In 1982, I interviewed Nigel Gunn, who at that time was the Honorary Chairman of Bell Gouinlock, a well- respected boutique investment dealer specializing in municipal debt. My dissertation (Politics and Public Debt) is about federal public debt management from the 1920s to the 1950s. The one critical point Gunn made in the interview that I will never forget was his statement that when the United Kingdom Treasury abandoned gold in September 1931, “this lead to a distrust of everything.”

A similar phrase was heard during the 2007-2009 financial crisis, but with Ben Bernanke to the rescue- a student of history- the finger was put in the dike. Here we are again at another financial reckoning.

At the present time, our Bank of Canada is following a conventional, yet extraordinary path, of quantitative easing, or QE. QE is a device whereby the central bank buys an array of assets that speculators are likely to attack. What do I mean by that? Financial markets are agoras or markets where a range of human emotions and motivations are manifest. Fear and greed are obvious, but opportunism and exploiting fears are evident as well.

In an atmosphere where NO ONE knows that will happen next, “informed observers” will make judgments and bets on what “adults in the room” (central banks and national Treasuries) will do next. Right now, central banks and Treasuries are “coordinating” their responses by providing “ample liquidity” to a variety of financial markets. The central banks start with the largest markets – national public debt-and work their way down.

Market players, such as hedge funds, are looking at ways to deploy their own capital and borrowed capital (from banks and clients) in ways that pay off very quickly. It does not take a rocket scientist to know that energy and below investment grade corporate debt will/are plunging in value providing an opportunity to sell the debt and then buy back the debt at lower prices. Provincial government debt, especially resource dependent economies are another “play. “

At times of high volatility in equity and debt markets, there are opportunities for fabulous gains if the investor possesses the fortitude to take such gambles. This is the type of financial environment we are in.

The official response has been for central banks to create money “out of thin air” by buying all types of assets- commercial paper, short term and longer term provincial securities, and mortgage securities to provide those markets with liquidity. Liquidity is crucial because without buyers or sellers, there is means of price discovery to allow buying and selling to take place and no market value to record at the end of the day.

So we have come to this. Extraordinary purchases by the central bank essentially mean that when the trader at the Bank of Canada buys a provincial bond from a securities dealer, the Bank simply creates a digital credit to the dealer’s account. This transaction signifies the Bank has confidence that, over time, it will be able to sell at a later date, the security at minimal loss, or hopefully at a profit, when financial markets normalize. This is the firepower that central banks have.

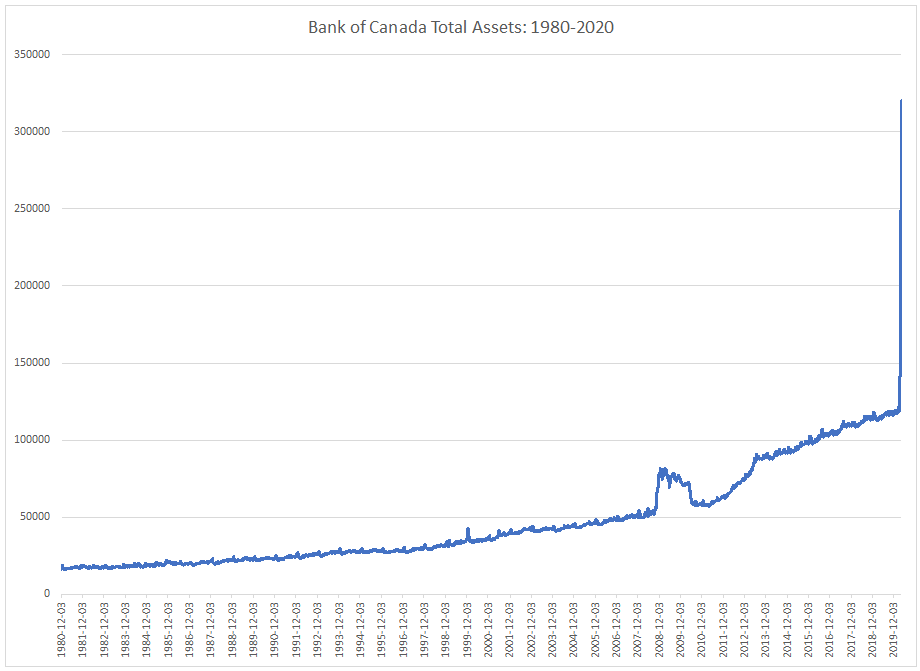

The chart below shows that Canada’s central bank has employed its extraordinary power quickly over a very short period of time. The long time series below demonstrates this incredible power.

Bank of Canada Total Assets 1981-April 2020

The chart above illustrates well the comparison between what is happening today compared to what happened during the Global Financial Crisis (GFC) when Mark Carney and David Dodge supervised the unusual measures to safeguard Canada’s banking system.

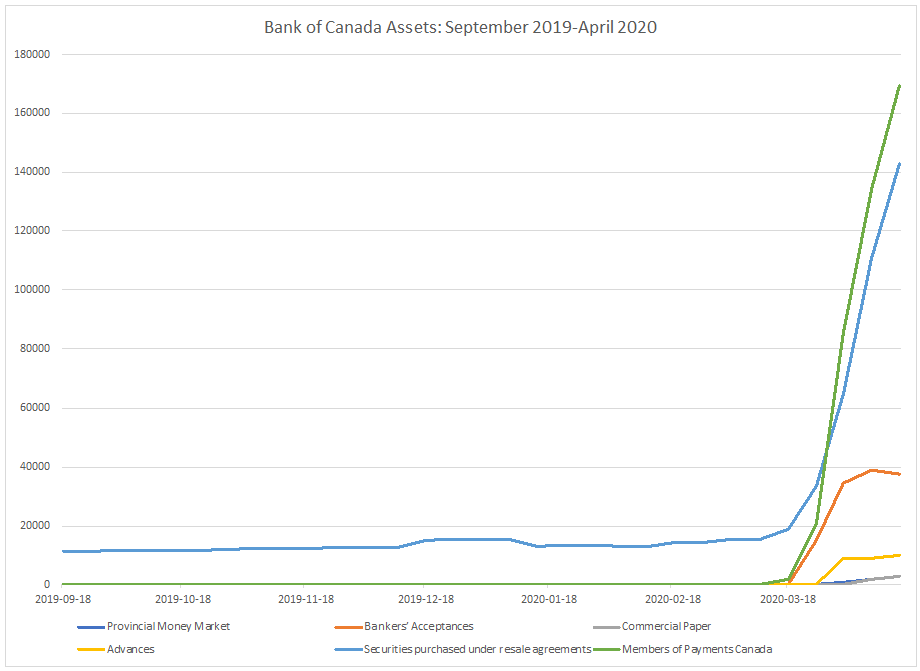

Bank of Canada- Selected Assets: September 2019-April 2020

While we are told our banks are “sound,” we should be circumspect as citizens and investors. Our central bank has been “monitoring” the financial system annually over the course of the past decade. The Bank has been concerned with the high level of mortgage and consumer debt. Fortuitously, the rates of interest on consumer and mortgage debt remain at historically low levels allowing consumers to service the debt. Various scenario testing showed that risks to the financial system (banks) and the Canada Mortgage Housing Corporation and Genworth Insurance (who insures high ratio mortgages) are “manageable.” However, what happens in this new era of “black swans,” where extreme “tail events” are now commonplace?

In a worst case scenario, we could see massive loan loss provisions in a wide range of areas. These provisions will not be limited to commercial real estate and energy portfolios but to tens of thousands of small businesses that will not re-open and many tens of thousands of heavily-leveraged individuals, laid off and with significantly lower disposable incomes.

We will not know the full implications of these extraordinary measures for a very long-time. Right now, central banks and Treasuries are doing the best they can to cushion the economic consequences of COVID-19. Since Treasuries and central banks are ultimately accountable to taxpayers, where these organizations employ their firepower is rather important.