Elizabeth Smythe- Democracy in Alberta – Interview

For the video, click here.

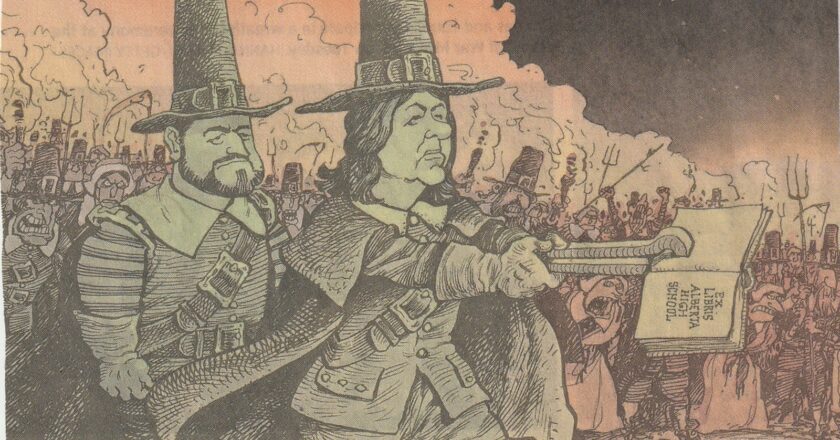

In this episode, Dr. Elizabeth Smythe speaks about her course on democracy at Edmonton Lifelong Learners' Association (ELLA) this past May. She discusses western political scientists' views on democracy, including ideas about "exporting" democracy. She explains the evolution of government authority from absolute monarchy to today's representative system as well as direct democracy. Representative democracies are not purely democratic, however because voter franchises expanded only after significant push by those representing under-represented groups like women or men without property.

In addressing democracy in Alberta, she notes a decided trend toward the cabinet (executive) making decisions rather than representative elected bodies. Democratic b...