Budget Speech delivered on Tuesday 28 February 2023, Legislative Assembly of Alberta

Mr. Speaker,

I count it a tremendous honour to rise in the House today to present Budget 2023 – the fifth I have presented on behalf of Albertans.

In the fall of 2019, I put forward a four-year plan to bring the province back to fiscal responsibility and a balanced budget.

In some respects, these past four years have felt like a century – in part, due to the extraordinary global challenges we faced but also because of how far we’ve come.

When, as a government, we took office in 2019, Alberta had an economy that was flat-lined, and we were spending $10 billion more than comparable provinces on services, without better outcomes.

Our plan to strengthen Alberta’s economic foundation was two-fold:

First, to bring discipline to Alberta’s spending. We could no longer afford to be the spending outlier among Canadian provinces.

And then, we were determined to position our province for competitiveness, leading to exceptional investment attraction, economic growth, diversification and job creation thereby ensuring an increase in fiscal capacity and provincial revenues.

| The above paragraph is an excellent summary and insight into the accepted wisdom of Alberta conservative politicians on the role of the state. Government business is all about the economy- keywords being competitiveness, investment, growth, diversification and job creation. This fiscal philosophy suborns the inner workings of government to the economy. This philosophy is not about what services government provides and the quality of the services to support people as citizens. Rather the function of government is to provide a hospitable environment for business and represents the triumph of a colonial attitude towards economic development. A caveat is needed- to be re-elected, governments must also worry about services, particularly in a run-up to an election. |

These goals were, to put it mildly, ambitious.

To achieve them, we committed to three fiscal anchors that informed our decision-making.

The first anchor was the commitment to keep Alberta’s debt-to-GDP ratio below 30 per cent. This would ensure that debt and debt repayment wouldn’t strangle our economic growth.

Second, it was imperative that we would get our spending in line with comparator provinces.

And the third anchor, when there was economic clarity, to chart a path to a balanced budget.

As we implemented our ambitious Economic Recovery Plan, the impact on Albertans was almost immediate.

Our Red Tape Reduction initiative has saved Albertans $2.1 billion.

| There is no evidence in the Fiscal Plan how this number was arrived at. Presumably this number is taken from the UCP-friendly Canadian Federation of Independent Business. From 2022-232 to fiscal 2023-24 the full-time equivalent staff in Service Alberta and Red Tape Reduction is growing from 959 to 1077. More recently the government in announcing legislation concerning firearms is reported to be increasing the numbers of officials administering the program from 30 to 70. |

We established the Alberta Indigenous Opportunities Corporation with $1 billion dollars of capital so Indigenous communities can be full partners in the Alberta Advantage.

Our government invested in strategic infrastructure projects that were essential for future growth while getting Albertans back to work when they needed it most.

By July 2020, we had cut Alberta’s corporate tax rate from 12 to 8 per cent.

| See my chapter in the forthcoming volume in Anger and Angst Jason Kenney’s Legacy and Alberta’s Right as well as Ian Hussey’s report from Parkland entitled “Job Creation or Job Loss? Big Companies Use Tax Cut to Automate Away Jobs in the Oil Sands.” |

We recapitalized Alberta Enterprise Corporation, adding $175 million to support investment into Alberta start-ups.

We established Invest Alberta Corporation to sell the province’s incredible value proposition to the world.

| Support for out-of-province investors. A continuation of elephant hunting and servility to outside capital. A classic example I can speak to was the tendency at ATB Financial when I was an employee of looking south and east for expertise. In particular, the ill-fated Synergy project, giants SAP, IBM, Accenture were responsible for a project that apparently was beyond the keen of people in the province and the employees. A sad example of the classic colonial mentality. |

And, on February 23, 2022, I was able to stand in this House and present Alberta’s first balanced budget in a decade.

That brings us to today.

Today, Alberta is leading the nation in economic growth.

High commodity prices are expected to continue supporting Alberta’s GDP growth in 2023. The agricultural sector looks favourable in 2023, following a recovery from the drought in 2021. The biggest concerns for Albertan farmers involve uncertainty about demand concerns and input price uncertainty. The province’s GDP is forecast to be 2.1 per cent in 2023, before accelerating to 2.8 per cent in 2024.”

| The Conference Board of Canada news release 28 February 2023. https://www.conferenceboard.ca/press/canadian-provinces-poised-for-slow-economic-activity/ |

Today, with a rapidly diversifying economy, there are career opportunities that didn’t exist even a few years ago.

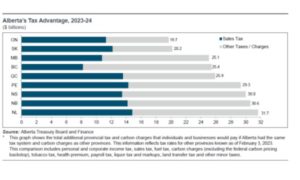

Today, Albertans pay $20 billion less in taxes than they would if they lived in the next lowest-taxed province.

|

Minister Toews again is floating the trial balloon about a revenue review along the lines of the MacKinnon report. $20-billion is nearly equivalent to the health department’s budget. $09-billion is also equivalent to the difference between 2021-22 non-renewable resource revenue (NRRR) and 2022-23 NRRR. This number also represents the fiscal illusion that is created by NRRR paying a large portion of operating and capital expenses. Current fiscal policy since the early 2000s have been premised on the Alberta Tax Advantage – that famous table which compares what an Albertan taxpayer would pay in taxes (tobacco, sales, income tax, etc.) if Alberta followed the rates used in the other nine provinces. This revenue raising capacity is truly formidable and figures in the credit ratings of the province. And yet, premiers of this province do not wish to hear the word uttered near them (see Graham Thomson’s chapter in A Sales Tax for Alberta- Why and How?) While about one-half of Alberta’s tax advantage is because we have no sales tax, there is still a huge amount of room in the sphere of other taxes. Remember what former Premier Stelmach (a former member of the Deep Six PC caucus) said about taxes? I paraphrase- the easier thing for a politician to do is raise taxes.’ Actually, raising taxes is the hardest thing to do for any politician let alone Alberta politicians. Since Alberta’s economy is still an export-staples economy, when oil prices are high, the best thing to do to control the ugly froth of a boom economy is to raise taxes., not use booms as occasions to spend more and lower taxes. We do have a volatile revenue structure in this province and at some point, some day, Albertans are going to have to consider what we need to do to correct that,” Toews said in his speech. Toews more than perhaps all his predecessors know what revenue volatility is – he has presided over both vast surpluses and huge deficits principally caused by the rise in oil prices. He is aware of the treasury’s dependence on the Big Four and all that goes with a failure to diversify revenues. Albertans like to complain a lot about being forced to sell into only one market. This unfortunate chain of events has much to do both with foreign capital- which the minister is welcoming with open arms, and free trade with the Americans that perpetuated Canada and Alberta’s dependence on the U.S. market. |

Today, after some very difficult years, the opportunities for small businesses and entrepreneurs are exploding.

And, today, I again present a balanced budget.

This means debt is on the decline.

In this last fiscal year Mr. Speaker, we paid off over $13 billion of debt, all of the debt that matured in 2022.

This means lower debt service costs and more resources available for health, education, and other programs.

It means more available fiscal room, and thereby more runway and capacity should we experience another economic shock.

Mr. Speaker, we are far below our net debt-to-GDP ratio ceiling of 30 per cent. Today, Alberta’s at 10 per cent – the lowest in all of Canada.

And, because of our strong balance sheet, Alberta has received its second credit upgrade of the year, remarkable when we consider that our last credit rating increase was back in 2001.

| Fitch and Moody’s raised Alberta’s credit rating earlier this year. |

Investment attraction is essential to Alberta’s strong economic growth and job numbers.

In my business experience, a government will either help or hinder progress, get in the way or get out of the way. It’s an attitude, Mr. Speaker, and it matters to investors. (emphasis added)

|

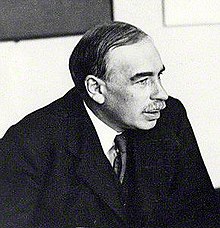

I am not sure that Mr. Toews truly understands Wall or Bay Street where the big money is sought. For the most part, these investment bankers are risk managers AND deal makers. Pooling smaller amounts of capital is Alberta in small boutiques are of the type that Brett Wilson, Adam Waterous, the late George Gosbee, and Mac van Wielengen represent. But Wall Street and Bay Street have many options where to place their short and long-term money. It is truly worrisome for the minister of finance of the third largest provincial economy to be praising “help or hinder”- a divisive, belligerent expression that speaks to power relations and not economic common sense. This is the type of laisse-faire faith which was preached over 150 years in British school classrooms which Keynes spoke so clinically of. In Keynes Essays in Persuasion, he devotes his attention to the evolution of the doctrine of laisse-faire tracing it into educational curriculum. Of note is this passage about the role of government… It is not, indeed, until we come to the later works of Bentham -who was not an economist= that all that we discover the role of laissez-faire in the shape in which are grandfather’s knew it, adopted it into the service of the utilitarian philosophy. For example, in A manual of Political Economy, he writes “The general rule is that nothing ought to be done or attempted by government: the model or watchword of government, on these occasions, ought to Be quiet … The request which agriculture, manufacturers, and commerce present to governments is as modest and reasonable as that which Diogenes made to Alexander: ‘Stand out of my sunshine.’”  John Maynard Keynes, Essays in Persuasion, Macmillan, 1984, p. 279. Mr. Toews’ budget is not however about the government getting out of the sun. This budget continues a legacy of governments catering to the needs of business and citizens. Catering to business is in the form of grants, subsidies, low taxes and royalty holidays. Unlike Mr. Toews’ bravado, many Alberta businesses prefer the long shadow of government involvement, whether it be the form of less than competent regulators or politicians who speak on their behalf. Mr. Toews continues the old script of seeking capital which is predominantly foreign and from oligopolistic sectors such as oilsands production, petrochemicals, and logistics (Amazon). These sectors offer good short-term construction jobs followed by ongoing capital maintenance and few permanent jobs- in comparison to construction employment. With some exceptions- the oilsands with headquarters in Calgary- there are few or no senior management moved to Alberta. In the 2023 extension of colonialism the province receives about 10 per cent of revenue as owners of oil and gas and bitumen reserves which completely overloads the budgetary situation- as Mr. Toews knows full well. But continuing colonialism- whether it be to Toronto Ottawa, New York or Houston is the choice ministers of finance- spend when moneys available- especially before elections, cut spending when our ability to borrow is curtailed, keep taxes low, and put money aside if surpluses become embarrassing. For employment development use foreign sources. And what do we have as a result? Do we develop or keep the technological licenses, the design work, product development, and the majority the income from this? The capacity to fully exploit the full range of fossil fuels? Which successful and surviving enterprise does Alberta have after 75 years since Leduc? Four Calgary headquartered, foreign owned oilsands producers accounting for about 2 to 3 percent of global oil production. This is not to recognize that there are a few semi-international success stories- Stantec, PCL Construction (owned by employees), maybe Precision Drilling with market capitalizations of two or three billion dollars. And then there is Shaw to be swallowed by Toronto’s Rogers and TELUS privatized by the provincial government (full disclosure- I was involved) which now calls Vancouver B.C. its headquarters. |

The problem with niceties about governments getting in the way is the long economic history of government underwriting, owning, guaranteeing, or taking over national building projects which include CN Rail, CP Rail, Alberta Gas Trunkline and TransCanada Pipeline (now TC Energy), Alberta Energy Company (now Ovintiv) Air Canada. It is not until governments back investment in this country and province that domestic and foreign investors willing to invest their own money for infrastructure development want governments to be on the hook. Today we also

Throughout Canada’s history, we find huge projects invariably to extract and ship staples to the where people live unfinanceable without government support. It is this naivete which is so tragic. Mr. Toews believes the more his government panders to investors, the more the Alberta state and Albertans will benefit.

Lest us not forget that Canada’s and Alberta’s two major pipeline companies Enbridge and TC Energy are now dominant North American pipelines enterprises which, while more favoured by Canadian institutional investors than oilsands producers, grew from government beginnings. These were nation-building projects.

TransCanada Pipelines was sponsored by the federal government and NOVA the predecessor to TransCanada- now TC Energy (to make it more appealing for American institutions) which the Alberta Gas Trunkline, an early success among Alberta retail investors (similar to TELUS issue in 1989). 46 per cent of TC’s shares are held by U.S. and Canadian mutual fund complexes. And Enbridge’s corporate origins, according to the company, started with an Act of the federal government.

Not only we these projects “nation-building” there were continental in scope: “Through the years, we’ve (Enbridge) continued to open new markets for Canadian crude, and played a critical role in developing North American energy infrastructure. Thus Enbridge served two masters the early oil explorers and the U.S> consumer market including military , consumer and industrial users.

Source: CN Rail

Four years ago, we put up the “Open for Business” sign, and we followed it up with real actions, not just words.

We’ve reduced business taxes, cut red tape, and created one of the most business-friendly environments on the continent. The results speak for themselves.

In a year when venture capital investment dropped in Ontario, Quebec, and BC, we in Alberta, at $729 million, set another record.

Businesses across sectors and across the province are creating thousands of new jobs while diversifying Alberta’s economy.

Just days ago, Applexus Technologies announced they were moving their Canadian headquarters to Calgary, creating 125 tech jobs.

Southland Trailer Corp., in Lethbridge, will double its production creating 250 new jobs.

De Havilland Canada is moving its head office to Alberta, and it’s building an aerospace centre and manufacturing plant that will employ 1,500 people.

Canadian Gypsum Company is building a $210 million wallboard manufacturing plant in Wheatland County.

And Garmin Canada has announced expansion plans for their Cochrane head office that will double their workforce over the next two years.

We have:

Imperial Oil investing $720 million in the Heartland for a bio-diesel refinery.

Drilling activity in the oil and gas sector ramped up to an 8-year high last year and investment is expected to grow by a further 19 per cent in 2023.

IBM is opening its Client Innovation Centre for Western Canada in Calgary.

Sidetrade is investing $24 million to make Calgary its North American headquarters.

Air Products is building a net zero hydrogen complex in the Industrial Heartland.

Amazon, Walmart, Canadian Pacific, Infosys, Mphasis, HBO, Northern Petrochemical, RBC, CN Rail, Ernst & Young

… I could go on.

|

Mr. Toews collection of investments comes from Government of Alberta news releases directly connecting the UCP government to the investment. This would lead one to believe that these achievements were the result of the partisan politician’s individual intercession with these organizations. In the world of rural Alberta this may make sense that your MLA is doing this job for you. This ignores the hard work of departmental bureaucrats whose jobs are to attract investments with government programs, incentives, or various ploys to ensure they operate within the corners of various trade agreements. Errata- in spite of a splashy announcement of the Northern Petrochemical Corporation in November 2021, the corporation’s website is still “under development.” This project is especially important to Toews as it is slated to be built in the Grande Prairie area. Announcements do not create jobs as we know. Regrettably the IBMs, Amazons, Googles, Air Products, Imperial Oils, Infosys, RBCs, and Walmart of the world owe no allegiance to this province. We have seen this phenomenon with Google reassigning staff from their DeepMind group in Edmonton to other places in North America. Once financial markets tighten, the periphery is the first to lose their jobs, not the CEO’s assistant. |

There’s not enough time this afternoon to detail every good news investment story in Alberta’s economy.

But, Mr. Speaker, I want to be crystal clear here – and it’s important that our colleagues across the floor hear this – governments do not create wealth. They create the conditions favourable for investment attraction and wealth creation.

And over the last four years, this government was relentless in its focus to make Alberta the best place to do business in North America (emphasis added)

And Mr. Speaker, behind the long list of good news stories, the best part of the story is what this means for Albertans – on the ground, everyday.

92,000 jobs were created in 2022, and over 20,000 in January of this year. In fact, almost a quarter of all jobs created in the nation in 2022 were right here in Alberta.

And these jobs are paying Albertans more.

Workers in our province make more than in any other province. Since January 2019, the amount Albertans earn per week has gone up by 12 percent and we expect these earnings to keep growing.

Further to that, thanks to the lowest taxes in Canada, Albertans keep more of their hard-earned money in their pockets.

Mr. Speaker, Canadians from other provinces and those new to Canada are taking note of Alberta’s growing economy, our lower cost of living and the abundant opportunities we offer.

Like the story of Nick and Jessica, two young professionals, one from Edmonton, one from Vancouver, debating where they’re going to start life together.

| In last year’s budget edition, the focus was on Larry the Welder an unemployed welder who had been suffering for too long. This year we have Nick and Jessica “two young professionals.” This signals a more sophisticated political sensibility – the UCP must realize they own Larry the Welder- the election challenge is to appeal to others, including newcomers with the song of promise and opportunity, key sales pitches of the province, including low taxes. Battleground Calgary. |

When Jessica recently visited Edmonton for the first time, she was surprised by its natural beauty, but what tipped the scales? It was… the high wages, affordability and the cost of housing. “Edmonton is cold,” Jessica said, “but I can buy a coat”.

It’s not surprising then, that Alberta is leading the nation in population growth and more Canadians are moving to Alberta than to any other province.

Our growing population means good news for Alberta’s labour market. Opportunities in every sector from finance to film, energy to agriculture mean we need a skilled workforce to keep up with the labour demands in the province.

Budget 2022 committed $170 million intended to create 7,000 training spaces for jobs in high demand.

I want to commend our Minister of Advanced Education for his work in this area Mr. Speaker, because he took funding for 7,000 spaces and worked with our post secondary institutions to create 10,000. 10,000 additional learning spaces for high demand occupations and professions across sectors and across this province.

Now, while Alberta’s economy strengthens, we cannot afford to become complacent.

We continue to face economic headwinds.

Fueled by supply chain constraints, global unrest and our federal government’s irresponsible fiscal policy, inflation is making life more costly for all Albertans – at home, in business, and in government.

At the same time, despite record breaking investment in Alberta, we continue to see declining business investment nationally.

Since 2015, Canadian real GDP has grown by 13 per cent, but this growth has been driven entirely by government and consumer spending and residential investment. Much of this growth has been funded by debt and it has masked the stagnant state of Canadian business investment.

Alarmingly, between 2015 and 2019, business investment in Canada actually declined.

One of the impediments to business investment is Canada’s growing reputation as a nation where it’s difficult, if not impossible, to get large projects completed.

Global investors have taken note of the many projects killed by the Trudeau government – Northern Gateway in 2016, Energy East in 2017, the Teck Frontier mine in 2020 and at least 15 LNG projects (emphasis added).

In fact, since the federal impact assessment legislation, Bill C69, was passed in 2018, there has not been one project subject to the act approved in all of Canada.

Not only has Canada lost out on billions of dollars of investment that would have created more jobs, better paying jobs, and greater financial stability for Canadians, we have turned our back on a world that desperately needs what we offer, including responsibly produced energy.

If Canada fails to maximize responsible energy production, we’re not only failing Canadians, we’re contributing to massive hardship for the world’s most vulnerable.

Canadian energy will help those living on the margins heat their homes. It will make fertilizer more affordable and boost agricultural output.

It will improve air quality by displacing dirtier fuels. But it can do none of these things if it is left in the ground.

If Canada abdicates production, it simply moves to countries that give no credence to ESG concerns with despotic leaders who use the energy wealth for destructive purposes. And it leads to increased emissions and pollution as more coal is used in electricity generation (emphasis added).

In fact, Mr. Speaker, if Canada is serious about reducing GHG emissions, the best thing we can do is export clean burning Canadian LNG.

An energy-rich democracy like Canada that continues to hamstring its world class, responsible energy production with carbon taxes, emissions caps, and a regulatory quagmire at a time of global shortage is irrational and grossly irresponsible.

Canada not only has an opportunity, we have a deep responsibility to prove ourselves a reliable trading partner and ally, and deliver responsibly produced energy.

| The economic and investment consequences of, and partisan public spanking of the federal government, are hard to know at this point. At this moment, an imagined energy crisis has been created to regain economic momentum which continues to tie Alberta’s fiscal ship with an energy industry with one of the highest emissions contents and lack-lustre environmental stewardship by both the industry and the government. |

Mr. Speaker, as we reflect on our journey as a province over the past four years and as we recognize both the significant triumphs and the challenges we’re experiencing today, the question becomes “Where do we go from here”?

How do we maintain a strong balance sheet and positive economic trajectory? What can we do today to secure Alberta’s future for tomorrow?

First, Mr. Speaker, I am appealing to the rest of Canada to follow Alberta’s lead to make business competitiveness a key priority.

Securing a prosperous future for the next generation depends on it.

We need to be a nation that, once again, can get big, visionary projects completed. We need to be a nation that values the welfare of Canadians above the ideologies of the elite.

In the 1980s and 90s, there was a saying going around the province, “Please Lord, give us one more oil boom. I promise not to squander it this time.”

Remaining disciplined and responsible is most difficult during years of plenty. I expect most, if not all, of us in the House today would agree that whether in businesses or in our households, the tendency to unsustainably increase spending as revenues rise is almost inevitable.

In this province, with an economy heavily influenced by commodities and our volatile revenue structure, it has been our story all too often.

The second key then, Mr. Speaker, is to maintain responsible fiscal management into the future through a framework, a series of well-calibrated fiscal rules and guardrails.

We are introducing legislation which will require a balanced budget.

We’ll limit year-over-year operating expense growth to population and inflation, ensuring appropriate and disciplined spending growth in easy and difficult times.

We’ll implement a fiscal framework for surplus allocation to ensure that Heritage Fund earnings are retained in the Fund and debt repayment is given first priority.

Mr. Speaker, had we, from day one, invested the earnings back into the Heritage Savings Trust Fund, without any additional deposits other than what we have made to date, instead of the $18 billion we have in the fund today, the fund would be approaching $300 billion.

A fund of this size would earn Albertans close to $20 billion a year in investment income, and while we all wish we started reinvestment earlier, the best day to start is today.

And speaking of today, to make up for lost time, we will immediately invest an additional $2 billion into the Heritage Fund from the surplus of the last two years.

All of these measures, together, provide fiscal stability, enabling low taxes, and will ensure that business investment continues to be preferential to Alberta.

And it means future generations will not be encumbered with a debt they did not incur.

Mr. Speaker, Budget 2023 is about the future.

It’s about doing more of what has worked these past four years, more to champion Alberta’s incredible value proposition around the world, more to attract investment, more to ensure Albertans have the services they need, and more to give a hand up to the vulnerable among us.

To further position Alberta’s economy for investment attraction, we are introducing a non-refundable tax credit for agriculture-processing and manufacturing investment.

This carefully calibrated incentive will build on our broad-based value proposition and ensure we’re able to compete with neighboring jurisdictions growing our value-added agriculture sector.

As the largest hydrogen producer in Canada, we are building for the future with the Alberta Petro Chemical Incentive Program, as we do the regulatory work, assign carbon hubs, and work with industry to advance logistics in our commitment to position this emerging sector for growth.

And we’re ensuring that future generations of Indigenous Albertans are partners in prosperity with a 50 per cent increase allocated to the Aboriginal Business Investment Fund.

According to the Canadian Federation of Independent Business, there are 100,000 unfilled employment positions in Alberta today.

| This is the UCP’s favourite go-to business organization whose values correspond to the business friendly, red-tape reducers. Reducers who are now asking “independent” universities to report on free speech on their campuses. How many dollars will be taken away from the universities’ mission to pay for this abomination of the nanny state the UCP deplores. Or is it that the ideas of UCPers are not getting a fair deal in the academy? And yes, the primary role of the university is not an education but to supply corporate cut-outs to fill the 100,000 jobs Mr. Toews is advertising. See more specifics in speech below.. |

A skilled workforce is crucial to meet the needs of a growing and diverse economy and, as such, broad and diverse training opportunities are needed, not only to ensure key capacity for employers but to ensure more Albertans are invited into the Alberta Advantage.

In addition to the 10,000 post-secondary seats created last year, Budget 2023 is allocating $111 million to expand seats in construction, tech, business, and energy; and another $11 million for aviation training with the new Bachelor of Aviation program.

Over $180 million is earmarked for upgrading or expanding facilities around the province, including a new School of Business building at MacEwan University and a Power Engineering and Instrumentation lab at Northwestern Polytechnic.

Budget 2023 secures our future with an additional $580 million for transportation projects around the province with a focus on projects that improve productivity and competitiveness.

Mr. Speaker, in Alberta, we, like every other province, are experiencing a serious challenge in health care capacity.

This challenge is less about bricks and mortar, but instead a lack of front-line health care professionals.

The new Health Workforce Strategy provides $158 million to support multiple initiatives to recruit and retain health care workers, including the targeted recruitment of internationally trained nurses.

This budget provides funding to increase the number of seats available in health care professions, including 1,800 new seats for health care aides, licensed practical nurses, and registered nurses over the next three years, and an additional 120 seats to train more physicians at our schools of medicine, a 50 per cent increase in physician training capacity.

Budget 2023 provides $2 billion over three years to fund the Health Care Action Plan with investments to strengthen the EMS system, reduce surgical and ER wait times, enhance and update Alberta’s primary health care network, and empower frontline workers to provide improved services to Albertans.

Although Alberta has the youngest population in Canada, it is estimated that the demand for long term care beds could double in the next 25 years. We are investing more than $1 billion dollars over the next ten years to ensure that our loved ones, the ones on whose shoulders we stand, will receive the care they need in their later years.

Mr. Speaker, affordability and the high cost of living due to inflation has been a source of hardship for many Albertans.

The Affordability Action Plan provides over $3.0 billion in relief measures that will help all Albertans.

The fuel tax suspension program is saving Albertans and Alberta businesses real dollars every time they fuel up, and gives Albertans an enduring affordability advantage as we benefit from an owned resource.

Electricity rebates are providing almost 2 million Alberta homes and businesses with relief on the high cost of electricity.

And targeted affordability payments will support families, seniors, and our most vulnerable.

Under this Action Plan, the student loan interest rate will be reduced and the no-interest, no-payment grace period will be extended to one year after graduation.

Mr. Speaker, with so many families recognizing Alberta’s incredible value proposition and choosing Alberta, additional resources are required for our K-12 education system.

Budget 2023 provides $820 million to ensure schools are well prepared to welcome new students and includes additional targeted funding to provide for the increasingly complex needs of our youth.

And, Mr. Speaker, with all these new students we need more schools.

Budget 2023 provides new capital for 58 schools for planning, design, upgrading, and construction.

Budget 2023 increases funding for school bus transportation, offsetting rising costs, supporting school choice, and providing a ride for an additional 80,000 students with a new family friendly distance eligibility.

Mr. Speaker, living a life free from the effects of crime should be the expectation of every Albertan. Sadly, this is not the case for some.

Budget 2023 includes a significant investment into justice and public safety with funding to include more crown prosecutors and support staff to address the backlog, increase capacity, and modernize our courts

Funding is provided for increased law enforcement: more boots on the ground to better fight crime in our communities, both urban and rural (emphasis added).

Budget 2023 is also providing $65 million over three years to strengthen First Nations policing. This will fund a new First Nation police service for Siksika and additional officers across the province.

Mr. Speaker, part of investment attraction means making sure we have the infrastructure and systems to meet the demands of growth.

With tens of thousands of Canadians making Alberta home, the volume at Land Titles has been unprecedented.

To all the realtors, developers, and lawyers out there, we’ve heard you.

| This is whom the UCP and Mr. Toews generally listen to and are large contributors to the UCP party’s coffers |

Service Alberta will again receive increased funding to clear up the backlog at Land Titles and, more importantly, to finally modernize the system.

And speaking of critical infrastructure, keeping communities connected with a road network that supports jobs, and ensures the safe and efficient flow of industrial, commercial, and passenger traffic is essential.

Mr. Speaker, Thomas Jefferson once wrote, “The measure of society is how it treats the weakest members”.

| Fine but why is this buried in the bottom of the speech. The doctrine of Toews & Co, is energy, investment, hard work, doing what Alberta governments have been doing for decades with the faulty correlation that high wages and investment is equivalent to the good life. The following recitation by the minister is a modest apology for four years of ignoring mental health issues, punishing addicts and pushing a tough on crime agenda and provincial pension plans while women’s shelters are forced to scrounge for donations. |

I believe that the budget I’m presenting today reflects the true measure of Albertans with care – across the province, across ministries – for the most vulnerable and those who need a hand up.

Budget 2023 provides for three new addiction recovery communities.

| The emphasis on addiction recovery is consistent with Toews’ conservative, evangelical values – moderation, public order, and stigmatization- base values of most of the UCP caucus. The science of addiction and evidence-based policy is sublimated in a sea of perdition for the offenders. |

$117 million will expand mental health services for youth across the province.

And in Children’s Services, $4 million dollars in new adoption supports will make it easier for a child who needs a home to become part of a family.

Now, Mr. Speaker, government initiatives and funding are essential in the care of vulnerable Albertans. They are so important.

But the measure of our society goes so far beyond government programs.

This province was built by people who didn’t wait for government. They saw a need in their family or their community and they stepped out to meet that need.

The future of Alberta will, in some measure, be contingent upon our ability to preserve and foster the character trait of self-determination, even in our compassion.

There are examples every day, from every corner of our province. People like:

Matthew Potts, from Samson Cree Nation, who opened up his restaurant’s kitchen to Ukrainian newcomers.

Like those from an Edmonton youth group who prepared a traditional Lebanese meal and care package for members of Edmonton’s homeless community.

People like Tylyn Hollingshead from my constituency in Sexsmith, who raised over $24,000 for the Stollery Children’s Hospital.

And 11-year-old Kennedy Bruno, who started her own t-shirt design business and donated proceeds to the Ermineskin Women’s Shelter.

There are thousands of stories like these across our province, and it’s stories like these that fill me with such hope for the future.

Albertans are generous, compassionate, and intentional. And just like economic investment, when it comes to generosity, government can be a help or a hindrance for Albertans as they work together to meet the needs in their communities.

A good job is more than just paying the bills, having the freedom to invest in the future, raise a family, or build a business. It creates conditions favourable for people and families to thrive so they can lend that helping hand to their neighbour, to newcomers, or to those in their community who are less fortunate.

I would like to thank the MLA for Peace River who brought forward Bill 202, reflected in this budget, which increases the value of the Charitable Donations Tax Credit. This is a substantial investment in supporting the generosity of Albertans.

Mr. Speaker, in three months, Albertans will have a decision to make regarding the next government.

As a province, we have the benefit of contrasting two very different approaches to governance and the economy; not theoretical or hypothetical conjecture, but the actual results of two contrasting economic strategies.

Mr. Speaker, I want to be clear. I believe that almost every MLA comes to this House with the intention of making life better for Albertans, regardless of which side of the aisle they sit.

But, we have to be honest with ourselves and the people we were elected to serve.

The Opposition’s economic management model of raising taxes, increasing regulatory burden, high operational spending, and working to expedite the energy transition in conjunction with the federal government was nothing short of disastrous.

It resulted in the flight of billions of dollars in capital, tens of thousands of lost jobs, and perpetual deficits.

| A reminder about the upcoming election |

Our government brought a different approach.

Sound fiscal management coupled with tax reductions and reduced regulatory burden has positioned Alberta to lead the nation in economic growth, with a surplus budget, less debt, more and better jobs and, from my perspective, a whole lot of hope.

Mr. Speaker, 61 years ago my parents came west to Alberta with nothing more than a dream, a big work ethic, and a deep sense of self determination, a story shared by so many others in this province.

They worked hard, sacrificed much, and built a home and a life for their family in a place where opportunities abound, and in a province where family, faith, and community are held in high regard. We, the next generation, are privileged to build on that solid foundation and are now working to secure a similar future for those that will follow.

Mr. Speaker, four years ago I sought public office for one reason – to fight for an Alberta that can offer the next generation of Albertans the same opportunities, prosperity, and freedom this province has afforded me and my family (emphasis added).

The same opportunities for our children and grandchildren, for people like Nick and Jessica, and for those that don’t yet call this land their home. The same opportunities for all Albertans.

| Past treasurers and finance ministers typically insert some element of their personality, their humanness. This is a telling passage with the words-opportunities, prosperity, and freedom- nicely summing up his personal philosophy and that of his political party. Fair enough. More telling are the words- family, faith, and community- a personal testament to his family, faith, and community. No messy worries about other faiths, families, communities, and the environment- our straight-shooting finance minister may retire happily- balanced budget as promised and hope for the future. |

We’ve faced some real challenges these last few years but, like those that came before, Albertans have dug in, worked hard, made incredible progress and I couldn’t be more optimistic and hopeful about the future of this province.

In fact, Mr. Speaker, I believe Alberta’s best days are ahead.

The Economic Consequences of Mr. Toews

Mr. Toews’ 2023 budget speech is a departure from earlier speeches of restraint and sacrifice. Alberta’s prosperity has returned. The hard effort of “opening Alberta for business” has finally paid off. Alberta is punching about its weight again.

Amidst the modest swagger, the predictable remonstrances of the Trudeau government, and horrors of the Notley years, there are the predictable patterns of the past. To be clear, the economic consequences of Mr. Toews are the economic consequences of a alternatively “rich” and “impoverished” provincial state. Over Alberta’s 117-year history, the province has depended entirely on “foreign investors” to either finance the state’s deficits or its single commodity production.

Each time the cycle went against the province, the government was fiscally embarrassed – depression, the lost decade of the 1980s, and the 2014-2021 period where default, heavy borrowing in Montreal, London, New York and Toronto got the province through cyclical troughs. This is why finance ministers and premiers of all Canadian provinces head to Toronto and New York to ensure their audience that their investments are in “safe hands.”

These periods, also coincidentally are associated with conflict with the federal government- in the depression – over banks’ capacity to foreclose and the province’s inability to do anything given Alberta’s single commodity economy. But during Manning’s years it was back to normal with the debt restructuring act, the road paving scandal at Treasury Branches, and diminishing fiscal room as the commodity cycle turned. Fortunately for Lougheed, OPEC governments, not businessmen, created sheikdoms in Alberta. But this episode was imperiled by the federal government’s efforts to take some of the resource rent. Unlike the Great Depression this was settled with champagne and minimal legal expenses.

Again the commodity cycle shifted and once again the “give me another…” seemed to chasten Albertans during the 1980s and the 1990s. Caution and cutbacks eventually seemed to satisfy the gods of commodity prices and again Alberta was the place to be. Fiscal rules were implemented but gradually loosened as more foreign and bank capital poured into Alberta with the oilsands boom, an unparalleled success in economic terms. Alas the boom was pis—d away with rising deaths on Highway 63, rising drug use and other social costs of the dark side of prosperity.

Suddenly the financial backstops of the Debt Retirement Account and Stabilization fund were gone as the Alberta state kept on growing in response to prosperity- the Doug Horner-Alison interlude. And then we saw the cycle repeat. As Marx said- “History repeats itself, first as tragedy, second as farce.” The tragedy- the financial baggage delivered to the NDP after 44 years of Tory prosperity- vanished with the falling prices of natural gas (fracking) and oil. After four years of a Don Getty like government, Albertans turned to a Ralph Klein look-alike with particular animus towards his former home- Ottawa. Then Danielle Smith – what comes after farce, I wonder?

The economic consequences of Mr. Toews and his predecessors is a clairvoyant misunderstanding of economic and political history, an inferiority complex which arises when others are to blame, a failure to understand the pain of colonialism, and a misunderstanding of what is important- people not things.

Related Posts