In the wake of the “energy settlement” of August 1981 when Trudeau and Lougheed toasted champagne, economists at Alberta Treasury’s Budget Planning and Economics group were refreshing their economic forecasts. In the Economic Outlook reproduced below, attention focused on the anticipated mega-projects expected to drive Alberta’s economy in the medium term. The Outlook reinforces the notion of Alberta as a single-commodity based economy relying on the construction and engineering sectors to drive economic growth and employment.

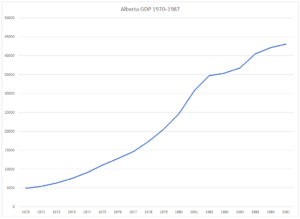

As the Chart shows, things did not turn out quite what the analysts have thought they would based on econometric models based upon assumptions about the trajectory of various mega-projects. Very shortly after the projection, an inflection point was reached in 1982 with economic growth decelerating through to 1984 and growth almost flattening by 1985. Economic models are only as good as the assumptions that feed into the models. As economics science progressed, along with greater programming flexibility, economists began to undertake scenario analysis to provide a fuller range of possible future outcomes. Forecasting is as much as art as a science and requires the forecaster to be open to the wide range of possible social, technological (e.g. fracking) and political (e.g. Iranian revolution) factors which influence the investment climate for oil and gas development.

PRIVATE

ALBERTA TREASURY

Budget Planning and Economics

21-Sep-81

ALBERTA ECONOMIC OUTLOOK 1981-86

Introduction

Treasury has prepared a preliminary outlook for the Alberta economy for the period 1981 86 based on the new energy agreement and a likely pattern of development of the oil sands. As a result of the energy agreement, the initial assessment indicates that Alberta economy is poised to enter a period of sustained and rapid economic growth. Our analysis indicates that the rate of economic growth will accelerate in 1982, reach its peak in 1984 and then decline slightly over the rest of the period. The driving force of economic growth in this period will be investment expenditures arising from a revitalized and expanding conventional oil and gas industry, the development of the oil sands, and the construction of petrochemical plants, refineries, power generation facilities, pipelines and other major projects. This forecast for economic growth will have to be modified if the timing of oil sands development differs significantly from what we have assumed and if further analysis indicates that the economy does not have the capacity to undertake all of the major investment projects which we have included. In addition, the positive outlook for the conventional oil and gas industry presented in this forecast should be viewed with some caution given the industry’s initial reaction to the energy agreement.

Table 1 shows some of the major areas of investment projected for the 1981 86 period as a result of the new energy agreement, investment in the conventional oil and gas industry, which is forecast to decline in 1981 by about 15 to 20% in real terms, will rebound in 1982 and continue to expand throughout the forecast period at an average annual rate of about 11%. The pattern obviously assumes a very positive reaction by the oil and gas industry. The timing of investment in the oil sands projects is shown in Table 2. It has been assumed that construction activity on the Alsands project will be accelerated in 1982 and therefore the project will be on schedule. In the case of the Cold Lake project, it has been assumed that the project does not proceed until 1983, with the investment which was originally planned for the first two years of the project taking place in that year. The figures for investment in petrochemicals, power generation, pipelines, and forest products are based on a list of major projects prepared by Economic Development (see attached- in PDF below).

| Table 1 | |

| Major Areas of Investment in Alberta, 1981-86 | |

| ($millions of 1980 dollars) | |

| Conventional Oil and Gas | 23,790 |

| Oil Sands | 8,240 |

| Petrochemicals | 8,210 |

| Refineries | 1,010 |

| Power Generation | 1,430 |

| Pipelines | 1,150 |

| Forest Products | 520 |

| Figures are rounded to the nearest ten million and exclude expenditures on land and interest payments during construction | |

According to this information, real investment in these projects will peak in 1983 at about $3.5 billion (1980 dollars) in 1986. The timing of the investment in these major projects may be affected by the pressures which will be imposed on the Alberta economy, especially the construction industry, as a result of the oil sands projects.

| Table 2 | |||

| Major Areas of Investment in Alberta, 1981-86 | |||

| (millions of 1980 dollars) | |||

| Syncrude Expansion | Alsands | Cold Lake | |

| 1981 | – | 145.9 | – |

| 1982 | – | 295.2 | – |

| 1983 | – | 685.1 | 255 |

| 1984 | 705.5 | 1148.1 | 445.9 |

| 1985 | 705.5 | 959.6 | 909.9 |

| 1986 | 352.9 | 577.1 | 1056.9 |

| Figures are rounded to the nearest ten million, and exclude expenditures on land and interest payments during construction | |||

Alberta’s Economic Outlook for 1981 and 1982

The highlights of Treasury’s short-term outlook for the Alberta economy are shown in Table 3. Real Gross Domestic Product (GDP) is forecast to increase by about 4 – 5% in 1981, down from the 1981 growth rate of 6.6%. This slowdown basically reflects adverse developments in the province’s oil and gas sector resulting from the energy dispute. Trailing investment, which has in recent years provided major economic stimulus, has been reduced as a result of measures introduced in the National Energy Programme (NEP). In addition, crude oil production declined as a result of the cut back programme and the production problems experienced by Syncrude and Suncor. The effect of these events were offset somewhat by increased investment in the manufacturing and housing sectors. In 1982, real GDP is expected to grow by about 5 – 6% on the basis of somewhat stronger real investment growth and increased natural gas exports.

Employment growth in 1981 is expected to be about 6.7%, up from the 5.7% recorded in 1980, mostly as a result of stronger growth in the primary and construction Industries. Alberta’s labour force is expected to increase by 6.5% as the participation rate is anticipated to register the largest single year increase on record. As a result, the unemployment rate is expected to fall to 3.6%, the third successive annual decline. In1982 employment growth is expected to slow to about 5.2% while the labour force expands by 5.4%. The unemployment rate, therefore, is expected to edge up slightly to about 3.8%C

Consumer prices are expected to increase by about 12.5% in 1981 and 11% in 1982 given our expectations of more moderate increases in food and energy prices in 1982. Average weekly earnings are forecast to increase by about 14% in 1981 and 13.5% in 1982. With earnings growing faster than inflation, real incomes in Alberta are expected to continue to rise over the 1981-82.

In 1981 the two areas of the economy which are expected to register the greatest Improvement are agriculture and construction. Realized net farm income is forecast to increase by about 35% with bumper wheat and barley crops and employment in agriculture, which has been declining since 1977, is expected to increase by over 5%. The construction sector, spurred by increased housing, petrochemical, refinery and pipeline construction, is expected to record an increase in employment of about 15%.

In 1982 non residential construction is expected to be a major source of strength in the Alberta economy especially with the acceleration of activity on the Alsands project. The oil and gas industry is expected to improve on its 1981 performance as oil production returns to normal levels, drilling activity begins to recover after spring breakup and exports of natural gas increase.

| Table 3 | |||

| Alberta’s Short-Term Outlook | |||

| 1980 | 1981 | 1982 | |

| Real Gross Domestic Product (% change) | 6.6 | 4-5 | 5-6 |

| Real Investment (% change) | 11.6 | 9-10 | 10-11 |

| Consumer Price Index (% change) | 10.2 | 12.5 | 11.0 |

| Average Weekly Earnings (% change) | 11.4 | 14.1 | 13.5 |

| Employment (% change) | 5.7 | 6.7 | 5.2 |

| Labour Force (% change) | 5.6 | 6.5 | 5.4 |

| Net Migration (thousands) | 56 | 45 | 55 |

| Unemployment Rate (%) | 3.7 | 3.6 | 3.8 |

Alberta’s Economic Outlook, 1981-86

Our forecast for some key economic variables for 1981-86 is shown in Table 4 and compared with performance over the past five years. The average annual growth rate of real GDP is forecast to be higher than in the past five years, especially over the period 1983-86. Employment growth will average 5.6% which is about the same rate as in the past five years. By 1986, employment will increase by 400.thousand. Because of the buoyant labour market, the average unemployment rate is expected to be about 3.8% and real wages and salaries per employee will increase by about 2.6% per annum. Total population is projected to grow at an average annual rate of 3.6% reaching about 2.6 million in 1986.

| Table 4 | |||

| Alberta’s Medium -Term Outlook | |||

| 1976-80 | 1981-86 | 1983-86 | |

| Real GDP Growth (average annual % change) | 6.1 | 7.1 | 8.3 |

| Real Investment Growth (average annual % change) | 13.1 | 12.9 | 14.6 |

| Population Growth (average annual % change) | 3.2 | 3.6 | 3.7 |

| Employment Growth (average annual % change) | 5.5 | 5.6 | 5.6 |

| Net Migration (average annual in thousands) | 42.9 | 54.4 | 56.8 |

| Unemployment Rate (average %) | 4.2 | 3.8 | 3.8 |

This forecast for the Alberta economy is very similar to that of the Resolution Scenario contained in “Impact of an Energy Impasse” (8-Jun-81) prepared by Treasury and Economic Development. In that Resolution Scenario, the average annual growth rate of real GDP and real investment were 7.3% and 11.7% respectively and the average unemployment rate was 3.9%. The lower growth rate of real investment in that scenario is primarily due to the lower growth rate of real investment in the conventional oil and gas industry. This is offset to some extent by the delay in the construction of the Cold Lake Project in the current forecast.

Treasury cautions that this forecast may be overly optimistic for the 1983-86 period because it may overestimate the capacity of the Alberta economy to attain this level of economic activity, especially in the construction sector. Critical shortages of materials and skilled labour may occur and the resulting cost increases may lead to the postponement of some of the major projects which we have assumed will take place in this period. By way of illustration, 1984 is forecast to be a year of extremely rapid growth with real GDP growth of 9.9%, real investment growth of 17.8%, employment growth of 7.1% and an unemployment rate of 3.5%. Because of tight labour market conditions, real wages and salaries per employee are predicted to increase by 5.4%. In the construction industry, Real Gross Domestic Product is forecast to increase by 18.3%, with employment growth of 18.7% (29 thousand employees) and increases in wages and salaries per employee of 18.6%. Shortages of highly-skilled workers such as boilermakers, pipefitters and pressure B welders, and escalating costs may result in the postponement of some of the major projects which we have assumed will take place. Further analysis may allow us to determine the extent of the displacement of major project investment and permit us (to) further assess the reasonableness of this forecast.

Source: Provincial Archives of Alberta, PR 1986.0245 (Hyndman Papers), Box #45, File #636.