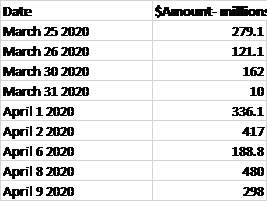

At the end of March, the Alberta cabinet passed Order in Council 104/2020 which authorized the “President of Treasury Board and Minister of Finance to make advances to or purchase securities of the Alberta Petroleum Marketing Commission.” In addition, the Minister was given the authority to raise:

“up to $2 000 000 000, by the issue and sale from time to time of notes, bonds, debentures or interest-bearing or non-interest-bearing treasury bills issued by the Crown in right of Alberta or any other securities under which the Crown in right of Alberta is the debtor (collectively referred to hereafter as “Government securities”) for the purpose of making advances to or purchasing securities of the Alberta Petroleum Marketing Commission in respect of the development of a hydrocarbon pipeline project.”

This Order authorized the Finance Minister to invest in, in other words, finance, the Keystone XL pipeline project.

Orders in Council are made under the authority of Acts of the Legislature- in this case the Petroleum Marketing Act (sections 6.3, 12 and 12.1) and the Financial Administration Act (sections 56, 58 and 80).

APMC – a brief history

This Order (O.C.) delivers control of the investment to the Alberta Petroleum Marketing Commission which has gained notoriety for its negotiation of the North West Upgrader Project.

The Alberta Auditor General’s report (pp.8-10) examined the Government’s contracts with the North West Redwater Partnership. While much of the following will be eye-glazing to those uninitiated into the arcane worlds of finance and accounting, the Auditor General was essentially saying what had been known for years: the Stelmach government was duped into an arrangement which committed the PC government to too much risk for too little reward.

Accordingly to Alberta’s Auditor,

“Under a 30-year tolling agreement, once the refinery reaches commercial operation date, APMC will provide 75 per cent of the bitumen, share 75 per cent of the refinery revenue, and pay 75 per cent of the monthly cost of service toll. This toll includes a component for the operating cost of the refinery, NWRP’s debt and debt servicing costs, and equity for financing the refinery….. the contracts commit the government to $26.7 billion in toll payments over 30 years. APMC has the option to renew the processing agreement for successive five-year terms.”

APMC does has the ability to renew the processing agreement every five years. As discussed below, this option is practically worthless at this moment.

The AG did say he “found management’s assessment and conclusion that the NWRP processing agreement is not an onerous contract to be reasonable.” Note the phrase “not an onerous contract to be reasonable.” But what does this mean? Does this mean the contract is not onerous and the contract is reasonable?

The OAG provided some useful context around the agreement.

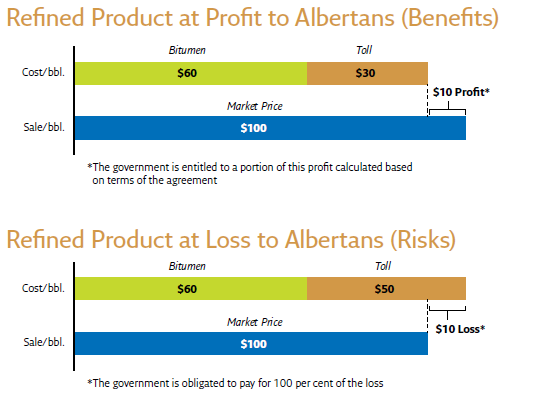

For the government to make money, the difference between the market price of refined product and the cost of bitumen (the value-add of the refinery) must be higher than the toll the government is required to pay. However, this potential benefit is uncertain because the market price of refined products and cost of bitumen are hard to forecast. In addition, the debt toll the government is required to pay also increases as the capital cost of the refinery increases.

In this helpful schematic, the incentive structures of this agreement are laid out.

The asterisks are paramount- on the upside the government is entitled to a “portion of the profit” but on the downside, taxpayers take 100 per cent of the losses. This is a familiar formula, seen during the global financial crisis where losses were socialized and any gains accrued to capitalists responsible for the fiasco.

With respect to the “Debt tolls,” APMC was to start paying the debt toll beginning 1 June 2018 irrespective of whether the refinery accepts delivery or processes bitumen or not. By 31 March 2019, APMC (e.g. the provincial taxpayer) had paid $261 million in debt tolls.

As to whether this contract was “onerous,” the OAG determined that the complex cash-flow valuation model, which spans 40 years is:

“inherently complex because the NPV (net present value) calculations depends on a number of variables, such as crude oil prices (WTI), heavy light differentials, ultra low sulphur diesel-WTI premiums, exchange rates, capital and operating costs, interest and discount rates, and the operating performance of the refinery compared to its capacity”

The foregoing means the “complex” model is open to gaming the NPV projections to positive results. While the OAG acceded to the APMC’s management sanguine analysis, the OAG said “there is significant uncertainty related to this calculation.”

The OAG then examined the project’s environmental liabilities. The OAG reminded its primary audience -MLAs that “Government has also accepted responsibility to clean up contamination on orphan sites created by industrial activity over the last century before current environmental laws and standards existed.”

Why the Province should be stuck with environmental liabilities on a private sector project is a great question. Such a question should be posed by ministers and opposition MLAs to persons who negotiated the agreement on behalf of the province and taxpayers’ interests.

According to this report on the Consolidated Financial Statements of the Province, under accounting standards for governments, environmental liabilities must be accounted for when:

› it accepts responsibility when operators no longer exist

› it inherits responsibility for historical industrial sites that predate current legislation

› operators are not taking appropriate steps at sites that pose an imminent and

unacceptably high risk to humans and the environment. The government would then

pursue the operator to recover any costs it incurred.

Under normal circumstances, the refinery should be able to convert bitumen to diesel and make a profit. However, the oil price drop means that diesel is selling for considerably less than it once did. While the cost of bitumen has declined precipitously, so too have the differentials between crude bitumen and diesel retail prices. Thus, if the upgrader/refinery becomes uneconomic or the Alberta government “inherits” environmental liabilities, Alberta taxpayers could also be on the hook for remediation expenses.

Further detail and analysis can be found in in Ted Morton’s communique “The North West Sturgeon Upgrader: Good Money after Bad? Morton notes:

Rather than being an exception, NWU fits the larger and longer pattern of failed forced-growth” diversification initiatives in Alberta and other provinces. Alberta politicians should think long and hard before succumbing to the next version of the “refine it where you mine it” diversification siren song

Treasury’s Work Load

The difficult work ahead for the Treasury group in Alberta Treasury Board and Finance will be complex and multi-faceted over the next year or more. Not only has the 2020-21 deficit been blown out of the water (Premier Kenney’s Address) there are other funding issues.

These issues include funding concerns for ATB Financial. On 31 March, the provincial Cabinet authorized the President of Treasury Board and Minister of Finance to borrow up to $9-billion, a rise of $2 billion, on behalf of ATB. While Treasury has been acting as agent for borrowing short-term for ATB for several years, this role is amplified in significance because of the major role ATB plays in the economy of the province.

While ATB encountered difficulties in the 2015-17 Alberta recession, its loan losses were relatively minor when compared to the ABCP debacle in 2007. Underlining the significance of ATB to the provincial economy, from 2007 to the end of 2019, ATB’s deposit liabilities (which are 100 per cent backed by the provincial government) rose from $18.3 billion to $35.2 billion.

During the same period, ATB Financial has increased its total loans from $17.1 billion to $47.3 billion at 31 December 2019. During the same period, business loans grew to $23.8 billion from $5.4 billion. ATB is a very significant lender to the energy sector ($4 billion) and to Alberta’s commercial real estate sector ($6 billion).

A one hundred per cent write-down of energy loans would mean ATB’s equity (built up since 1998) would be entirely wiped out. Add a 50 per cent loss on rural hotels condo, office and warehouse projects in Alberta and you have a capital destruction of $7 billion in the past several years.

In addition to finding buyers for the $1.5 billion in “Keystone-XL Alberta paper,” Treasury will likely need to borrow close to $30 billion (including re-financings) in a market with a “flight to safety.” On top of this, the group will need to address many detailed questions from rating agencies who will be more inquisitive than in normal times.

C.D. Howe recently commented on the provincial government funding markets. In its 7 April update from its Working Group on Monetary and Financial Measures (co-chaired by David Dodge and Mark Zelmer), the Group noted:

many provinces are in worse shape relative to their fiscal positions before the last financial crisis. Furthermore, the loss of provincial revenue from tax deferments will require increased debt financing, putting additional funding pressures on governments whose financial positions are already precarious.

The Working Group suggests the central bank initiate purchases of longer term bonds, going on to say that the Bank’s actions should not favour one borrower over another. In the case of additional support required beyond these measures, C.D. Howe suggests the use of the fiscal stabilization program.

Alberta’s December 2043 maturity is now trading to yield 3.089 per cent versus a similar dated bond of B.C. to yield 2.651 per cent. A similar tenor for Quebec yields 2.642 per cent and Ontario 2.667 per cent. This spread of about 50 basis points must be disconcerting for Alberta Finance officials and of course current and future Alberta taxpayers. (Quotes from RBC Fixed income order system at 2:15 p.m.- 8 April 2020).

All hands on deck!

Provincial Money Market Purchase Program