Martin and Stephen Harper, did little to raise Canada’s competitiveness, productivity and living standards. Instead, share buybacks and hefty executive and director pay packages were the main result.

The Theory

Recent work by two Alberta academic economists Ergete Ferede and Bev Dahlby use historical data (GDP growth rates, CIT rates) to examine the effect of a change in corporate income tax rates on GDP growth.

The authors find: “a one percentage-point reduction in a provincial government’s statutory CIT rate increases the growth rate by 0.12 percentage points four years after the initial CIT rate cut and increases real per capita GDP by 1.2 per cent in the long run.” Using robustness tests, the authors conclude that these other factors do not support objections that commodity prices or U.S. economic growth are more deterministic than CIT rate changes for Alberta. This finding is interesting and counter-intuitive to macro-economic convention.

Still are the results of these empirical tests, which show rather small increases in GDP, sufficient evidence to justify lowering corporate taxes? These experts have found that the provincial CIT rates are “sticky” and that the most intensive forms of tax competition may be tax incentives for research and development, television and film and oil and gas royalties. Another study cited emphasizes that the allocation formulae by which the CIT of companies operating interprovincially is weighted by sales and payroll costs. This tax allocation formula “has greater impact on the marginal cost of hiring labour than the tax rate differential between the provinces,” Ferede and Dahlby write.

Second, a foundational belief of the theory is “tax bases almost always shrink in response to a tax rate increase because taxpayers have an increased incentive to alter their labour, savings and investment decisions.” This assumption is a canon of the neo-classical economics model (economically rational actors). The real world is arguably different and much more complex.

Most individual taxpayers and many small corporate taxpayers have no time to pay attention to differential tax rates since their mobility is theoretical, not real. The claim that “The shrinkage of the tax base is a measure of the harmful distortion in the allocation of resources caused by taxation” is a normative statement. This type of assertion, that taxation is a “dirty word” because experts say it is so, is tautological.

A further line of argument is the disputed provincial Laffer curve- viz. by reducing CIT, tax revenue will in the long run However, is the Laffer Curve an unprovable article of faith of the neo-liberal school? Second much of the neo-liberal school puts great faith in the view that over the long-run, long-term growth, as estimated by the models, will come true. This fact is belied by recent evidence that long-term economic growth has noticeably slowed in modern economies, mainly due to demographics. Many of these economies have, since the 1990s been the subject of neo-liberal experiments, which have had a rather questionable outcome when viewed holistically.

There is also the question of technological progress as a factor in overall economic growth. Dahlby, Ferede and others posit that higher CIT rates “reduce economic growth by reducing productivity and by lowering investment.” It is not clear from the context whether this statement is a fact, assertion, or an assumption. While plausible, there are many other factors which may reduce investment and hence productivity. One of the central factors currently affecting investment in Alberta is the desire by institutional investors to reduce their exposures to fossil fuel production.

Positives

There were some interesting ideas which emerged in the report. First, the objective of integrating quickly high- skilled, but uncredentialed, immigrants is good for all Albertans. Everyone suffers where trained doctors, engineers and other professionals are not reaching their full potential in the face of entrenched professional guilds. The new Fair Registrations Practices Act will streamline recognition of skills, credentials, and education.

The idea of a 130-kilometre “high-speed rail” link from Calgary and Banff is indeed bold. Such an idea, along with the multitude of infrastructure ideas, is thought to encourage economic diversification by building tourism services. This proposal reveals much about the thought processes of the prospectus drafters. First, rail infrastructure creates a lot of short-term construction jobs, making this attractive for politicians seeking re-election. Second, it levers federal dollars through the Canada Infrastructure Bank, so Albertans are getting a bigger bang for the buck.

However, this ERP/ Prospectus project is not “environmentally sensitive.” This might have been an opportunity to showcase electrification of rail tracks, but this does not appear to be the case. Catherine McKenna, Canada’s infrastructure minister, might be more receptive to electric rail, but this proposal is another example of we know best.

So many areas of public infrastructure assume increased fossil fuel use. Thus opportunities to experiment with different, more sustainable technologies has been wasted. Equally problematic for the rail link proposal into downtown Banff, it requires federal co-operation. Such a proposal will pit developers in Canmore and Banff against well organized conservation groups. In 2020, it does not make sense to ask the federal government for money without thinking about how these projects might reduce GHG emissions.

More challenges

The plan may be bold, but it’s not without its challenges.

The ERP also promises: “Advancing Alberta’s position as a leader in environmental, social, and governance (ESG ) to demonstrate the critical role Alberta’s resources, technology and renewable opportunities will play in the transformation to a lower carbon economy.”

This is the first and only mention of ESG and is not likely an afterthought. Indeed, ESG is in common use within the corporate firmament and is being more seriously thought about. Not only are corporate executives requiring primers on ESG but so to are the institutional investors who include ESG in the determining financial value. But do senior people in the Alberta government, with access to the Premier, dare push this concept of “concession” forward?

While the reference to ESG is vague and minimal, its mention hopefully conveys to international investors that Alberta’s political leadership might acknowledge (maybe) the importance of ESG. Whether large banks and pension funds buy this little section on page 11 remains to be seen.

Past experience with Premier’s visits to international finance capitals has not been particularly fruitful. No funding for Teck Frontier and no funding of Keystone XL without a $1.5 billion equity provincial commitment with up to $6 billion in government loan guarantees.

More problematic for the government could be antipathy from the libertarian element in the UCP who views government investment and loan guarantees as apostasy. This seems to be a government that speaks of the entrepreneurship while quietly picking winners.

Alternatives?

Conversely, a “bold strategy” might be to renounce billions in aid to Keystone XL and plow the money into Artificial Intelligence and Machine Learning. That would be bold, but certainly fraught with risks. But so is the Keystone project which is facing litigious opposition and November elections south of the border.

Next week, I will outline an alternative ERP to pivot the province away from its infatuation with “world-class,” towards a locally based enterprise geared to satisfy human needs, to rebuild literally from the ground up with the newest ideas and technologies.