Overview

Joe Ceci’s 2017 budget could be characterized as a “steady as she goes” budget. The citizens of Alberta will be paying for this budget, and many previous budgets, with higher taxes and higher debt service costs for years, if not decades, to come. There are many observers who feel the budget was “ok” since programs and capital spending are not disturbed. There are also many Albertans who do not believe using the credit card to support spending is the right way forward.

One half of Mr. Ceci’s address spoke of the capital spending and repair and maintenance undertaken by the Government. Virtually no corner of the province escaped mention:

- a courthouse for Red Deer

- a new hospital for South Edmonton

- Highway construction for Fort Saskatchewan

- Deerfoot Trail in Calgary and the new Cancer Centre

- Safe drinking in First Nations’ communities

- A new bridge for Peace River

- Affordable seniors homes and lodging in Leduc and Barrhead, Calgary and Londonderry, “from Clairmont to Fort Macleod, from Cold Lake to Canmore.”

Much of the blame for this capital spending on critical infrastructure is due to the previous government, according to the speech. For example.+

“Right now, we are dealing with issues of overcrowding and buildings that have been allowed to fall into disrepair. In some schools, there’s water damage and obsolete heating systems. In others, roofs sag and the cold winter’s wind seeps through aging window frames. When we took office, glaring infrastructure issues in health care needed fixing. …Here’s an example. There’s a bus in Lac La Biche where people have been forced for years to get their dialysis treatment. The bus doesn’t move, which is odd for a bus.The reason this dialysis bus doesn’t move – the wheels have literally come off.”

From an economic point of view, this will provide continuing comfort to the construction sector. But , the Budget speech did not address concerns found in the Economic Outlook portion of the Budget predicting construction to slow over the next couple of years reflecting the completion of major private sector projects (Ice District). To be sure, petrochemical investments subsidized by royalty holidays will support private investment but the halcyon days of oilsands’ megaprojects are gone- and possibly forever.

Reaction to Klein Cuts

“Some said – and still say – that government should make deep cuts to public services, such as health care and education.Some wanted to implement a health-care tax that would have hurt families who could least afford it. Families would have been forced to pay more and get less, with longer health-care wait lists, overcrowded emergency rooms, much bigger class sizes, and lost jobs.That’s why our government made a different choice.”

As I have written previously, much of the core base of the NDP endured several years of expenditure cuts, including reductions in wages. This experience is deep-seated and informs fiscal policy-making in many ways. The language above is deeply emotive and conjures up a Dickensian decade of great human tragedy. First, Klein cut salaries by five per cent. Today while management salaries, and political staff salaries are frozen, open collective bargaining continues. Normally when governments are running deficits of the current magnitude, wages are frozen or, in exceptional cases, cut. The budget highlights salary reductions for executives at provincial agencies saving $16 million and a deal with physicians saving $400 million in 2017. That is a good start and may leaven the demands of teachers and nurses.

Secondly, another legacy of the Klein cuts was a reduction in capital spending leading to an “infrastructure deficit.” In spite of the huge ramp up in capital spending during the Stelmach-Redford-Prentice years, there appears to be no shortage of needs in the infrastructure arena. The government was helped in making the case by David Dodge in his September 2015 report. Third, as the Klein government’s fiscal position rapidly changed through improved budgeting, a lower cost base, and rising non-renewable resource revenue, social democrats concluded that the cuts were unnecessary or revenue could have been raised to fill the budget gap. Across the border in Saskatchewan, the NDP government of Roy Romanow had inherited an even worse budgetary position than Klein was bequeathed. The Saskatchewan NDP approach was more balanced however with increased taxes but also tough choices on expenditures, including the closing of 52 rural hospitals.

Revenue

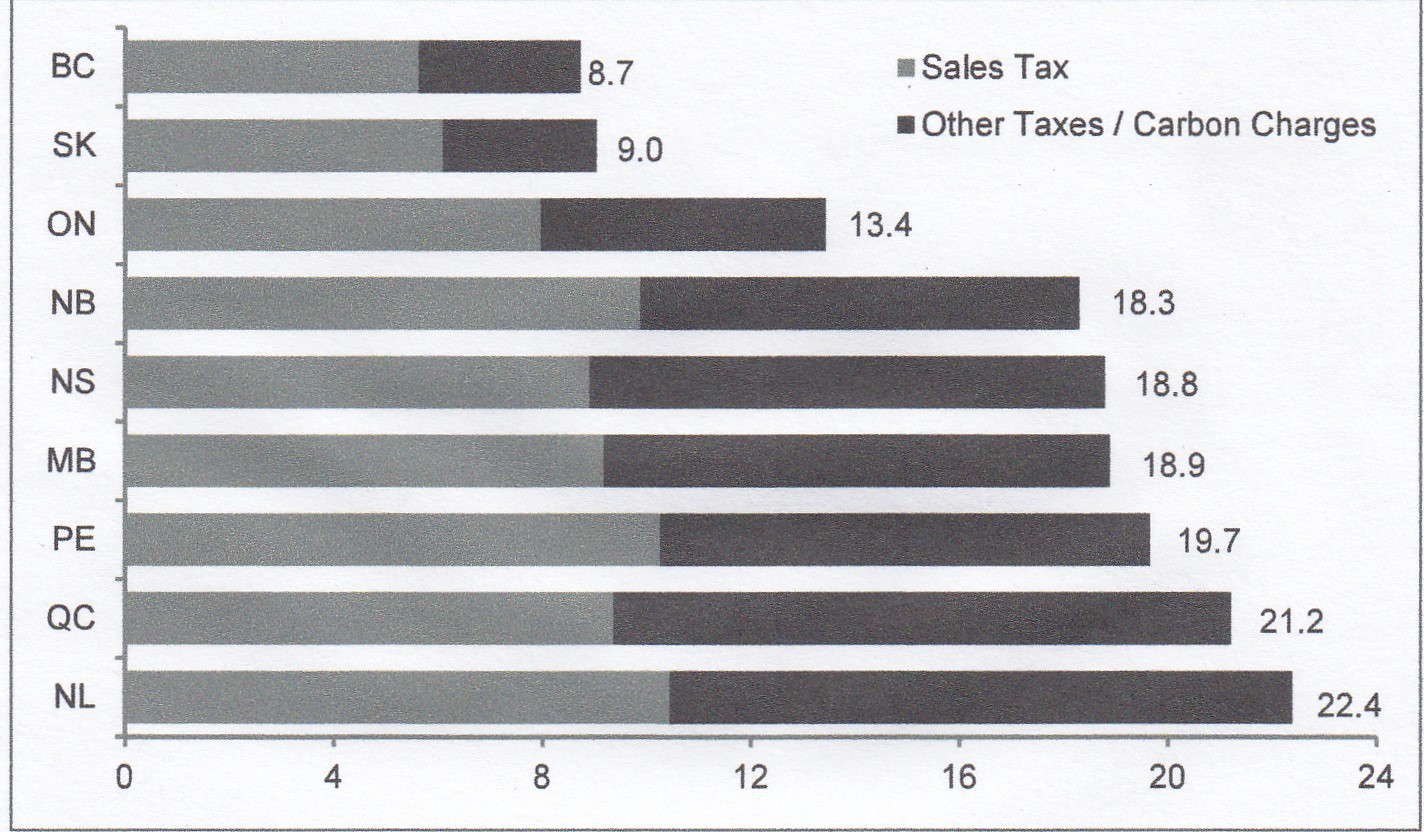

In a throwback to PC times, the tax section trumpets the glorious refrain from the Klein as Alberta’s Tax Advantage. The famous chart, circa 2017, is reproduced below.

Most of the difference is the absence of a sales tax in Alberta. Much was made of the fact that low-income Albertans and families pay virtually no tax. This is justifiably so as social cohesion is strengthened when those who can best afford do pay more in taxes. On the other hand, investor and investment tax credits are being provided to individuals who likely do not need government support to invest or likely would be making these investments anyway.

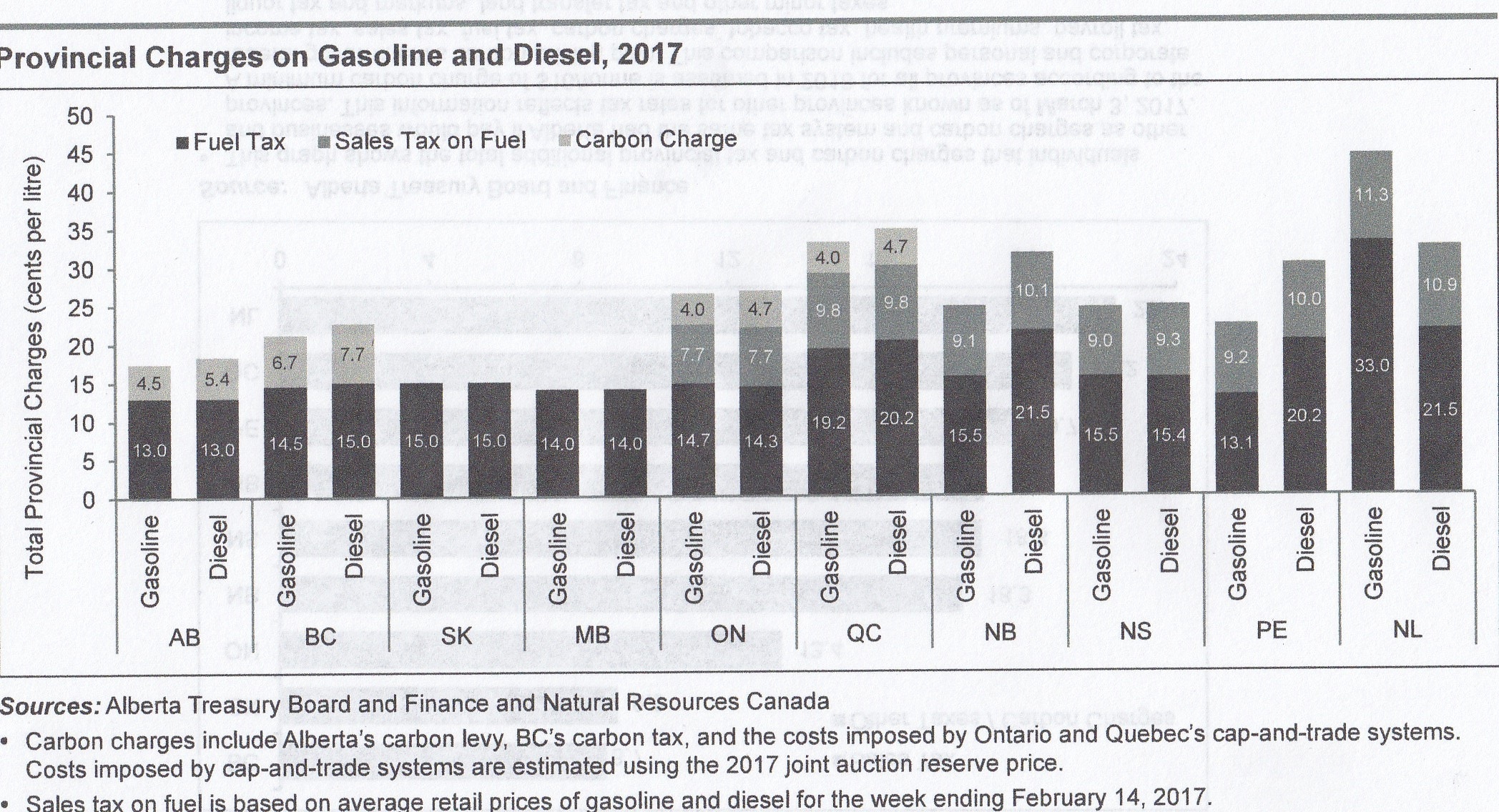

Happily for smokers and drinkers no increase to sin taxes was added. Nor was the government willing to examine increases in wealth taxes such as probate fees, which are amongst the lowest in the country. As far as the much hated carbon tax is concerned, except for Saskatchewan and Manitoba, gasoline and diesel fuel remain near the bottom of the taxation pole.

Of course underlying apparent desirability of being the lowest taxed jurisdiction is the fear of touching the Voldemort of Alberta politics- a consumption tax. If this budget confirms anything, it’s that the three main political parties (NDP, Wildrose, and the PC’s) are not willing to talk about how to replace the oil gusher.

Expenditures

On the expenditure front, spending continues to creep upwards. Since the debt is growing faster than other spending ($15.2 billion is to be borrowed this year or 46.5 per cent of the total quantum of debt at the end of March 2017!). Over time debt service costs which consume more and more of revenue collected. Debt servicing will total $1.4 billion in fiscal 2017-18, rising to about $2.3 billion in 2019-20. By then, this line item will be the fifth largest expense after Health, Education, Advanced Education, and Community and Social Services.

On total public sector compensation, the budget shows an increase of $456 million from current levels or a 1.8 per cent rise. This figure includes compensation for physicians. The salary creep will undoubtedly draw protests from the Opposition who will argue that the Alberta public sector workforce is one of the highest paid in the country and therefore should not be sheltered from the general economic downturn.

Capital spending, on a consolidated basis, will be $9.2 billion including $8.2 billion in core government spending and $1 billion for schools, universities, colleges. and hospitals.Capital spending will remain high at between $7.5 billion to $8 billion in 2018-20. Included in the Budget for the first time is a long list of unfunded projects.

It’s the Debt, Stupid

By 31 March 2020, the provincial government is estimated to have $42 billion in “liabilities for capital projects.” As well, another $29 billion in liabilities relating to the Teachers’ Pension Plan funding and “direct borrowing for the fiscal plan” will be added for a total of $71 billion. From an estimated financial asset position of $3.9 billion at 31 March 2017, the province is expected to have net financial liabilities of nearly -$45 billion by 31 March 2020. This astounding reversal is similar to the 1985- 1993 period when a $1.2 billion surplus turned into a series of eight straight deficits ranging from a low of $761 million to a high of $4 billion in 1986-87. Net assets fell from $7.2 billion to a negative $13.4 billion by 1994. The continued over-reliance on non-renewable resource revenue, the inability of past governments to save oil and gas revenue, to restrain spending, combined with an unwillingness to find alternative revenue sources, is reminiscent of this province’s fiscal history in the 1920s and 1930s.

Conclusion

As more citizens become aware of the string of deficits, we might expect them to ask questions about the provincial government’s finances. This is ultimately a good thing. The current government is convinced no cutting and no tax increases are the right way to run or stabilize an economy. In Alberta there seems to be a fiscal pendulum that occurs every generatio or so. The Klein revolution was a reaction to the Lougheed-Getty legacy of province-building and the Notley “revolution” is a reaction to Klein’s decision to attack spending rather than take a more nuanced approach on both revenue and expenditure. Now we have arguably the worse of all possible worlds- no tax increases, no expenditure restraint, and inexorably high deficits. Expect credit downgrades in the next few months.