Directors and Politics

ATB Financial will have three new directors as it charts a challenging course forward. On 13 May, Jim Davidson, Andrew S. Fraser, and J. Robert Logan were quietly appointed to ATB’s board effective 16 June 2020 for three- year terms. At the same time Wendy Henkelman (a director since 2014) and Mary Ellen Neilson (director since 2017) were re-appointed. No press release has been issued to date by either ATB or the Treasury Board President and Minister of Finance, although at ATB’s virtual public annual meeting, the new directors were expected to be introduced. Given the surprising absence of public disclosure, the following disclosure is a well educated guess of who these new board members are.

Source: https://oilandgascouncil.com/event-speakers/jim-davidson/

The most notable appointment is investment banker Jim Davidson who is the former Deputy Chairman of GMP FirstEnergy, “Canada’s leading energy-focused investment bank.” Jim Davidson was a founding partner in First Energy Capital Corp. Davidson is a past governor of the Alberta Stock Exchange (absorbed by the TSX) and a trustee/director of The Fraser Institute.

Mr. Davidson is a prominent Calgary philanthropist and financier instrumental in raising $65 million for Calgary’s Greenway project. Mr. Davidson will bring ATB’s board needed expertise in the field of oil and gas financing as ATB navigates the shoals of the recent Saudi-Russia oil price war and the collapse of global oil demand.

Source: https://www.ncsg.com/company/leadership/

The second new appointee is Andrew S. Fraser. Mr. Fraser is the President and CEO at NCSG Crane & Heavy Haul with its head office in the Acheson district of Edmonton. Fraser is a graduate of the University of Toronto’s Rotman School as well as Royal Rhodes University. He is the former President of Finning (Canada). With 30 years in the heavy equipment business, Fraser has deep knowledge of the equipment supply chain to the energy industry.

Who is J. Robert Logan?

The third new member of ATB’s board is J. Robert Logan. According to his Linked-In profile, Logan is an Advisor at Osprey Informatics, now known as Osperity. A graduate of the Richard Ivey Business School at Western, he has written about Deep Machine Learning and Artificial Intelligence. ATB has been experimenting with the use of AI for some time and Logan’s appointment recognizes the importance of this area for a regional financial institution.

OrJ. Robert Logan could be a Senior Advisor with Chrysalis Capital with over 30 years “of extensive financial industry and private small-to-medium enterprise (SME) investing and advisory experience in Canada and the United States. Rob graduated from the University of Waterloo with a Bachelor of Science (Jt. Hons.) and holds a Master of Business Administration degree (Dean’s List) from the Ivey School at Western University.” Either Robert Logan appear to be well qualified to serve on ATB’s board.

ATB Media Relations confirmed it is the first J. Robert Logan who was appointed to ATB’s Board. Pictures and bios will be updated on ATB’s website when their terms begin.

Politics- see Caveats below

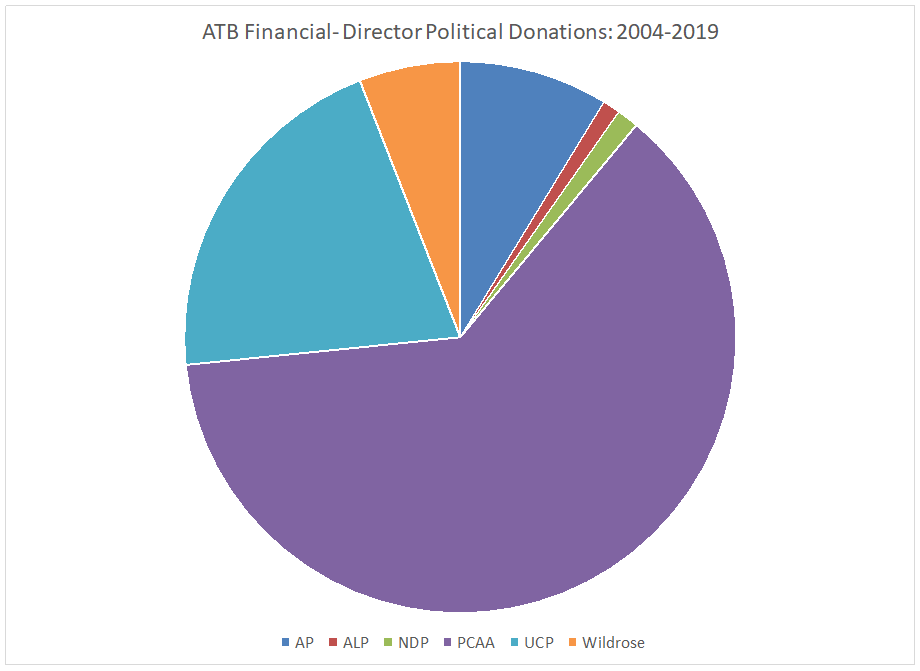

Mr. Davidson has been an generous contributor to conservative parties in recent years. The Financial Disclosure portion of Alberta Elections indicates Davidson’s prominent role in raising money for the Wildrose, Tories and the UCP.

Andrew S. Fraser also donated $3000 to the UCP in 2019. Both Davidson and Fraser follow in a deep tradition of political activity aligning membership on ATB’s board with conservative fund-raising. They join many of the 51 individuals who have been ATB directors over the past 24 years.

As the table below illustrates, political affiliation via support through leadership campaigns, general elections, candidates, constituency associations, or annual contributions, seem to facilitate appointments for conservative party members. Not surprisingly, the inter-regnum of New Democrats produced little financial benefit for the that party with two donations from Jim Carter in 2018 and Patrick Lor in 2018.

| ATB Directors 1996-Present | Total $ amount | Parties |

| Marshall Williams, Chair (1996-1999) | 10-4999* | PCAA |

| Robert Brawn | 1834 | PCAA, UCP |

| Garth Griffiths | ||

| Paul Haggis | ||

| Brian Heidecker | 16350 | PCAA, AP |

| Brian Hesje- Chair (2011-18) | 7000 | PCAA, UCP |

| David Hughes | ||

| V. Diane Hunter | PCAA, Wildrose | |

| Ian M. Macdonald | 3753 | PCAA |

| Elson J. McDougald | ||

| J. Garnett Millard | ||

| Raymond J. Nelson | 2500 | Wildrose, UCP |

| Ralph D. Scurfield | 6950 | PCAA, UCP |

| Gail D Surkan | 500 | PCAA |

| Ron P. Triffo, Chair (2000-2006) | 500 | PCAA |

| Garnet K. Wells | 500 | Wildrose |

| A. D. O’Brien | ||

| Gary G. Campbell | 1025 | PCAA |

| J.W. (Jack) Halpin | PCAA, on Constituency executive- Ralph Klein’s riding | |

| Brian McCook | 5008 | PCAA, UCP |

| Linda Hohol | 10995 | PCAA |

| Robert Clark | 2000 | UCP, Social Credit MLA |

| Arthur Froehlich | ||

| Bernard Kotelko | 7463 | PCAA |

| Norman McDonald | 1750 | PCAA, UCP |

| Robert Splane- Chair (2006-2011) | 12528 | PCAA |

| Wayne Wagner | 5000-10000* | PCAA |

| Garnett Altwasser | ||

| Joan Hertz ( Benkendorf) Chair Jan 1, 2019-2021 | PCAA Provincial Secretary | |

| Doug Baker | ||

| Colette Miller | 6308 | PCAA |

| Michael Percy | Liberal MLA, Chief of Staff, Premier Jim Prentice | |

| James Carter | 3460 | NDP, ALP |

| James Drinkwater | 10-4999* | PCAA* |

| Patricia Glenn | ||

| Bob Carwell | 1600 | PCAA** |

| Lloyd Craig | Non-resident | |

| Wendy Henkelman | ||

| Barry James | 8198 | PCAA, UCP |

| Robert Pearce | 400 | UCP |

| Shannon Susko | ||

| Diane Pettie | ||

| Clayton Sissons | 500 | PCAA |

| Todd Pruden | ||

| Mary Ellen Neilson | ||

| Manjit Minhas | ||

| Patrick Lor | 2000 | PCAA, NDP |

| Diane Brickner | ||

| Jim Davidson | 70,200 | PCAA, UCP, Wildrose |

| Andrew S. Fraser | 3,000 | UCP |

| J. Robert Logan | ||

| Italics NDP appointments | ||

| * Leadership donation | ||

| ** Campaign Chair Stelmach leadership campaign | ||

Caveats

The above list requires a few comments and caveats. For common names like Andrew Fraser, James (Jim) Carter, Robert Clark, and even Jim Davidson, I cannot be absolutely certain that the Financial Disclosure is reporting that same individual who serve or have served on ATB’s board. I have drawn inferences from the location of their donations and party preferences. Some contributions were made after board terms had ended. The Financial Disclosures search portal commences with donations after 2003.

As the list above shows, of those individuals who have made contributions to leaderships campaigns, election campaigns, candidates and a party, the list is dominated by three conservative parties: Progressive Conservative Association of Alberta, Wildrose and the United Conservative Party. THis should be of little surprise given the dominance of conservative parties in Alberta since 1935.

It would be cynical to state the obvious – “membership has its privileges.” There is more going on here that that. It would be more appropriate to question whether party membership equates to competence. It would also be fair to say that these individuals are “safe hands”- persons with technical and business experience with running substantial organizations in some cases. Financial results however are a key determinant in whether these directors are doing an ok or a great job for, ultimately, the taxpayers of Alberta.

Historical Overview

In the early years, notable contributors included Brian Heidecker ($16,350), whose contributions, after he left the ATB Board, were to both the PCs and recently the Alberta Party. Two other initial directors Ralph Scurfield ($6,950) and Brian Hesje ($7,000) have been significant donors to the Tories and both recently to the UCP.

Another key contributor was ATB’s third Board Chair, Robert (Bob) Splane ($12,528). In Splane’s case, nominal party contributions ($1,850) were dwarfed by constituency (Boyle) and candidate donations of $10,878. During that same period (2007-2015), Collette Miller and her professional accounting corporation donated $6,308.34 to the Tories with $1,625 to the candidate in the Vegreville constituency and the remainder to the the party. Director Bern Kotelko also donated $1,000 to the candidate of the Vegreville constituency in 2012 but gave most of the money to the party ($6,463) during 2012-15.

Another faithful Tory donor, Linda Hohol, gave nearly $12,000 to the party between 2004 and 2015. $2,300 of donations went to a candidate and constituency with the remaining going to party central. Recently ATB director Barry James and his Barry L. James Advisory Services Ltd. contributed $7,798 to the Progressive Conservative party and $400 to the UCP over a 15-year period. More than 75 per cent of his donations when to central party coffers.

Governance: What do ATB Directors do and how much are they paid?

According to ATB’s website “Corporate governance includes the policies and processes used to supervise the business and affairs of the corporation.” A key document known as the Mandate and Roles document– agreed to in January 2011 set our a “common understanding” of the roles of the Shareholder (Alberta government) and ATB. The 16 page document articulates ATB’s business purpose and that ATB “must be operationally independent from government.”

That document lays out the respective roles of the Minister, deputy minister, department, Board, Board Chair and CEO. In addition, recruitment and appointment of directors, ensures an active role of the Board in the recruitment and selection process. Various planning and reporting requirements were set in accordance with the Government Accountability Act (the Act was repealed in 2013).

The current governance framework is generally in line with governance best practices formulated by securities commissions and the Institute of Corporate Directors (ICD).

ATB Financial is committed to transparency and accountability and supports disclosure of its corporate governance practices, delivery of useful information through broad channels of communication, and use of appropriate financial and operational performance measures.

As we shall explore in this post and subsequent posts, ATB Financial’s disclosure policy has improved but the entity is by no means supervised or regulated like similar institutions (i.e banks). For example, why the identities of new ATB directors are not currently available is a puzzle. In addition, and more critically, ATB’s regulatory capital requirements are a pale imitation of the federal Office of Superintendent of Financial Institutions regulation.

Key governance materials include:

- Code of Conduct and Ethics

- Attendance and Compensation disclosure

- Director independence policy

- Board Chair, Vice-Chair, Committee Chair, and member position descriptions

- Directors remuneration policy

- Board Committee structure; and

- Terms of Reference

From a legal perspective, ATB directors owe a “duty of care” to ATB. In carrying out this duty of care, directors must “act honestly and in good faith and act “with a view to the best interests of ATB Financial, which shall include ensuring that ATB Financial meets its business objectives under section 11.1.” The new section, introduced in Bill 22, states:

In carrying on its business, ATB Financial shall

(a) manage its business in a commercial and cost-effective manner,

(b) seek to earn risk-adjusted rates of return that are similar to or better than the returns of comparable financial institutions in both the short term and the long term, and

(c) avoid an undue risk of loss by prudently managing its business, which includes establishing and implementing relevant plans, policies, standards and procedures

What is unique about ATB’s directors’ duty of care is that directors, when considering whether a “transaction or course of action is in the best interests of ATB Financial,… shall have due regard to the interests of the Crown in right of Alberta and the depositors of ATB Financial.”

In short, directors must always bear in mind a duty of care to the Crown- that is, the Minister and governing party. If a director wishes to be re-appointed they must be attentive to the general messages of the government. Depositors should always be taken into account but the government guarantee means effectively, the taxpayers of Alberta will be called on to pay out, if the unthinkable occurs. Ministers, not taxpayers and depositors, appoint directors,

Since this framework came in place in 1997, the government has allowed ATB to operate independently. One minor exception occurred in 2010 when ATB and the Finance Minister announced ATB would undertake a loan program and in October 2015 more “capital” was given to ATB and ATB directed to lend more money to Alberta businesses.

A director therefore carries a fiduciary duty to three “entities”- 1) the government, who appoints directors, sets regulatory policy and supervisory processes and guarantees deposits, 2) ATB depositors who range from children to multinational corporations, and 3) to ATB as a corporate entity.

Expectations of ATB Directors

When a director is appointed to ATB’s board, they undergo an orientation that typically consists of a half day or full day session of briefings usually involving the board chair and executive management of ATB. Directors soon learn that they must 1) communicate only in accordance with the Communications policy; 2) speak with “one voice” once a decision is made “subject only to legal exemptions regarding declaration of conflicts of interest and abstentions;” 3) focus on strategy, stewardship rather than operational detail; 4) maintain good interpersonal relationships with other directors “with sensitivity to the complex relationship relationships that exist within the Board, the Directors, management and the Shareholder;” 5) demonstrate competence (applying their special skills, experience, knowledge, and external contracts (sic) to provide a unique contribution to the Board’s overall performance”), informed decision-making, risk mitigation knowledge, and integrity and ethics. Key personal attributes include:

- a growth mindset and being open to other opinions;

- a willingness and ability to engage in constructive challenge;

- an ability to manage conflict and work with others;

- a natural inquisitiveness and curiosity; and

- an ability to act independently

In short, an ideal ATB director is a super-human who brings a range of skills dispassionately to the governance of Alberta’s Crown jewel agency.

ATB directors are paid poorly by large corporation standards, but decently for ordinary Albertans. The most recent table web-published shows that directors earned from $28,200 to $55,100 a relatively modest sum for the fiduciary responsibility of a $50 billion organization. In contrast, CWB directors’ pay in 2019 ranged from $157,500 to $318,500 for the Chair. CWB’s total loans of $29 billion are roughly one-half of ATB’s $47 billion in loans. ATB employs roughly double the numbers of CWB staff.

This disparity raises questions about the incentive structure for ATB directors. ATB directors are paid in cash an annual retainer of $15,000 whereas CWB’s directors are paid both in shares (DSUs-$80,000)) and cash ($95.000). Each component at CWB is significantly higher than the total annual compensation of any ATB director. Is this a problem? Is this fair? Maybe? Time will tell. Business school gurus and corporate executives refer to “skin in the game” as a major motivator for engaged board members. This begs the question- equally applicable to AIMCO directors- does this remuneration a) attract suitable candidates and b) give ATB directors enough motivation to question with management is effectively managing the vast credit and other risks undertaken by this provincial agency?

The next instalment will critically examine ATB’s financial results which made public on 28 May 2020. The analysis will show that many of the details provided by Canadian chartered banks are missing for ATB. This gap is especially problematic today given the enormous financial stress on Alberta’s economy: government, industry and working people.