The Alberta Heritage Savings Trust Fund (AHSTF), established by Peter Lougheed in 1976, has been seen as a Crown jewel of Alberta’s fiscal management. Recently, the AHSTF long viewed by rating agencies as a vehicle to stabilize finances, has begun to lose its lustre. Is the Heritage Fund merely a relic of Alberta’s golden day in the sun when money poured into provincial coffers? Should the AHSTF be eliminated given the rise of Alberta’s debt. How does the reporting on the AHSTF’s management obscure what should be a laser focus on debt management?

Clarity and Transparency of Reporting

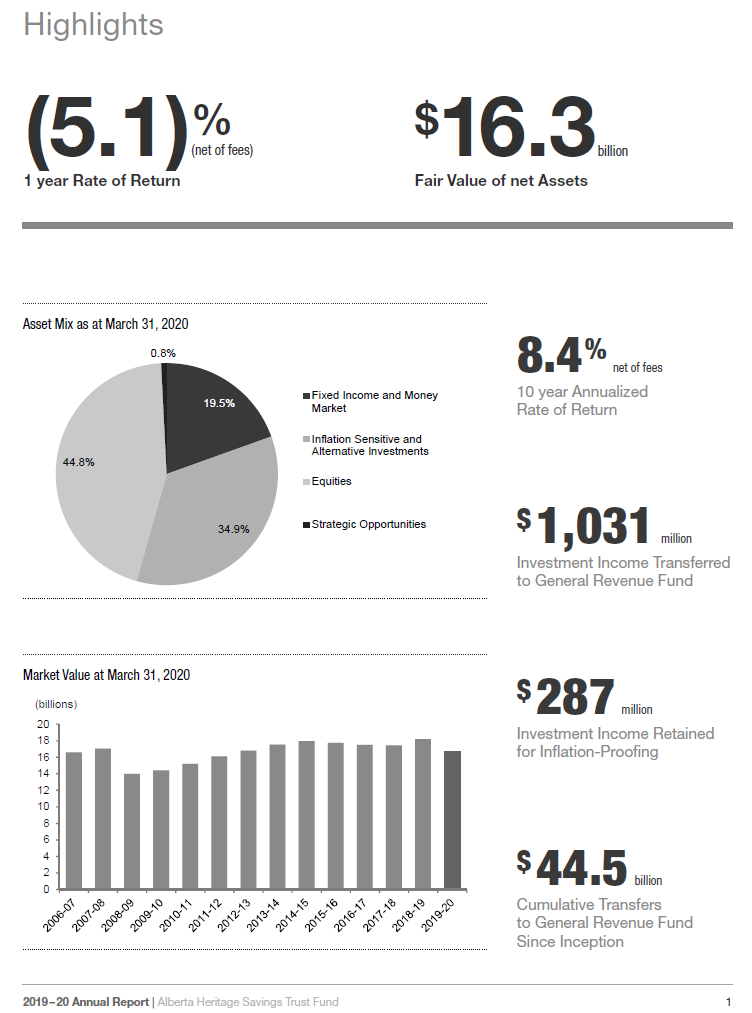

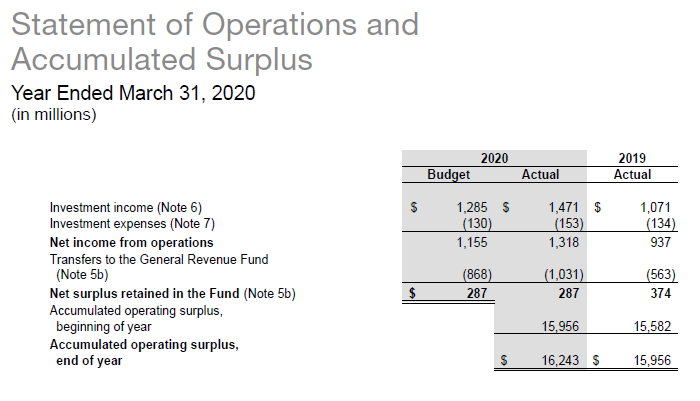

The Fund returned a negative 5.1 per cent return in 2019-20. For the second time since 2008-08, the value of the Heritage Fund was less at the end of the year than the beginning. This fact is camouflaged on the first graphic showing over $1 billion of income was transferred to the General Revenue Fund, and $287 million of that investment income has been “retained” for inflation proofing (Illustration 1). All this despite the bad news that the AHSTF is worth $1.9 billion less at the end of March 2020. Further obscuring the true failings of the past year is the fact of all the income ($44.5 billion) that has been transferred to the General Revenue Fund over the past 4 decades.

So, what did the Finance Minister, accountable to the Legislature for the loss, have to say?

“This has been a difficult year for investments and the Alberta Heritage Savings Trust Fund is no exception…As the minister responsible for the Heritage Fund, I will continue to monitor and review the fund’s performance….Responsible long-term investing requires patience, and I believe better years for the fund, and for our province as a whole, are ahead.”

Certainly, the Minister seeks to assuage anxious Albertans that he is watching over the Fund’s performance which has been managed by AIMCo over the past 12 years.

Illustration 1

Alberta Growth Mandate “eliminated”

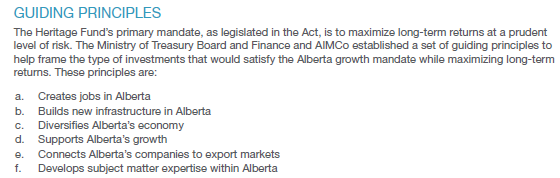

The Alberta Growth Mandate was initiated in Joe Ceci’s first budget in 2015. Below are its guiding principles. The amount of investment was capped at three per cent of the AHSTF’s assets or about $500 million.

Illustration 2

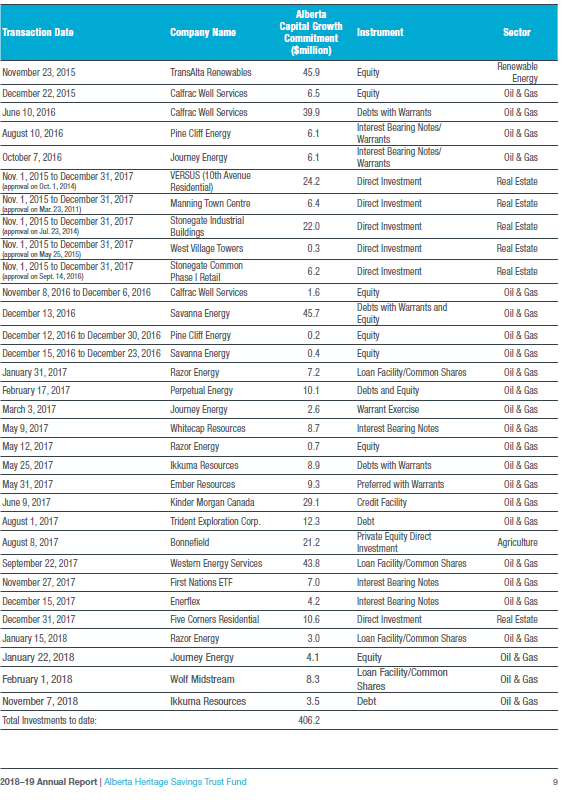

In the 2019 Annual Report, the following illustration shows he list of investments.

Illustration 3

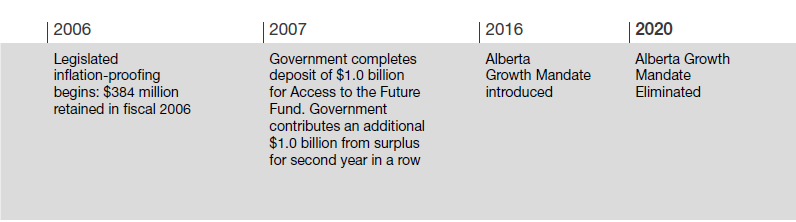

In this year’s Annual Report, a clever graphic recounting the life of the AHSTF, announces the Alberta Growth Mandate (AGM has been ‘eliminated.” While the AGM has been largely ignored by the media, its elimination should focus media and Opposition scrutiny over AIMCo’s, and the government’s accountability, for performance of this earmarked portfolio of the AHSTF’s assets.

Illustration 4

The real question mark about the fate of the AGM is the vague claim made in the following paragraph:

The real question mark about the fate of the AGM is the vague claim made in the following paragraph:

In November 2015, the government gave AIMCo a mandate to invest up to three per cent of the Heritage Fund (approximately $500 million) in investments that directly invest in Alberta’s growth. This mandate was eliminated in the fourth quarter of the 2019–20 fiscal year, as it was deemed no longer necessary. The mandate was eliminated as all investments exceeded AIMCo’s risk/return targets. These investments would have been made whether the mandate was in place or not.

The foregoing statement carefully exculpates the investment managers and forgives the predecessor government for its questionable management. Why is the elimination of the fund and most importantly its current value recorded in this vague way? As the 2019 listing and previous listing gives the investment commitments to these companies, there has been no disclosure of the current value of these investments. This lack of transparency begs for an explanation of its performance.

The AGM is dominated by energy and energy service company holdings (Illustration 3) at the time when these companies were struggling with high debts, low oil and natural gas prices, no access to capital, and many with orphan wells to remediate. This investment strategy was probably rationalized as opportunistic based on an assumption that oil and gas prices would rebound dramatically. This strategy would then allow the AGM to exit at a higher price, while enjoying high interest payments on debt instruments. Whether this strategy worked the public will never know with the present disclosure.

That said, the preceding ministerial statement would be welcome to the current government for the struggling energy sector and hence for the strategy’s continuation. Second, declaring the AGM a risk-adjusted success reaffirms the competency of AIMCo’s managers. Third, the claim that the investment decisions would have been made anyway justifies continued channeling of funds to the energy (and real estate) sectors. More dangerously, this statement provides a cover for the continued use of public sector pension plans investing in junior oil and gas, shopping malls, and oil service companies. This may be a good strategy but the lack of transparency does not give the public information on how this success was achieved.

Some Questions

The fading away of the AGM into a purported rosy sunset leaves many unanswered questions. Hopefully the media and Official Opposition will address the following questions to AIMCo’s Minister, deputy minister, members of the AIMCo board, and lastly the AIMCo executive team.

- What is the market value of these AGM investments at 31 March 2020? What are the current market values of these investments June 30, 2020?

- What process did the Minister, department, Board and management go through every year in monitoring the value of these investments?

- Were any of these 32 investments written off? Which ones?

- What are the current holdings of former AGM investment in all the public sector pension plans and other funds AIMCO invests for?

- What benchmark was used to evaluate return on a risk adjusted basis?

- How realistic are these benchmarks? With high levels of risk, one would expect the portfolio would expect returns of 15 to 25 per cent. Unless the benchmark is dominated by failing energy companies (TSX Energy Index) it is very unlikely this portfolio over the past five years generated any positive returns.

- Why doesn’t the current government reveal the actual performance against the benchmark?

- Is the public to believe that with energy companies and real estate the main investments over the past five years, returns could ever be at that level, especially now?

- Who did the independent analysis to substantiate the claim that “all investments exceeded AIMCo’s risk/return targets?”

- Would the Auditor General have examined the records of all such investments and be comfortable with this claim?

- Was the investment strategy consistent with the Guiding Principles established when the AGM was created?

From this researcher’s point of view, the claims in the Report about the AGM don’t make sense unless all of the above questions are answered in an open, transparent manner.

Mixed Messages on when a loss is a loss

Instead of reporting a loss though, the accountants include the actual losses on the balance sheet and not the income statement. The Statement of Operations and Accumulated Surplus and accompanying (unaudited) management discussion maintain the fiction that investment income was about $1.5 billion (above the $1.3 billion forecast in the last budget) and the fund was inflation-proofed. While this may fool some, it won’t fool the rating agencies who understand legerdemain in accounting presentations.

Illustration 5

Time to eliminate the AHSTF?

The bottom line is: why should the Alberta public continue to support the costs of the infrastructure of the AHSTF, including legislative oversight, when Alberta’s debt will soon blow past $100 billion? Why should a government that is focussed on cost cutting persist in keeping alive an institution that has long lost its central purpose? That purpose was to ensure intergenerational transfer through constantly saving and reinvesting the income. In 1982 the portion of royalties deposited was reduced in half and eliminated entirely in 1987- a policy error that has had grave implications for a big spending province. Furthermore in 1997 the Fund was restructured to reduce Alberta- centric investments, a positive step but one that has introduced more volatility to governments since that time.

Why is the province spending $153 million in AIMCo and third-party fees to administer the AHSTF? Is the cost of attempting to outperform the cost of servicing Alberta’s debt really worth it? It seems like the right time to rethink the cost of this administrative and reporting structure. Is it not time for Alberta politicians to recognize that the golden years have passed as resource revenue plummets? Surely a higher priority needs to be paid on the debt side rather than the investment side. By eliminating the AHSTF, a portion of debt would be reduced meaning lower debt servicing costs as well as the costs of investment management including payments of $67 million to third parties who managed about 20 per cent of the Fund’s assets.

Related posts

https://abpolecon.ca/2020/05/02/aimco-faces-first-major-test-analysis-and-opinion/

https://abpolecon.ca/2020/04/03/politics-of-alberta-growth-mandate-agm/