Over the past three weeks, the two main parties and two smaller parties have released their full policy platforms or position statements. The following is a high level look at some of the policy proposals by highlighting good, bad, and “ugly” proposals.

Animosity between 2 major parties

It goes without saying that much of the campaign has featured personality politics with Rachel Notley spending an inordinate amount of time questioning Jason Kenney’s character. At the time of writing, this tactic has not appeared to have improved her party’s chances of retaining office. One of the most evident features of this attack is that it has demonstrated significant weaknesses in her party’s capacity to articulate visionary policies.

The Good

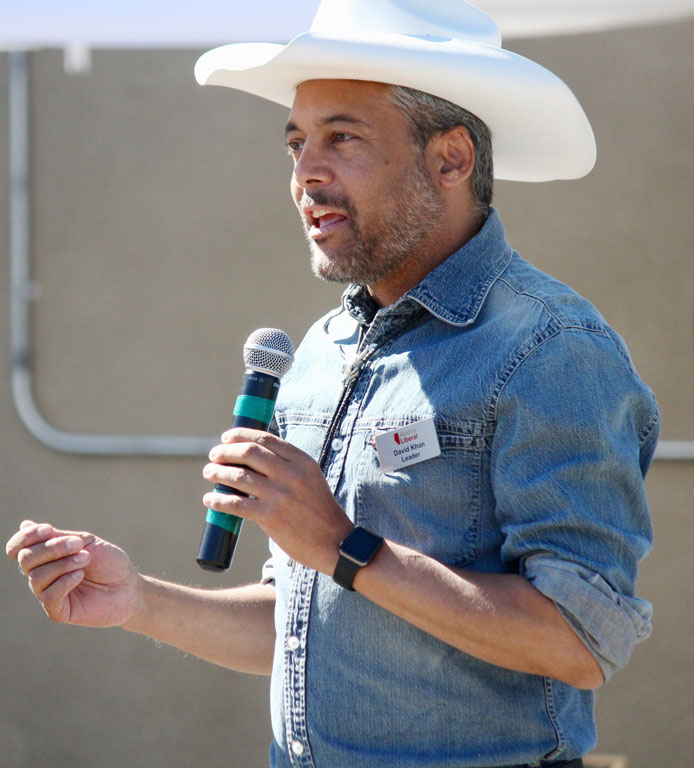

The Alberta Liberals have chosen to go after a serious weakness in the two major parties’ platforms- the credibility of their fiscal platforms. While the two frontrunners seek to convince voters their fiscal plans will preserve Albertans’ tax “advantages,” David Khan’s platform has boldly called for the introduction of an eight (8) per cent harmonized sales tax alongside lifting the exemption levels for personal income taxes. A key message underlying the policy is to wean Alberta finances off its volatile resource revenue. This policy is aimed to allow Alberta to “get off the royalty roller coaster, address revenue issues and incentivize economic growth.”

Source: CBC Power Politics

The UCP, citing Conference Board of Canada research, is recommending a “Fair Access to Regulated Professions and Compulsory Trades Act to help ensure that regulated professions and individuals applying are governed by registration practices that are transparent, objective, impartial and fair.” This legislation is designed to bring more immigrants with post-secondary education, trades experience, and work experience from their former countries, into the Alberta workforce. This measure is part of the “Alberta Advantage Immigration Strategy” to “knock down barriers to the full inclusion of new Albertans.” The measure is an innovative approach to tackle the subtle barriers placed in front of new Canadians who face professional monopolies primarily charged with keeping barriers to entry high and fees egregiously high. This policy will be very tough to crack as various professional bodies- colleges, licensing councils -will strongly resist changes that promise to create more competition and diversity in professions ranging from medical to accounting to dentistry.

The NDP is recommending a strengthening of the Conflicts of Interests Act. According to their platform, amendments will “guard against former officials using their position to gain undue influence and benefit, including extending cabinet ministers’ cooling off period to two years.” Why this hasn’t been done earlier in their mandate is a question. Nevertheless policy goes to the issue of trust in both appointed and elected officials using their contacts and expertise after retirement to “feather” their nests. The recommendation is a not-too-subtle reminder to the electorate that the NDP government’s generally scandal free term contrasts sharply with controversies enveloping the UCP.

The Alberta Party proposes to make Alberta a hub for the development of autonomous vehicles negotiating in cold weather. While this project may sound pie in the sky, it at least recognizes that the future of the automobile, which has driven economic development for the past century, is no longer a fossil fuel play, but is a software and intellectual property game.

The Bad

The Liberal Party recommends “class-size caps that make it mandatory for the Government and school boards to keep class sizes small.” In addition, the platform adds: Hire as many teachers as needed to meet the class-size requirements.”

While noble in sentiment, this platform uncritically accepts demands made by the educational establishment for more funds. The Alberta Teachers Association is a powerful lobby body. This body has two principal functions: first: bargaining agent for teachers and second, a professional body. Alberta teachers are paid more than teachers in other major problems. While the NDP did an admirable job in slowing pay increases province-wide, the issue of wages is inextricably tied to “hiring more teachers.” This is a financial issue not only for teachers but for the broad public sector including physicians, university employees, and nurses. There is a fundamental imbalance with other provinces’ pay scales. The argument that because average wages in the economy are the highest in the country does not, or should not mean that public sector wages are automatically the highest in the country. That said, one of the problems with paying public sector workers more money is because in our boom-bust economy, royalty gushers permitted politicians the luxury to pay more. That is decidedly not the case, and the Liberals’ sales tax idea would stabilize provincial revenue. Taking resource royalties entirely out of the province’s general revenue fund and saving the money for future generations would prevent the periodic assault by rentier associations on the public purse.

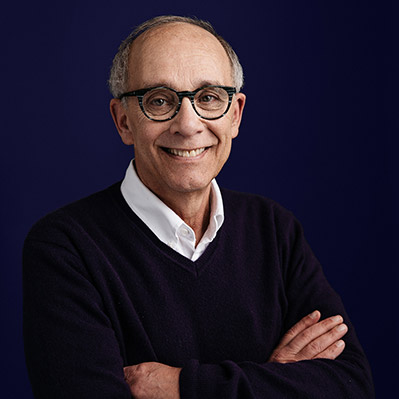

Source: Alberta Liberal Party

The UCP’s first bill will be to scrape the carbon tax. The premise on which this policy is based is that the NDP’s “alliance” with Justin Trudeau has failed. They believe that the premise of a “social license” is false. Moreover, they believe that taxes are punitive on consumers and small businesses. Finally, the UCP leader believes that the carbon tax is unconstitutional.

This main plank is misleading for several reasons: 1) without the Climate Leadership Plan, Alberta’s support of pipelines was going nowhere, 2) The Climate Leadership plan remits to lower income families all or most of the costs incurred from the tax; 3) small business tax reduction to two percent assists small business; 4) the federal government will in all probability win the case against recalcitrant provinces wasting millions in legal fees and government resources; and 5) even the abolition of the ALberta carbon tax does not impede the federal tax unless it is ruled unconstitutional. Further, the repeal will cause confusion for gasoline retailers and consumers.

The NDP with other parties are big fans of small business. In their platform, they state: “We will create a Small Business Investment Office to streamline small business regulation and support new and growing businesses, and we’ll keep small business taxes low.”

Most voters do not really understand that small businesses pay only 2 per cent of their net income in corporate income tax. Many small businesses fail in their first few years but those that survive and keep their revenue below a certain threshold level ($500,000) can reduce income taxes which would be payable at much higher personal tax rates for the business owner. According to the recent provincial budget, this form of “tax expenditure” costs the Alberta treasury a whopping $1.9 billion. The failure by federal Finance Minister Morneau several years ago to clean up the abuse of small business tax rates by “professional business corporations” is a testament to the need for a broad review of corporate and individual taxation in Canada.

The Alberta Party, if elected, intends to create a Ministry of Early Childhood. These ideas make bureaucrats cringe. Offices have to be moved, reorganizations implemented, existing stationary and business cards shredded, plus, plus. Such platforms signal the interest of the party leader in a new constituency or policy issue. Such proposals are often hard to resist and often appeal to certain advocacy groups a party hopes to attract. However after listening to speakers at the UofA Chancellor’s FOrum on the Opioid Crisis, I tend to think that perhaps that issue deserves more of a profile that early childhood. Once again, noble sentiment but problematic.

Source: Alberta Party

The Ugly

The Liberal Party proposes an exemption from small business corporate income tax for the first three taxation years after incorporation. Depending on how this plan is structured, it will encourage a slew of new incorporations for already existing businesses. To prevent this, a Liberal government would have to make the regulations more complex to prevent abuse. It would likely mean more bureaucratic hiring.

The UCP platform will “Require large final emitters (LFEs) in the electricity sector to meet a “good-as-best-gas” performance standard, which means that over 60% of coal fired electricity emissions will be subject to compliance.” Along with reducing the compliance costs of large emitters from $30 a metric ton to $20 dollar, this effectively means the coal phase out by 2030 will be suspended. In addition, industry will continue to receive some the money back through “technology subsidies” to improve oilsands extraction technology “and supporting research and investment in carbon capture, utilization and storage (CCUS).”

The retrograde policy places Alberta to the back of the pack in terms of action to clean up Alberta’s environment.

Much of the NDP economic platform has been based on “economic diversification.” For many politicians, their sole job is defined by either protecting or saving jobs. This is evident in this campaign as the NDP have channeled Peter Lougheed (as a recent coop-ed from Allan Warrack in the Edmonton Journal was titled.

“Our priorities centre on the largest diversification plan Alberta has seen since Peter Lougheed, bringing $75 billion in new investment and creating 70,000 new jobs by 2030. Our plan gets our oil to new markets at higher prices for our province.”

While the intent is noble, there is little compelling evidence that businesses solely invest based on “incentives.” Corporations are inventive in minimizing taxes at all times and invest for periods of decades or more. Corporations understand the electoral cycle, partisan politics and also the complexity of obtaining regulatory approvals. Corporations also take into consideration not only access to cheap supply but also the costs to transport their products to market. While Premier spoke in the debate about where the “economic puck” was going, it is certainly not going towards more massive fossil fuel or plastics facilities. Finally, Albertans as owners of the resources must be careful to understand the trade-off between lower natural gas royalty payments and the cost to create the thousands of short-term construction jobs and hundreds (maybe) of permanent jobs. That said, the platform to support the growth of industries such a media and AI businesses makes sense. More money should go into these industries of the future than to fossil fuel companies.

An Alberta Party government promises to provide a “Business Certainty Guarantee.”

“An Alberta Party government will establish the Business Certainty Guarantee on day one of taking office. Under this Guarantee, businesses and investors can have confidence that the overall costs of doing business in Alberta will either stay the same or go down during the four-year term of the government.”

Several questions arise with this platform. Why should this promise be directed at business only and not the general public that have faced tax increases over the past few years, particularly at the municipal government level? Would municipal government tax changes be caught? Under our Westminster system of government, legislatures are supreme in their jurisdiction. That is to say, a succeeding legislature (new government) can make any laws it wants. Such an Act is constitutionally groundless and ill-conceived. It is pure grandstanding. In any event, astute businesses looking to invest should understand not only what the current rules are but what the future might hold. If businesses aren’t planning they are not doing their homework. Arguably, one could make the case that the coal-fired utility companies in Alberta were asleep at the switch on the global warming issue and did not investigate the costs of future regulation nor renewable energy alternatives. In other words, their strategists should have been on top of the climate change debate if not for the past ten years, if not back into the 1990s.