In the mid-1970s, major efforts were made by the Alberta government to support the expansion of oilsands production. Up until this time, Great Canadian Oil Sands (GCOS), operated by Sunoco, was the only source of commercial bitumen. With the rapid increase of oil prices in 1973, the provincial government encouraged the development of a consortium involving private and public funds. Construction began in 1973 and production commenced in 1978.

Between February 1975 to March 1980, the Alberta government had cumulatively advanced $281.8 million to the project of a total cost of $2.875 billion. Prior to 10 March 1980, the Province sold some of its interest to Alberta Energy Company for $54.9 million and had received cash receipts of $48.1 million from the sale of its entitlement of synthetic crude.

In this exchange of correspondence involving the Minister of Energy and Natural Resources, Merv Leitch and Lou Hyndman, Provincial Treasurer, fears about the federal government’s interpretation of Syncrude’s rise in profitability and therefore royalty bonanza are featured.

The correspondence also shows the importance of employment and the distributions of spending on the facility by province. Alberta naturally receives the greatest benefits from spending and employment, although the spread of contracts and employment outside Alberta is meaningful. The correspondence is also significant as it refers to the upcoming federal budget- the infamous 28 October 1980 budget which brought in the National Energy Program.

In Treasurer Hyndman’s reply, a fear surfaces that the federal government will interpret Syncrude’s rising profitability and royalties to mean that bitumen receipts and royalties will replace shorter lived conventional royalties. Hyndman rejects the federal assertion due to the very high operating costs associated with this production mode and the expected lower royalty rates. It is somewhat ironic therefore that 40 years on, Alberta’s budget very much relies on these bitumen royalties which last year amounted to $3.2 billion of total resource royalties of $5.4 billion.

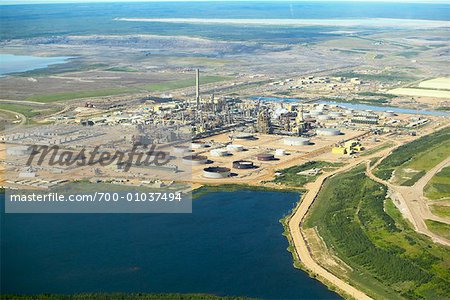

700-01037494 © Boden/Ledingham Model Release: No Property Release: No Syncrude Canada Ltd’s Mildred Lake Plant, Alberta, Canada

FROM: Merv Leitch

Minister of Energy and Natural Resources

TO: Honourable L.D. Hyndman

Provincial Treasurer

August 15th, 1980

SUBJECT: Syncrude Canada Ltd.

I understand a Syncrude estimate will be coming in shortly forecasting a substantial profit. Would you give some thought to the timing of its release because of the possible impact on the Premiers’ Conference and the Constitutional Conference.

Signed: Merv Leitch

FROM: T. R. Vant

Chairman

11 floor, Petroleum Plaza, North

TO: Honourable Merv Leitch

Minister

Energy and Natural Resources

407 Legislature Building

DATE: August 26th, 1980

SUBJECT: Syncrude Quarterly Report Under Order in Council to 244 / 72

Attached is the June 30, 1980, quarterly report prepared by Syncrude covering Alberta and Canadian content in terms of Manpower and dollar commitments. Sufficient copies are attached to allow for distribution of the report to Mr. R. Clark, Leader, the Official Opposition, and to the Legislative Library

Signed: T. R. Vant

SYNCRUDE CANADA LTD.

Mildred Lake Project

TOTAL COMMITMENTS TO JUNE 30, 1980

Geographically Distributed:

| Location | Dollar Value | Percentage |

| Alberta | $1242 MM | 62 |

| Ontario | 252 | 13 |

| Canada (excl. Alberta & Ontario | 87 | 4 |

| World (excl Canada) | 409 | 21 |

| Total Distributed Commitments | 1990 MM | 100 |

| Undistributed commitments | 95 MM | |

| Total Commitments to June 30, 1980 | 2085 MM |

NOTE: Location indicated source of final manufacture and/or assembly of equipment and materials and indicated location of performance of work in the case of subcontracts and labour.

SYNCRUDE CANADA LTD.

Mildred Lake Project

SOURCE OF EMPLOYMENT

Syncrude Canada Ltd. Employees

June 30, 1980

| Number | Percentage | |

| Alberta | 2139 | 52 |

| Other Canadians | 1850 | 45 |

| Non- Canadians | 123 | 3 |

| 4112 | 100 |

FROM: Deputy Provincial Treasurer

TO: Hon. Lou Hyndman, Provincial Treasurer

28 August 1980

SUBJECT: Syncrude royalty Hon. Merv Leitch request of 15- August-80

On 5- Aug-80 Syncrude revised its “good faith” estimate of Alberta royalty for 1980 to $126.6 million. the previous good faith estimates for 1980 had been $33 million, issued on 28- Mar-80.

We believe Mr. Leitch’s concern over this revision stems from an expectation that the federal government may use it to rebut Alberta’s argument that our current high level of non-renewable resource revenue is a temporary phenomenon resulting from the sale of a depleting resources. The federal government may attempt to argue that royalties from non-conventional production will eventually replace those lost as conventional production declines.

Such an argument would be incorrect. If the volume of non-conventional production ever became high enough to replace declining volumes of conventional production (which in itself would require massive levels of investment over the next 20 years), the economic rent associated with that production would not match that from conventional production. (Economic rent is the term used to describe that share of the value of production left after subtracting normal payments to all factors of production, including capital). The existence of high economic rent from present conventional oil production allows the industry to pay relatively high bonuses and royalties. The high capital and operating costs necessary in non conventional oil production, both synthetic oil and enhanced recovery, will not allow the province to collect such high revenues.

For this reason, the $127 million- royalty Syncrude expects to pay to Alberta this year should be compared to the economic rent available from an equivalent volume of conventional oil. That rent would be approximately $550 million and, under present arrangements, about 55% of this rent would have gone to consumers (due to artificially low domestic prices) while about 45 % would have been paid to Alberta as conventional petroleum royalty. That is, Alberta’s royalty on a comparable volume of conventional oil production would have been about double what we expect to receive from Syncrude this year. (These calculations assume our royalty Provisions reasonably approximate the degree of economic rent.)

A.F. Collins

Italics are words underlined by Treasurer Hyndman.

Handwritten note to Merv Leitch from Lou Hyndman- 9 – Oct 80

Merv:

- CC of memo from Treasury on this attached.

- As to timing, I suggest you consider a question in the House, 2 or 3 days after federal budget, orally posed to you. You could then confirm the higher profit but explain that non-conventional revenues will never be as high as those from flowing crude etc, etc. (Or I could supplement your answer, if that’s preferable.)

- Let me know which course you prefer. I doubt whether we should make this public prior to federal budget, now expected October 20 to 22.

Lou