The Provincial Archives of Alberta slumbers in obscurity, but the work of its archivists is essential to the conservation and preservation of Alberta’s rich social and political history.

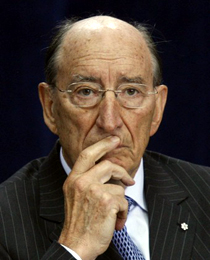

Lou Hyndman served with Peter Lougheed’s ministry from 1971 to 1985 when he returned to the private sector. Hyndman served in many key cabinet positions, including Education, Intergovernmental Affairs, and Treasury. He donated over 100 boxes of records from his time in the provincial government.

In this extract, the Deputy Minister of Energy- Energy Resources, Dr. Barry Mellon advises his minister, the Honourable Merv Leitch about impending storm clouds circling over Alberta’s energy sector. This revealing memorandum was written six months after Pierre Trudeau won a majority election on 18 February 1980, defeating Joe Clark’s Conservative government.

In the memorandum (produced in its entirety below but without the referenced Appendices), reference is made to John Crosbie’s budget which led to the minority PC’s defeat in the House of Commons. The 11 December 1979 budget proposed to increase the excise tax on gasoline by 18 cents per litre. The budget was delivered in the context of the Iranian Revolution which caused oil prices to spike. This action provoked fears about security of supply and continued reliance on foreign OPEC supplies by the U.S. government. .

Mellon’s memo presciently states:

If we don’t move, or get bogged down in numerical detail, Lalonde and company will move in next September with a federal position paper on energy policy from which they will not be able to back off. At that point, the situation will become completely polarized, and the threat of a confrontation will transform itself into reality

Indeed, Mellon’s forecast of the federal move by “next September” was off by nearly one year. On 28 October 1980, Allan MacEachen, the federal Finance Minister delivered his budget which featured the very National Energy Program Mellon was predicting, as well as the polarization which would be remembered for decades.

The underlines in the memo are by Barry Mellon, however Hyndman’s copy highlighted the following passages.

At least 99% of the people employed by the Calgary-based petroleum industry are Canadians. Much of the equipment used by the industry is manufactured in Canada, and our service industry has developed to the point where it is now selling Canadian equipment and technology abroad, including the United States.

“We in Ottawa know best how your money should be spend on your projects. give us a billion dollars or two, and we’ll buy control of your resource projects.”

Readers will recognize the animus which had evolved between Alberta ministers and senior officials since the early 1970s towards federal, “Liberal” government’s ministers and officials.

Alberta Energy and Natural Resources

From: G. B. Mellon

Deputy Minister Energy Resources

To: Honourable Merv Leitch

Minister Date: August 7, 1980

SUBJECT: Energy Negotiations – Statement by Mark Lalonde Dated August 1, 1980

I have with my staff reviewed the federal Minister’s statement on energy issues stemming from the increase in oil and gas prices announced by Alberta on August 1.

I’m not sure how you want to handle a possible response to Lalonde, but we would like to comment on some of the points or issues contained in the statement.

A National Energy Program

- Paragraph 4 (“Opportunity”)

“……. too many of the benefits of industrial expansion are accruing to people who are not citizens of Canada.”

This is bunkum by any other name. At least 99% of the people employed by the Calgary-based petroleum industry are Canadians. Much of the equipment used by the industry is manufactured in Canada, and our service industry has developed to the point where it is now selling Canadian equipment and technology abroad, including the United States.

On its part Alberta has insisted on the “Alberta content” clause as a condition in the approval of major energy projects (we should change this to read “Canadian content”). We have offered to work with federal Authorities on a “Canadian content” policy, but with little success to date. Even at that, the direct and indirect industrial benefits to all Canadians accruing through major energy resource development in the west stands to be enormous.

As to the Canadian ownership issue, the obvious trend in recent years (and the federal numbers confirm this) is to rapidly increasing Canadian equity in the petroleum industry (see Attachment 1). Ironically, this trend could slow down or even be reversed if the Liberal energy proposals, including a gas export tax, are implemented. The smaller Canadian companies would be especially penalized, and many of these companies are now looking to the US for new investment opportunities.

In short, Lalonde and Company are open to a strong rebuttal on the issue of Canadian content and associated benefits. If the federal authorities had structured the corporate tax system to give Canadian investors a break 20 or 30 years ago, concerns over foreign ownership never would have arisen.

- Paragraph 4 (“Fairness”)

“… actually loses money when energy prices rise…”

Sheer nonsense! for every dollar the domestic price increase, the federal compensation program saves approximately $200 million per year on the cost of importing foreign crew. They also save an additional $60 million in compensating Syncrude and Suncor for world prices. Additionally, the federal corporate tax coffers stand to gain from domestic prices increases. If they don’t, the onus is on Ottawa to change the system.

With logic like this, Mr. Lalonde should be put in charge of the Canadian space program. He could repeal the law of gravity and bring about a revolution in interplanetary travel. Think of the Savings in Rocket Fuel, alone!

Federal Energy Expenditures

Source: www.paho.org

I recall distinctly Messrs. Don McDonald and Jack Austin regalling (sic) in 1974 the yokels from western Canada about a “Prairie Development Fund”. The idea then is the same as now. “We in Ottawa know best how your money should be spend on your projects. give us a billion dollars or two, and we’ll buy control of your resource projects.”

Great stuff if you believed in the divine right of the Federal government. Hell, if Ottawa had exercised control over oil sands in the first instance, we’d still be waiting for federal approvals on the GCOS project.

Oil Pricing Policy

- Paragraph 1

“a critical juncture” ….” many of the same goals”….etc.

One goal we obviously don’t share is the need to bring on domestic sources of crude oil and equivalent at the earliest opportunity. We’d sooner pay world prices to Mexico or Venezuela than to our own projects.

I think we should make abundantly clear that we have stressed and continue to stress the supply issue. Ottawa’s concern is dollars, not supply.

5. Paragraph 5 (Alberta pricing proposal)

My recollection is that Mr. Lougheed offered Mr. Trudeau a “cap” on the adjustment to 75% of North American price on January 1, 1983. The Prime Minister’s specifically queried the Premier, who confirmed Alberta’s offer. Thus, the Canadian public would be protected under any unusual or extreme rise in external prices in 1983.

6. Paragraphs 6 and 7 (incentive prices)

Is Senor Lalonde also offering President Portillo incentive prices for Mexican oil, or is he paying what the Mexicans demand?

7. Paragraph 8

The new Canadian “blended” price will hit all consumers across-the-board, for the refinery tax required to achieve this price is an excise tax on all products by Any Other Name.

In contrast, the Tory budget of December 11 would have tax consumers of diesel and gasoline only. Home fuel consumers would have been spared. Thus, from a conservation point of view, Mr. Crosbie’s approach would have been more effective.

I don’t think the Canadian consumer really understands what Lalonde and company have in store for them on the pricing side of things.

The Need for Substitution

8. Paragraph 2

Lalonde notes that Alberta’s incentive price for new gas sales is “probably not sufficient for the program we have in mind”. Yet under the Liberal proposal for a blended oil price, he states that the relative price of gas would fall to about 63% of oil parity by 1985.

The obvious question here is “Why is there a need for an “incentive” gas price at all?” Even at 85% parity many customers are switching from oil to gas. At 63% everybody would switch.

The implied criticism of Alberta’s offer is simply indefensible.

The Need for Revenue Sharing

Mr. Kanik and his staff are preparing the exact numbers required to give a detail rebuttal on this section of the federal Minister statement. These have been forwarded as a separate package.

I have a few comments on the main issues raised by Lalonde:

9, Paragraph 1

The producing provinces would not receive $40 billion under the federal pricing proposal unless one includes land bonuses and the so-called “Western Development Fund”. Attachment 2 shows that Alberta, Saskatchewan and British Columbia would receive $31 billion under the federal proposal.

10. Paragraph 3

Lalonde maintains that under some pricing scenarios “Alberta’s revenues would be enormous within a very short time period”. He then submits a price forecast comparison contrast in Alberta’s estimate with corresponding federal estimates (base case and high case). We have two comments on this particular piece of propaganda:

- We do not agree with the assumptions that have gone into the federal estimates of prices for January 1/83 and January 1/84. Mr. Kanik’s staff have documented the basis for our disagreements.

- Even in the unlikely event that our estimates are too low ($3 and $5 for January 1/83 and January 1/84, respectively), my recollection is that the Premier offered a “cap” on these prices in his Friday AM, July 25 meeting with Trudeau.

I think the second point, above, needs to be confirmed by Mr. Lougheed and made public in refuting Lalonde’s statement.

11. Paragraph 5

“From each dollar of petroleum revenue, governments now get.55 cents, of which.45 cents goes to the province and 10 cents to the Government of Canada.”

Pure hokum! Our calculations show that the revenue distribution on the existing dollar (excluding land bonuses and the federal export tax revenues) is about: Alberta.33 cents, Federal.12 cents, and Industry 55 cents including operating costs.

12 Paragraph 6

Export tax on gas: our views on this are well-known. However, Lalonde’s offer to explore “alternative fiscal proposals which would prove more acceptable to the producing provinces” rings a bit hollow in view of our well-known counter proposal for an excess profits tax.

Western Development

13. Paragraphs 1 and 2

This is the same nonsense proposed in 1974 by Don McDonald under the guise of a” Prairie Development Fund”. In essence, Lalonde is saying that he can spend our money more effectively than we can on projects of interest to western Canada.

But the most galling issue to the federal authorities is that addressed in the second paragraph— namely, that Alberta is now circumventing Ottawa by dealing directly with the other provinces in financial matters. I’m not sure what the appropriate response to this concern is. Perhaps a modified version of the Energy Bank is one approach, which is stronger federal involvement.

Summary (Appendices)

The term “flaws” in Alberta’s proposal is unacceptable. Ottawa might not agree with us for various reasons, but to call our proposal flawed simply emphasizes the arrogant attitude of Lalonde and his ilk.

looking at the two proposals, I think they might be compared in this way:

| Alberta | Federal | |

| Oil pricing | Gradual phase-in to 75% of North American price gives Canadian consumer a competitive “break” in his major market, the U.S.A. Also, a “cap” on the Jan. 1/83 adjustment in case of an unforeseeable jump in North American prices would give the consumer additional protection. | Blending in imported oil prices helps transfer the burden of the compensation program to the consumer, but at the expense of domestic prices. Thus, cash flow to companies is reduced and exploration will suffer. |

| Gas pricing | Natural gas prices would remain in same relation to domestic oil prices if we exclude the Syncrude levy from the gas pricing formula. Incentive plan will help promote new gas sales. | Natural gas prices will drop from 85% to 63% parity with ‘blended” crude oil price. Will cut back on cash flow to exploration companies. Unnecessarily “rich” for an incentive scheme. |

| Supply/Demand | Alberta proposal would continue to promote exploration, including oil sands and “frontier” development. Gradually increased prices to consumers will encourage conservation. | Federal proposal would lead to cut-back in exploration and probably cause cancellation of major oil sands and heavy oil projects. Impact on conservation probably similar to Alberta. |

| Revenue sharing | Excess profits tax on incremental revenues would give Ottawa significantly increased share of revenues. Conventional oil reserves depleting rapidly: should get revenues now or never. | Export tax on oil and gas unfair to producing provinces. Would not only cut back provinces’ share but also industry’s revenues. Would significantly lower net benefits to provinces than proposed P.C. “energy package”. |

| Expenditures | Producing provinces should handle “western development” through their own resources. Don’t need Ottawa bureaucracy involvement. | Main requirement is for funding costs of compensation program. Other investment schemes poorly thought out: why should Ottawa take our revenues to buy control of oil sands or heavy oil? |

SUMMARY

In short, the federal Minister’s statement is long on the Trudeau government’s philosophy on resource management and short on facts. It requires a quick and effective rebuttal from Alberta and, in my view, an obvious initiative from the producing provinces to implement an alternative strategy based on supply.

If we don’t move, or get bogged down in numerical detail, Lalonde and company will move in next September with a federal position paper on energy policy from which they will not be able to back off. At that point, the situation will become completely polarized, and the threat of a confrontation will transform itself into reality

G.B. Mellon

Encls.

cc:: M.F. Kanik

D.W. Minion

J.J. Seymour