On 27 February Treasury Board President and Minister of Finance Nate Horner tabled the budget for the fiscal year 2025-26 and as required by law the budget sets out targets for fiscal years 2026-27 and 2027-28.

I was privileged to be the guest of NDP MLA for Edmonton-Goldbar, Marlin Schmidt. For over 40-years I have been able to attend budget addresses, work on about 10 budgets while at the Treasury department, and attend half a dozen budget lock-ups while at ATB Financial and the Institute for Public Economics. I have watched the performance of many finance ministers under 9 premiers (excluding the caretaker David Hancock). I note that no finance minister over these 40-years has ever become premier. Notable were Jim Dinning, Doug Horner, Ted Morton, and Travis Toews’ challenges for the premiership.

Overview

The main surprise was a fiscal deficit of $5.2-billion for 2025-26 and two more $2-billion deficits in the succeeding fiscal years.

The title of the budget, “Meeting the Challenges” pays homage to Alberta’s past and how the governments of the day met challenges such as the great depression, including U.S. tariffs, wildfires, and of course the National Energy Program.

Alberta has never hesitated to rise to any challenge, to fight for what’s fair or fight against whatever might threaten our quality of life. (page 2)

The minister suggested what was occurring in the global environment was not “unprecedented,” the implication that Alberta would be prepared. Yet what we have seen south of the border- threats of a “World War III” to a former ally, government employees being fired and government agencies being practically eliminated by an un-elected plutocrat, and heightened insecurity, are unprecedented. All this of course provides cover for a deficit one year after a $5.8-billion surplus. This is not a shining example of fiscal prudence, and is the the continuing hallmark of crack cocaine fiscal mismanagement.

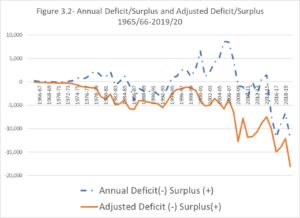

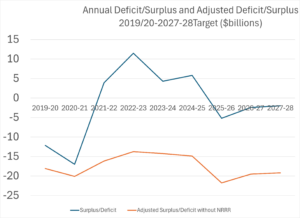

Alberta continues to run a deficit if non-renewable resource revenue is excluded

Horner follows a long line of finance ministers who have presided over surpluses which quickly turn into deficits without non-renewable resource revenues (NRRR) to fall back on. Horner extends the fiscal record of deficits excluding NRRR, a fiscal reality well known to historians of Alberta’s public finances. The first chart taken from A Sales Tax for Alberta- Why and How covers fiscal years from 1965-66 to 2019-20. The next chart shows the adjusted deficit during the UCP administration and shows a continuation of large deficits, a characteristic of the over-reliance on the crack cocaine of non-renewable resource revenue.

I apologize for sounding like a broken record. Premier Smith knows the dangers: this from her School of Public Policy paper in 2020-

She identifies the problem as “not a lack of diversification in industry, the problem is a lack of diversification in the provincial government’s source of revenues, and a lack of innovation in the public service as a whole.” Furthermore, “Alberta has built its operational spending for the vital services everyone needs – health, education, post secondary, social services – on volatile and unstable sources of funding.”

This is the fundamental conundrum of Alberta. We want gold-plated services and we don’t want to pay more taxes for them. Politicians are to blame for maintaining the fiction that this was sustainable. Anyone who proposes an alternative to raise taxes the sales tax is the most obvious source of long-term revenue the province could adopt to solve this structural shortfall – it is instantly shot down by politicians fearing they won’t be re-elected.

Past (conservative) heroes

Homage was paid to the Progressive Conservatives under Peter Lougheed who faced turbulent times and who had the foresight to cut personal taxes during the inflationary 1970s providing cover for a fiscally irresponsible personal income tax cut, supposedly “two years ahead of schedule.”

As the Premier stated on the day she announced the tax cut, it’s your money. You earned it, not the government. (page 4)

Lougheed was also credited with establishing the Heritage Fund. Lougheed warned of “the very reliance on non-renwable resource revenue ” a factor that needs to be frequently underlined” (page 10).

The budget address was short and made up of uninspiring set of homilies, standard fare in UCP budgets. The homilies included cheap attacks on Ottawa, especially towards the outgoing Prime Minister and his late father,

Damaging federal policies, from Trudeau the Elder’s National Energy Program in the 1970s to Trudeau Junior’s production cap, impact assessment act, and tanker bans today (page 2).

In a time of tremendous uncertainty, geopolitical challenges from around the world, whether they be directly across our border or in other hemispheres, immense population growth, and continued dereliction of leadership from Ottawa, Alberta will meet the challenge (emphasis added (page 9).

- Red Tape reduction which supposedly has saved Alberta businesses $2.75-billion since 2019. This number is not an audited number.

- The “Alberta Advantage,” coined in 1993, feature low corporate and provincial income taxes, although a rise in the education property tax was not advertised in the speech. The speech referred to results of the Alberta Advantage – new investments from Dow Chemical, de Havilland, and a $500-million pulp mill expansion in Hintono. Unmentioned in the budget text was a multi-million gift to the Katz Group to revitalize Edmonton’s downtown core to “develop an event park and public realm space fully connected to Rogers Place in Edmonton’s ICE District, unlock more housing in the downtown core, and would also support site servicing for the Village at ICE District and demolition of the old Coliseum at Exhibition Lands.” Each party (Alberta, Edmonton, OEGSE) will continue one-third but the main benefits will accrue to the landlord and businesses of the ICE district.

All this to say that the Alberta Advantage is alive and well – and recognized by not only the many businesses and investors who choose us, but also by the many individuals and families from across the country and the globe who are choosing to relocate to our province.

“will not try to buy prosperity through higher taxes. Instead, it will build on Alberta’s existing advantage of low taxes and its free enterprise spirit to develop the most competitive economy in North America. The government will strengthen the

Alberta Advantage and sell it aggressively around the globe” (page 7).

- Another metric of note is Alberta taxpayers (personal and corporate) collectively pay $20.1-billion less in taxes than taxpayers in British Columbia.

Capital spending

The spread of government capital spending included funding for

- expansions to the Misericordia and Grey Nuns hospitals in Edmonton;

- investments in Norquest College to expand their skills training capabilities;

- money for the Northern Alberta Institute of Technology for a new Advanced Skills Centre;

- redevelopments of the Campus Centre at the Southern Alberta Institute of Technology,

- a major investment in the Biological Sciences Centre at the University of Alberta;

- and a multidisciplinary hub at the University of Calgary.

Numbers

A portion of this stunning deficit arises from Premier Smith’s 2023 election promise to create an 8 per cent marginal tax rate for incomes up to $60,000. Other causes include a contingency amount for disasters (wildfires, drought) and other uncertain situations (tariffs) which has been doubled from $2-billion to $4-billion. Another source of the deficit comes from NRRR which is expected to fall by about $4-billion this fiscal year based on a WTI price of $68.00 down from $74 per barrel last year. Operational spending continues to grow but only at a 3.6 per cent pace. This budget assumes inflation at 2.6 per cent and population growth of 2.5 per cent which sum is considerably higher than the avowed policy. Health spending will inch up from $22-billion to $22.1- billion while education sees a lift of 4.3 per cent and post-secondary is hit again with a derisive increase of $7-million on a total budget of $6.6-billion. This small increases continues austerity in the education sector. There is little room for wage increases to education workers barely earning the minimum wage. Meanwhile, Social Services sees an increase of 6.7 per cent exceeding the fiscal formula for the spending growth,

| Fiscal Metric | 2023-24 Actual ($billions) | Budget 2024 Forecast ($billions) | 2025-26 Estimate ($billions) | 2026-27 Target ($billions) | 2027-28 Target ($billions) | ||

| Revenue | 74.7 | 80.7 | 74.1 | 77.4 | 80 | ||

| Total Expense including Contingency/Disaster | 70.4 | 74.9 | 79.3 | 79.8 | 82 | ||

| Surplus (Deficit) | 4.3 | 5.8 | -5.2 | -2.4 | -2 | ||

| Non-renewable Resource Revenue (NRRR) | 18.5 | 20.7 | 16.6 | 17.1 | 17.2 | ||

| Deficit without NRRR | -14.2 | -14.9 | -21.8 | -19.5 | -19.2 | ||

| Oil Price Assumptions U.S.$ WTI | 77.83 | 74.00 | 68.00 | 71.00 | 71.50 | ||

| Production- oil, bitumen Barrels/day | 3843 | 3983 | 4077 | 4200 | 4256 | ||

| Sensitivity– U.S. $ 1 to WTI | $750-million | Sensitivity C/U.S.$ | _$560 million | Interest rates | $277 million |

Opinion

Albertans and Alberta taxpayers have been the beneficiaries of NRRR paying for anywhere between five and fifty percent of program spending. Thus all Albertans are free riders. The continuing fiscal challenge for politicians is having the mettle to educate Albertans about the fiscal dilemma Smith has written about- the conflict between gold-plated services and low taxes. The costs of perennial roller coaster fiscal policies means wild spending then austerity. This budget introduced with platitudes, self-praise and loathing for Ottawa has no heart. The budget was about numbers and not people. Not coincidentally thousands of education workers and teachers held a demonstration on the steps of the Legislature Building while Horner delivered his budget. Significantly lower tax rates in comparison with other provinces (no sales tax), payments to rich corporations to attract investment, and indifference to labour remain hallmarks of UCP financial policy.

Absent in the budget address were mentions of the government’s intentions regarding the new Heritage Fund Opportunities Corporation, AIMCo, and refreshed mandate for ATB Financial. The budget was also silent on the Alberta Pension Plan and an Alberta Revenue Agency. Another central issue facing Alberta and the whole planet is climate change mentioned once in the Fiscal Plan document and in relation to adaptation which is primarily related to the Technology Innovation and Emissions Reduction Fund (TIER) which will be handing out $646-million in grants over the next three fiscal years. This includes $173-million in grants for carbon capture over the next three fiscal years.

Related Posts

Northwest Upgrader- more surprises ahead for Alberta taxpayers?