Background

In March 2020 the Alberta government’s investment manager the Alberta Investment Management Corporation (AIMCo) lost approximately $2-billion due to trading losses. AIMCo had established an investment strategy based on, in effect, insuring counter-parties against volatility trading losses. This strategy was called VOLTs for volatility trading strategy. The losses occur occurred suddenly due to dramatic financial market volatility caused by the declaration of the global COVID pandemic.

The impact of these losses was felt most particularly by Alberta’s public sector plans including the Local Authorities Pension Plan (LAPP), the Public Service Pension Plan (PSPP) and the Special Forces Pension Plan (SPFF). Soon after the losses were revealed, AIMCo’s board commissioned a study to understand the factors underlying the large losses.

Subsequently, buried in Note 17 of AIMCo’s 2021 financial statements it was disclosed:

Certain clients have commenced arbitration proceedings against AIMCo and the Province of Alberta, alleging that AIMCo breached Investment Management Agreements in connection with portfolio investment losses incurred from a volatility trading strategy in calendar 2020. The aggregate of damages sought is $1,333,500, plus interest and costs. The outcome of the arbitration and any potential liability is not determinable. AIMCo intends to defend these claims vigorously (emphasis added).

Arbitration drags on

This arbitration proceeding was a way for the parties to come together for some type of settlement which would not require the dispute to go before the courts. For two years this issue dragged on. The sticking point was the absurd ruling of the arbitrator that the province was not a proper party to the proceedings. This decision was controversial because AIMCo is merely an investment manager with few assets of its own. If the arbitrator was to side with “certain clients” namely the large public sector pension plans, payment would have to come from the provincial government.

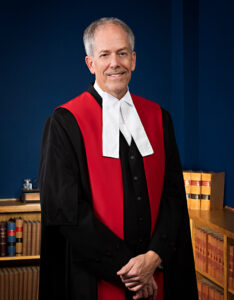

The arbitrator’s ruling was challenged by LAPP, SDPP., and PSPP at a hearing on 19 September 2023 at the Court of King’s Bench. Justice Lema’s conclusions were unequivocal.

[125] AIMCo is only and always a Crown agent.

[126] When it contracted with the Funds in the IMAs, it did so as agent on behalf of Alberta.

[127] As a result, Alberta is a party to those contracts, as AIMCo’s principal.

[128] The Funds’ arbitration notices tagging both AIMCo and Alberta were on target.

[129] The arbitration shall proceed with the Funds, AIMCo, and Alberta as necessary and proper parties.

[130] The Funds are entitled to costs of the application on a scale and at a quantum to be decided by me after receiving the Funds’ costs submissions (maximum 3 pages excluding any attachments e.g. draft bills of costs), due by October 27, 2023 and Alberta’s (same rules), due by November 10, 2023.

In essence, the ruling means that the Government of Alberta could be on the book for up to $1.33-billion in losses incurred in the VOLTs investment strategy. The 23-page ruling was a model of clarity relying on the very definitive intention of the legislation. The Alberta Investment Corporation Act created AIMCo to “provide investment management services in accordance with this Act and the regulations.” Section 3(1) of that Act states that “The Corporation is for all purposes an agent of the Crown in right of Alberta and may exercise its powers and perform its duties and functions only as an agent of the Crown in right of Alberta.”

Mr. Justice Michael Lema also cited a range of Crown corporations, both federal and provincial, where the scope of Crown agent status was specifically limited (paras. 107-112). However, AIMCo’s agent status was not limited meaning AIMCo was contracting with its clients as an agent for the Crown. When AIMCo is sued or an arbitration award sought, the government of Alberta, as the principal or creator of the agency status, is automatically a party to the arbitration or lawsuit.

Presumably it was the idea of the province to distant its involvement in the arbitration which the arbitrator chooses to accept. This action has taken two years to get to the point of going back to the arbitration process and taking testimony from the various AIMCo and pension fund administrators to render a conclusion. Doubtless Nate Horner, his predecessor Travis Toews and staff at Treasury Board and Finance are pleased that the reckoning is coming later.

Implications

First, the deep pockets at the Alberta government are now available for the pension funds to recoup their losses from the ill-fated VOLTs strategy. Second, at issue in the arbitration is the matter of did the pension plans’ administrators know and their boards anything about the VOLTs strategy. If they did and accept the risk, then it is a slam dunk AIMCo and the province are off the hook.

Second, AIMCo uses pooled funds to meet the investment strategy of each of their many clients (AIMCo has 38 clients including the [5] public sector pension plans, [3] endowment funds, the Heritage Fund, the WCB, and government short term investments.) AIMCo apportions clients to units in the pool which receive the blended returns of the various securities’ investments. The clients do not know details of the actual investments and within each portfolio (Canadian equities) are managed in a variety of ways such as “Systematic, Alpha, and Fundamental Active strategies. Externally managed investments include Long-only Equity and Hedge Fund strategies and are employed in areas where internal management does not offer a competitive or cost advantage.” Reading between the lines, from the viewpoint of the client these structures are fundamentally opaque and ultimately depend on the trust of clients.

Third, since AIMCo came into existence there has long been unhappiness among the pension funds about AIMCo’s returns and their poor customer management displayed by AIMCo. This was supposed to change under Kevin Uebelein. However, by 2017-18, the funds wanted an option to opt out of AIMCo’s services. With a sympathetic NDP government at the end of their mandate, the pension funds were given the ability after five years to give notice and seek management services elsewhere. This was quickly reversed under Toews’ first budget, giving AIMCo a huge victory and undermining further any goodwill existing between the pension plans and AIMCo.

Fourth, there may be further information available about this “contingent liability” in June 2024 when the provincial government’s financial statements are available. In the footnotes there may well be disclosure under contingent liabilities but it has not been specifically identified. It is interesting though that in 2022-23, the government authorized Alberta Investment Management Corporation (AIMCo) to acquire a revolving credit facility with CIBC to access up to a maximum of $2 billion in cash. The facility however is not to be available to pay out the $1.3-billion potential claim but its designed to provide AIMCo’s “pools with necessary liquidity.” The amount outstanding of the guaranteed line of credit was $377 million at March 31, 2023.

None of the about features of this saga reflect favourably on AIMCo or the provincial government.